Table of Contents

AI’s Influence on the Data Center Colocation Market

As Artificial Intelligence (AI) technologies continue to proliferate, they bring a series of challenges and opportunities for the data center colocation market. AI demands significant changes in data center design, unprecedented levels of power, improved power and cooling efficiency, and other factors. This article explores the demands of AI colocation, including:

- The current data center landscape and AI’s impact.

- The impact of artificial intelligence on data center power consumption.

- The shift to edge computing driven by AI demand.

- How AI is affecting secondary and tertiary data center markets.

- The impact of the AI market on colocation pricing and other critical cost factors.

- How Brightlio can help with your AI colocation needs.

Let’s get started!

The Data Center Landscape in the World of AI

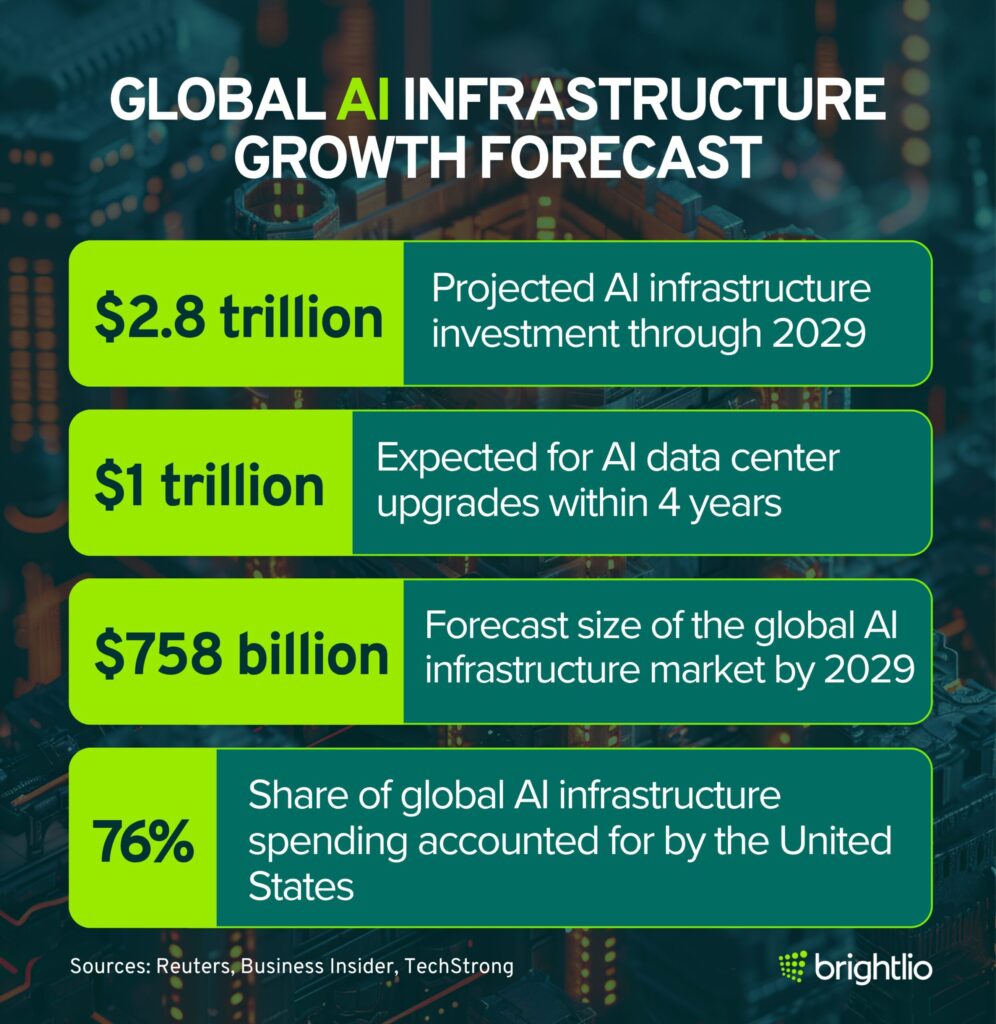

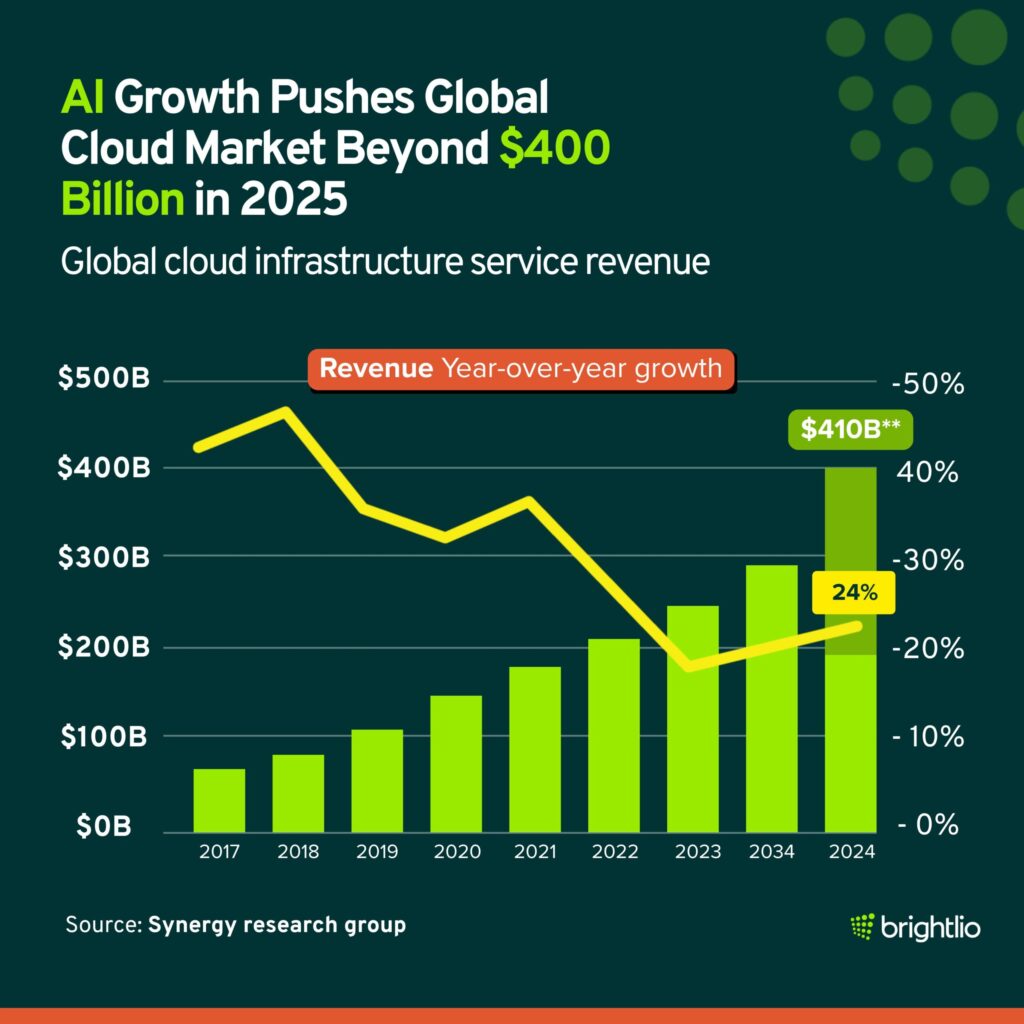

According to Data Bridge Market Research, spending on AI infrastructure is expected to reach $422.5 billion by 2029, representing roughly 44% annual growth over the coming years.

Nvidia CEO Jensen Huang estimates a much larger wave of investment, predicting that $1 trillion will be spent upgrading data centers for AI within just four years. Hyperscalers such as Amazon, Google, Microsoft and Meta are expected to absorb most of this cost as they modernize server fleets and scale GPU deployments.

