Table of Contents

100+ VoIP Statistics from Credible Sources (Jan – 2026)

The team at Brightlio has compiled a comprehensive list of up-to-date 100+ valid VoIP and business communication statistics for 2025.

In this article, you’ll find hand-picked statistics about:

- The Global VoIP Market Size

- VoIP Usage and Adoption Statistics

- VoIP Service Segments and Technology Stats

- The top VoIP providers and UCaaS market share

- Key industry trends, including AI integration and 5G

- VoIP adoption statistics by region, including North America, Europe, and Asia-Pacific

Without further ado, let’s check out the stats!

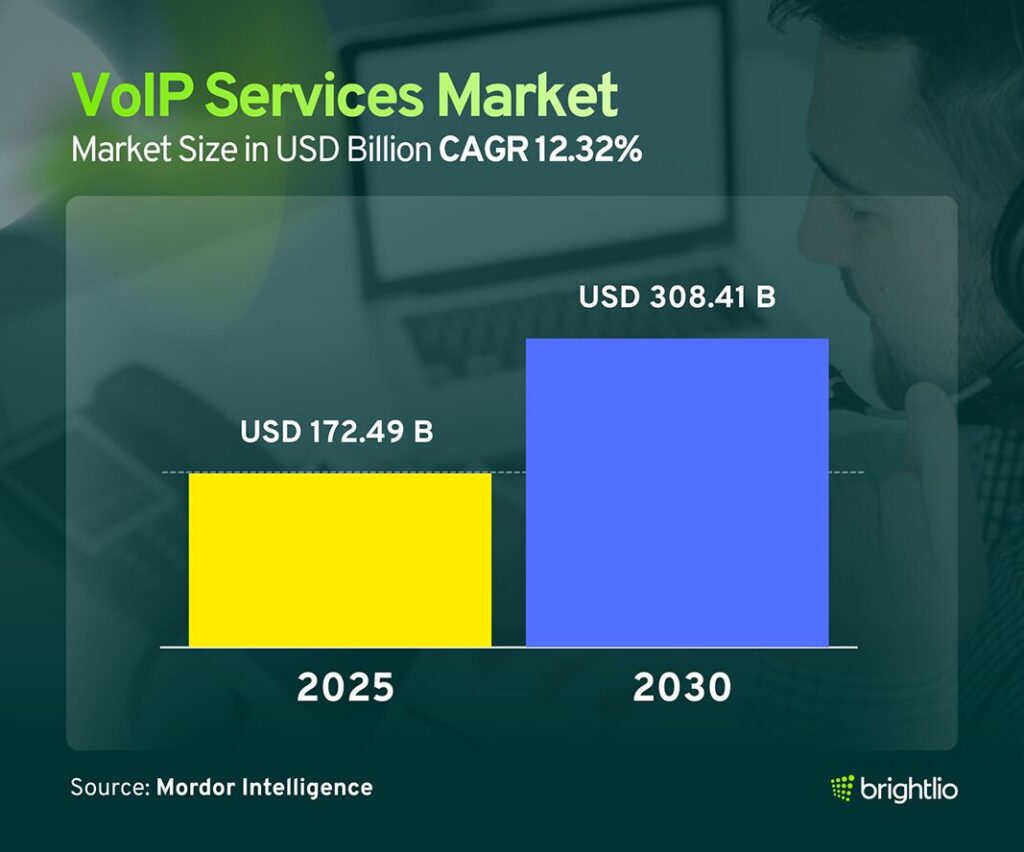

Global VoIP Market Size and Growth

- The mobile VoIP market is expected to reach $104.92B by 2030 with a 12.9% CAGR from 2024 to 2030. (Grand View Research)

- The global VoIP market measured $132.47B in 2023, increased to $144.77B in 2024, and is forecast to grow to $326.27B by 2032 at a 10.8% CAGR. (Fortune Business Insights)