IDC’s latest forecast shows the global AI infrastructure market reaching $758 billion by 2029. Spending on AI compute and storage surged 166% year-over-year in the second quarter of 2025, driven almost entirely by cloud and shared-infrastructure operators. Accelerated servers now represent 92% of AI server spending and are projected to surpass 95% by 2029.

The United States accounts for about 76% of global AI infrastructure spending, followed by China at 11.6%. China’s growth rate is expected to outpace the U.S. slightly over the next five years.

Fortune Business Insights places the AI infrastructure market at $46.15 billion in 2024, rising to $356.14 billion by 2032, a 29% CAGR. Hardware makes up more than 64% of current market share, with hybrid cloud expected to grow at more than 31% annually.

International Data Corp. previously estimated that about 20% of global data-center capacity is already dedicated to AI workloads. Cushman & Wakefield projects that AI will generate $75 billion in data-center demand by 2028, equal to 35% of the entire colocation market.

Market constraints remain severe. In Tier 1 markets such as Los Angeles, Phoenix, New York, Ashburn, Silicon Valley and Singapore, usable capacity is nearly fully absorbed. Newer data shows primary-market vacancy in North America falling to 2.8% in 2024, down from 3.3% the year before. Nearly 80% of all capacity under construction is already pre-leased, pushing companies to secure space two to four years in advance.

Citigroup recently updated its AI forecast, projecting more than $2.8 trillion in AI-related infrastructure investment through 2029. The bank estimates that hyperscalers will spend about $490 billion on AI infrastructure by the end of 2026. Supporting global AI compute demand will require an additional 55 gigawatts of power capacity by 2030, translating to roughly $2.8 trillion in cumulative investment. Each incremental gigawatt is estimated to cost around $50 billion to deploy.

Power, Cooling, and Environmental Realities

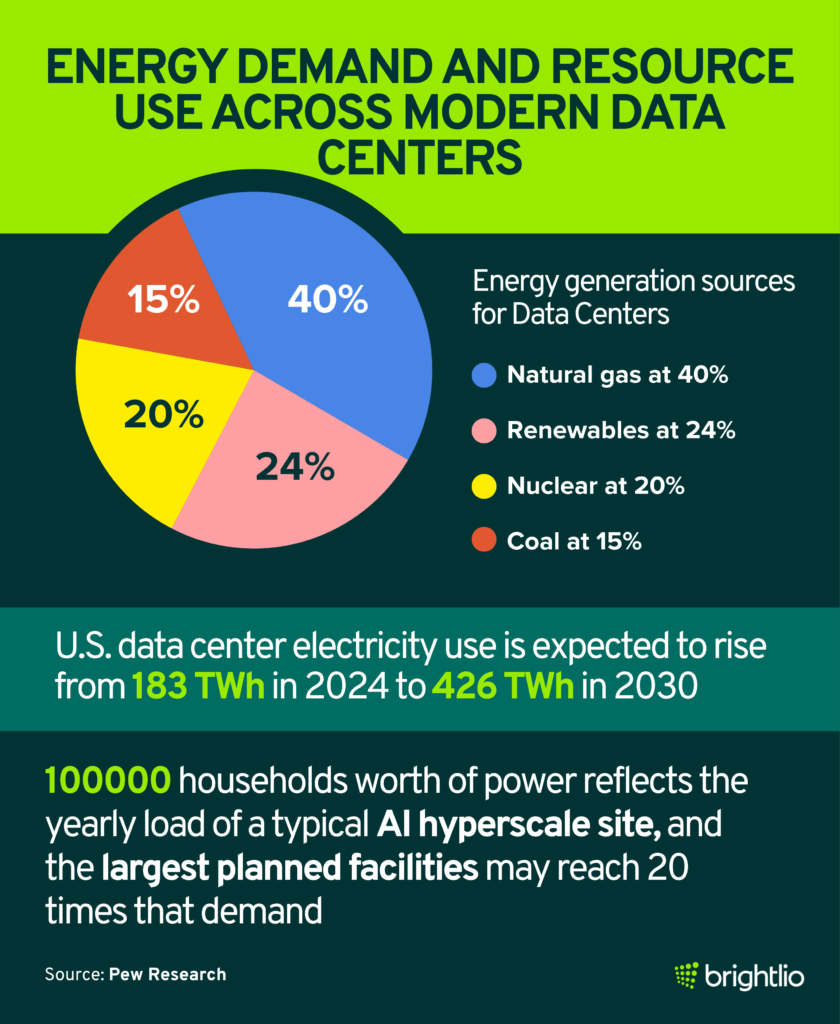

U.S. data centers consumed 183 TWh of electricity in 2024, more than 4% of national electricity use. That number is projected to grow 133% by 2030, reaching 426 TWh.

A typical AI-focused hyperscale facility now consumes as much electricity annually as 100,000 households, and the largest new facilities are expected to use 20× that amount. In some states, data centers already consume massive shares of the grid 26% in Virginia, 15% in North Dakota, 12% in Nebraska, 11% in Iowa, and 11% in Oregon.

Servers account for about 60% of total energy use, with cooling systems consuming 7% to more than 30%, depending on efficiency. U.S. data centers used 17 billion gallons of water in 2023, with hyperscale and colocation facilities responsible for 84% of that usage. By 2028, hyperscale sites alone may require 16–33 billion gallons annually.

As of 2024, natural gas supplied over 40% of electricity for U.S. data centers, followed by renewables at 24%, nuclear at 20%, and coal at 15%. (Source: Pew Research)