- Market size expanded from $112.9B in 2023 and is projected to reach $263B by 2032 with a 9.6% CAGR. (Allied Market Research)

- The VoIP services market generated $128.8B in 2023 and is expected to exceed $313.3B by 2030 with a 13.5% CAGR. (Intent Market Research)

- The global market was valued at $135.2B in 2023 and is expected to grow at a 10.60% CAGR through 2030. (Cognitive Market Research)

- VoIP revenue is forecast to hit $178.89B in 2025 and reach $413.36B by 2032 with a projected 12.7% CAGR. (Coherent Marketing Insights)

- The hosted PBX segment stood at $13.71B in 2023 and is projected to rise to $42.55B by 2030 with a 17.6% CAGR. (NMSC)

- Mobile VoIP revenue is expected to reach $58.21B by 2025 with a 12.2% CAGR. (Global Newswire)

- Pandemic-driven shifts helped accelerate VoIP adoption, supported by improvements in broadband access and corporate demand for remote communication services. (Coherent Market Insight)

- VoIP penetration is expected to surpass PSTN use in 145 countries by 2034. (Precedence Research)

- Worldwide VoIP revenue measured $29.95B in 2024 and is projected to grow to $63.73B by 2032 at a 9.9% CAGR. (Verified Market Research)

- The global IP telephony market reached $32.5B in 2024 and is forecast to rise to $61.8B by 2030 with a 10.5% CAGR. (Strategic Market Research)

- Hardware based IP phones are expected to represent roughly 40% of IP telephony revenue in 2024, while software based solutions are projected to grow at about 13% annually through 2030. (Strategic Market Research)

- The mobile VoIP market is forecast to expand from $38.0B in 2025 to $102.3B by 2035 with a projected 10.4% CAGR. (Future Market Insight)

- Revenue in the mobile VoIP sector was $30.89B in 2023 and is expected to reach $83.46B by 2029 with a 17.84% CAGR. (Tech Sci Research)

- Global mobile VoIP revenue reached $46.9B in 2024 and is expected to grow to $120B by 2033 with a 10.47% CAGR through 2025 to 2033. (Imarc Group)

- The mobile VoIP market generated $31.2B in 2023 and is projected to reach $73.4B by 2032 with a 10.4% CAGR. (Global Market Insights)

VoIP Usage and Adoption Statistics

- 84 % of organizations view integrated unified communications (UCaaS) and contact‑centre‑as‑a‑service as their long‑term model.

- Subscription‑based VoIP models can reduce installation costs by up to 90% compared with PSTN. (Global Newswire)