Hardware Density, Cooling and Market Pricing

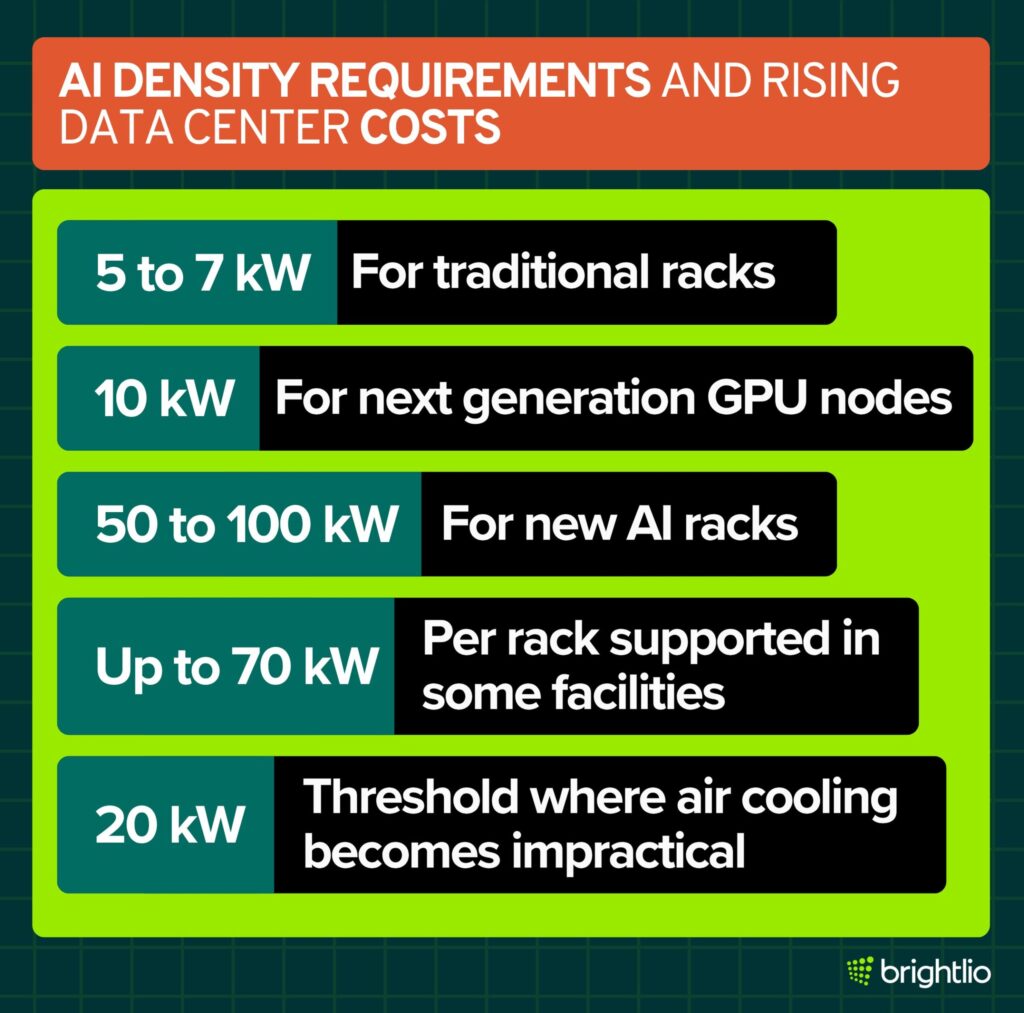

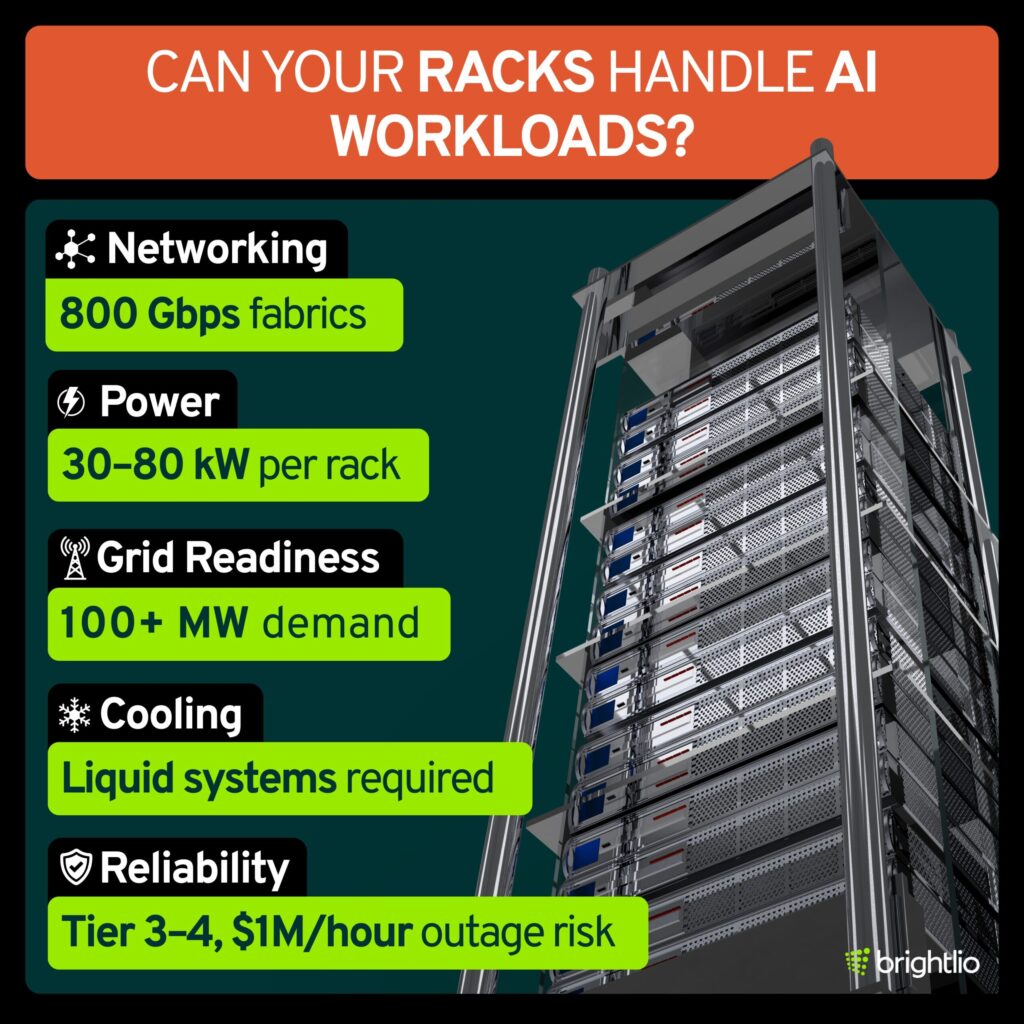

AI-optimized servers require far greater density per rack. Traditional racks draw 5–7 kW, next-generation GPU nodes require 10 kW, and new AI racks are being built for 50–100 kW power loads. Some data-center operators now offer support for up to 70 kW per rack.

Air cooling becomes impractical above about 20 kW, forcing the move toward liquid cooling and immersion systems. These upgrades are costly and contribute to rising colocation prices.

In Northern Virginia, prices increased 7.7% to about $140 per kilowatt in 2023. Silicon Valley reached $250 per kilowatt, a 43% jump, with vacancy at 2.9%.

Global Market Outlook

There are now about 11,800 data centers worldwide. The United States leads with more than 5,400 facilities, followed by Germany, the United Kingdom, China and France.

Global data-center market revenue is projected to reach $739 billion by 2030, growing at about 7% annually, with network infrastructure as the largest segment. Some analysts expect the market to exceed $1 trillion by 2027. (Source: Data Center Stats)

What This Means

These updated numbers show a market that is growing at an exceptional pace in both spending and technical requirements.

The projection of 422.5 billion dollars in AI infrastructure investment shows how quickly organizations are expanding their data center capabilities.

Other forecasts go even higher, reflecting strong demand for advanced hardware and high performance compute systems.

Citigroup’s multitrillion dollar estimate highlights how expensive it is to build and power the next generation of AI facilities.

At the same time, research shows that electricity and water use are climbing rapidly, which means the environmental impact of AI data centers is becoming a major concern.

The industry is also dealing with very limited available space in key regions, increasing strain on power grids, and higher colocation prices.

These challenges help explain why companies are locking in land, power, and cooling capacity years ahead of time and accelerating large scale development across many markets.

The Impact of AI on Data Center Power

As AI applications become more specialized, so does the hardware that powers them. We’re seeing the advent of customized AI processors and servers optimized for tasks like machine learning, natural language processing, and data analytics. These AI-specific chips, such as TPUs, require more power-dense racks to operate optimally.

High-performance chips and specialized servers for artificial intelligence require increasing the traditional 5-7 kW of power per data center rack. The next wave of GPU nodes uses as much as 10 kW per unit. 50 kW to 100 kW racks are being built for AI workloads. Digital Realty, a global data center leader, announced high-density colocation services in 28 North American markets with support for up to 70 kW per rack.

Higher power densities require more advanced cooling systems. Traditional data center air cooling technologies work up to about 20 kW per rack. The high power density racks AI needs require liquid cooling. This is an expensive retrofit for data center providers.

As energy costs are one data centers’ biggest expenses, power efficiency has a pivotal role in the future of data center design. Data center operators must design more efficient power and cooling equipment to support generative AI.

The Demand for Data Center Sustainability

As power requirements surge, the spotlight turns to energy-efficient operations. Data centers already consume as much as 4% of global energy. Colocation providers must supply sufficient power and do so in a way that aligns with growing sustainability concerns.

The good news is that AI data centers can leverage this technology to increase efficiency. Gartner states that by 2025, 50% of data centers will employ robotics with AI and machine learning capabilities. Using AI and machine learning in data centers will likely improve operating efficiency by 30%.