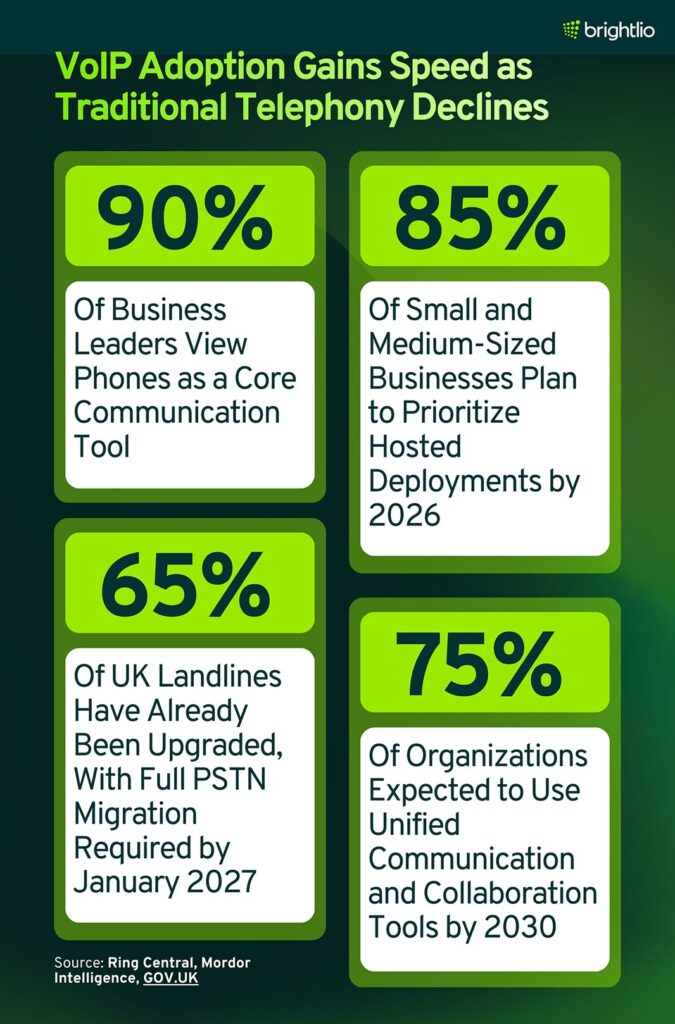

- 85% of small and medium‑sized businesses will prioritize hosted deployments by 2025. (Mordor Intelligence)

- Over 90 % of business leaders consider phones one of their main communication tools, and 52 % call it their primary tool.(Ring Central)

- Breakdown by company size: 58 % of small companies and 55 % of enterprises with 10,000+ employees said the phone is their primary tool.

- Use cases: Respondents use phones for internal calls (74 %), internal meetings (59 %), external client calls (82 %), external client meetings (61 %), vendor calls (70 %), outbound customer calls (64 %) and inbound customer service (52 %). (Ring Central)

- Messaging adoption: Over 95% of respondents use SMS in some capacity. (Ring Central)

- Personal lines migrating to VoIP: By 2031, household VoIP penetration globally is projected to reach 21 %, while PSTN penetration will fall to 10 %. Countries with more than 75 % VoIP penetration in early 2025 (France, Japan, Germany and Portugal) are expected to exceed 90 % by 2031. (TeleGeoGraphy)

- UK landlines migration: The UK Department for Science, Innovation and Technology reports that over two‑thirds of UK landlines have already been upgraded and all PSTN‑reliant devices will be fully migrated by January 2027. The same guidance notes that 2024 saw a 45 % increase in PSTN incidents, with over 2,600 major incidents recorded in 2024/25. (GOV.UK)

- Remote work enabling adoption: Remote and hybrid work patterns add about 2.1% to the overall CAGR for VoIP and unified communication services. Surveys also show that digital transformation initiatives and increased use of AI features continue to raise demand across global communication systems. (Mordor Intelligence, Precedence Research)

- More than three‑quarters of enterprises (about 77 %) say VoIP is a core part of their primary telephony strategy. (NoJitter)

- Unified communications and collaboration (UC&C) market will reach roughly $85.4 billion by 2029, growing at a CAGR of about 3.9% from 2025 through 2029. (NoJitter)

- UC&C market was $66.85 billion in 2024 and is set to expand to $150.44 billion by 2032, a CAGR of about 10.81%. (Fortune Business Insights)

- North America accounted for 37.38% of global UC&C revenue in 2024, and roughly 30% of companies already use UC&C as their primary communication platform. (Fortune Business Insights)

- By 2030, about 75% of organizations are expected to use unified communication and collaboration tools, and more than half of all firms are projected to shift their IT services to cloud environments. (Fortune Business Insights)

- About 97% of organizations reported that remote work increased their interest in unified communication and collaboration technologies. Roughly 50% of all respondents said they were already using generative AI tools in their communication workflows. (Fortune Business Insights)

- Globally, 74% of internet users said they preferred interacting with businesses via chatbots. (Fortune Business Insights)

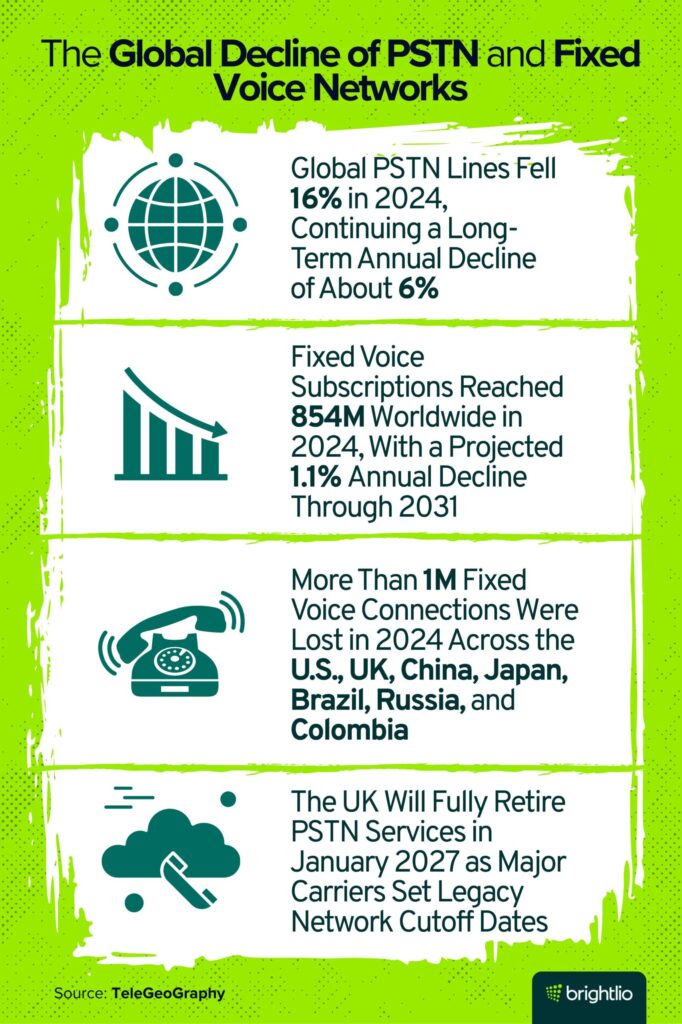

Decline of Legacy Telephony

- Global PSTN lines fell about 16% in 2024, continuing an average decline of roughly 6% per year since peak usage. (TeleGeoGraphy)

- Combined fixed‑voice subscriptions: PSTN and VoIP subscriptions totaled 854 million worldwide in 2024 but are forecast to decline 1.1 % annually through 2031. (TeleGeoGraphy)

- Country‑level declines: U.S., Russia, China, Brazil, the UK, Japan and Colombia each lost more than one million fixed‑voice connections in 2024, while India’s connections grew. (TeleGeoGraphy)

- Regulatory deadlines: The UK plans to retire PSTN by January 2027, and several major carriers (e.g., AT&T, BT) have announced similar cut‑off dates for legacy services. (TeleGeoGraphy)