Rise of Edge Computing due to AI

Edge computing is not new, but AI has accelerated its importance. AI algorithms often require rapid data processing near the source to reduce latency, especially in applications like autonomous vehicles, IoT devices, and real-time analytics. Running AI models close to the data source allows instantaneous data processing, which is crucial for applications requiring real-time decision-making.

Transmitting data to a centralized data center involves latency. Edge computing dramatically reduces this latency by decentralizing the data processing tasks.

Delivering AI to the edge requires data center and cloud deployments in more markets. Additionally, supply constraints in primary markets mean AI providers are overflowing into secondary and tertiary markets to meet demand. Salt Lake City, Austin, San Antonio, and Reno are all seeing increasing demand.

The Impact of AI on Data Center Colocation Pricing

AI is driving up data center pricing and the cost of colocation services. Data center demand is at an all-time high. This is having a noticeable impact on price.

Additionally, operators have to pass along higher operational expenses and costs to retrofit facilities for the demands of AI. These include costs related to state-of-the-art equipment, increased energy consumption due to high-powered AI workloads, and the hiring of skilled personnel well-versed in AI operations.

Strategic data center hubs are showing rising costs. In Northern Virginia, the world’s largest data center market, prices increased 7.7% to $140 per kilowatt in 2023. In Silicon Valley, where data center vacancy sits at a record low of 2.9%, the highest rates have reached $250 per kilowatt in 2023. This is an increase of 43% from 2022. This underscores the desperate scramble among tech giants and emerging companies to secure space in a region synonymous with cutting-edge technological advancements.

Final Thoughts

The impact of AI on the colocation market is transformative and far-reaching, altering everything from hardware specifications to market dynamics. As AI proliferates, it’s reshaping how data centers operate and where they need to be. Colocation providers need to swiftly adapt to these changes to capitalize on emerging business opportunities and satisfy changing client demands. Customers should also brace themselves for higher data center service prices.

Brightlio Delivers AI Colocation Solutions

If you are looking for colocation services, Brightlio can help. Whether you are looking for a dense power footprint for AI applications or a more traditional data center design, we leverage our global network of colocation partners to deliver solutions that meet your needs and budget.

Additionally, we offer network connectivity, cloud, unified communications, and advisory services. This allows us to deliver a holistic technology solution for your enterprise. We are committed to being your most trusted and responsive technology provider.

Get started with Brightlio today!

FAQ: AI’s Influence on the Data Center Colocation Market

Artificial intelligence (AI) is driving significant changes in the data center industry, requiring enhanced infrastructure to accommodate increased power demand, advanced cooling systems, and optimized AI workloads. I

Data center operators recognize the growing demand for AI applications, which require immense computing power and can have profound impacts on power consumption and data center infrastructure.

AI workloads, especially those related to machine learning and deep learning, require more compute and speed. They often demand higher power usage, advanced cooling systems, and specialized infrastructure compared to traditional workloads.

Yes, the increased power demand for AI can raise data center costs. This encompasses not only direct power costs but also costs associated with cooling and infrastructure modifications to support AI’s power-intensive tasks.

Cloud computing platforms, due to their scalable nature, are often at the forefront of integrating AI capabilities. They provide companies with the ability to leverage AI without heavy upfront investments in their own data center infrastructure.

AI workloads, particularly those on specialized hardware like GPUs, produce significant heat. The increased power consumption requires more advanced cooling systems to maintain optimal temperatures and protect systems.

John Minnix is the Founder and CEO of Brightlio, with two decades of experience in data center, cloud, and network solutions. He previously built VPLS Solutions into a top Southern California technology partner before its acquisition by Evocative, where he served as President and COO overseeing global sales, operations, and strategic acquisitions.

Recent Posts

Data Centers in Kentucky and Colocation Opportunities

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

Let's start

a new project together