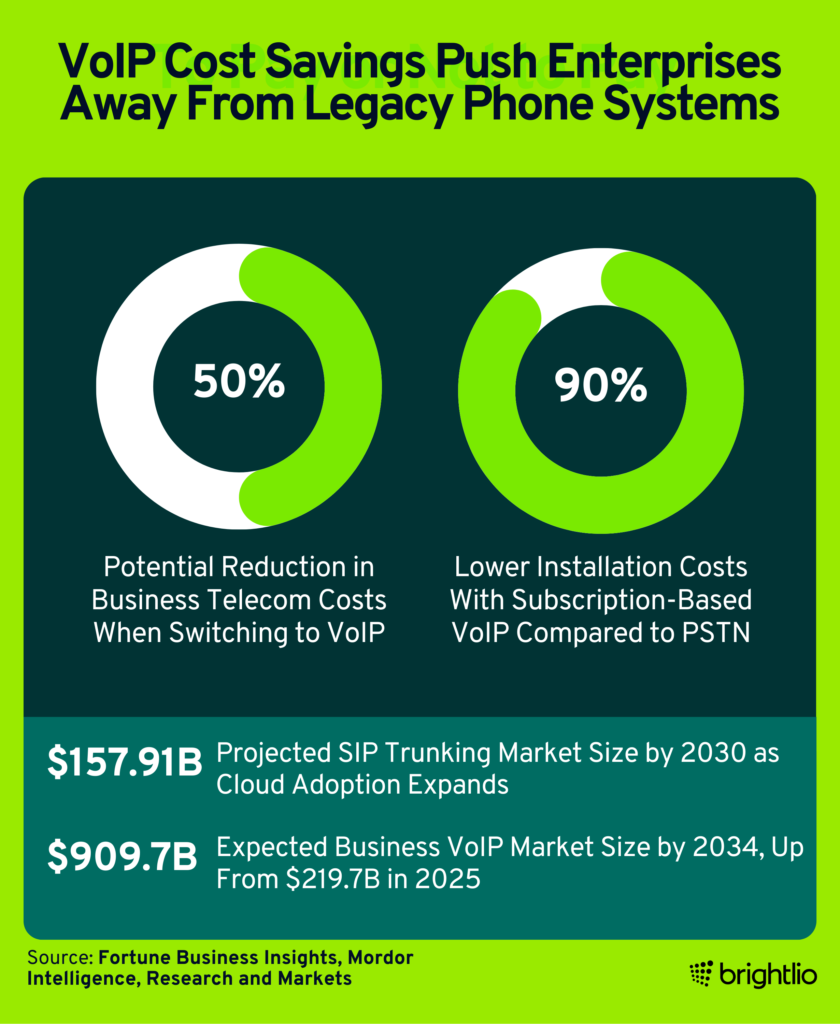

How VoIP Cuts Costs

- Telecom savings: Switching to VoIP can reduce telecom costs by up to 50 % for businesses. (Fortune Business Insights)

- Installation savings: Subscription‑based VoIP models can reduce installation costs by up to 90% relative to traditional PSTN deployments. (Mordor Intelligence)

- Historical implementation costs: VoIP deployment costs were about 20 % higher than time‑division multiplexing (TDM) during the first two years, largely due to local area network upgrades which accounted for 32–47% of project costs. (Webtorials)

- Cost advantages over PSTN contribute +1.8 % to the market’s CAGR, while 5G rollouts add +1.5 %. (Mordor Intelligence)

- The session‑initiation‑protocol (SIP) trunking services market will grow from $16.75 billion in 2024 to $18.52 billion in 2025 and reach $30.65 billion by 2029, representing a CAGR of 13.4 %. (Newswires)

- Switching to SIP trunking can cut communication costs by 20 % to 60 %, and that per‑channel SIP call charges range from roughly $1.67 to $15 per month. (Newswires)

- It also highlights that small businesses migrating from traditional phone lines to VoIP can save up to 40 % on local calls and up to 90 % on international calls. (Newswires)

- The SIP trunking market is valued at about $73.14B in 2025 and is projected to reach roughly $157.91B in 2030, with an annual growth rate near 16.64%.(Mordor Intelligence)

- On premises SIP solutions held about 75.70% of the market in 2024. Cloud based SIP deployments are projected to grow at roughly 15.20% each year through 2030. (Mordor Intelligence)

- Large enterprises accounted for about 60.81% of SIP trunking revenue in 2024, and the small and midsize segment is growing at roughly 15.30% per year.(Mordor Intelligence)

- By end‑user industry, the BFSI sector represented about 25.44% of SIP trunking revenue in 2024, and health‑care adoption is growing at roughly 13.70% per year. (Mordor Intelligence)

- Domestic calls account for around 62.18 % of SIP trunking revenue, whereas international call services are projected to grow at 16.10 % annually. (Mordor Intelligence)

- North America commanded roughly 62.70% of SIP trunking revenue in 2024, but Asia–Pacific is forecast to grow at about 16.50 % annually through 2030. (Mordor Intelligence)

- The business VoIP market is valued at about $219.7B in 2025 and is expected to reach roughly $909.7B in 2034, with a CAGR near 17.1%. (Research and Markets)

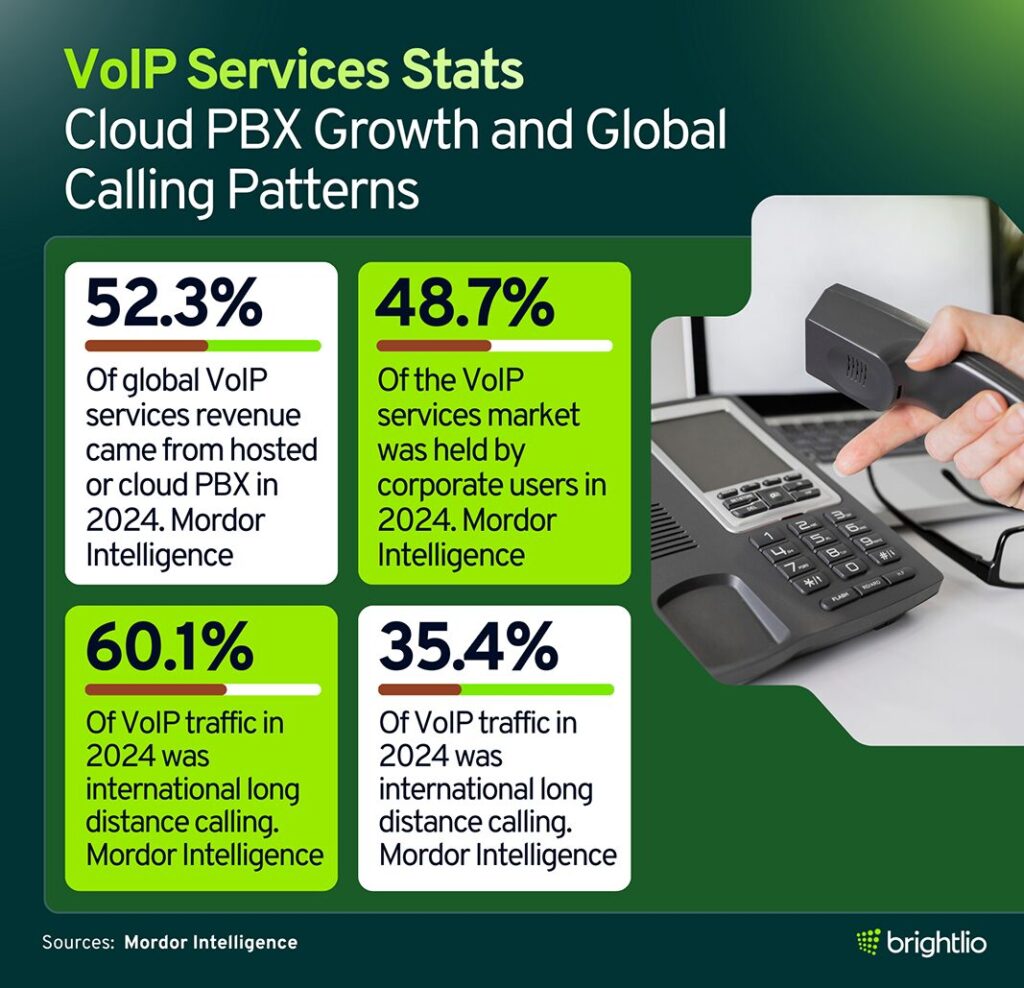

VoIP Service Segments and Technology Stats

- SIP trunking dominates: Session Initiation Protocol (SIP) trunking accounted for 46% of revenue in 2024(Precedence Research)

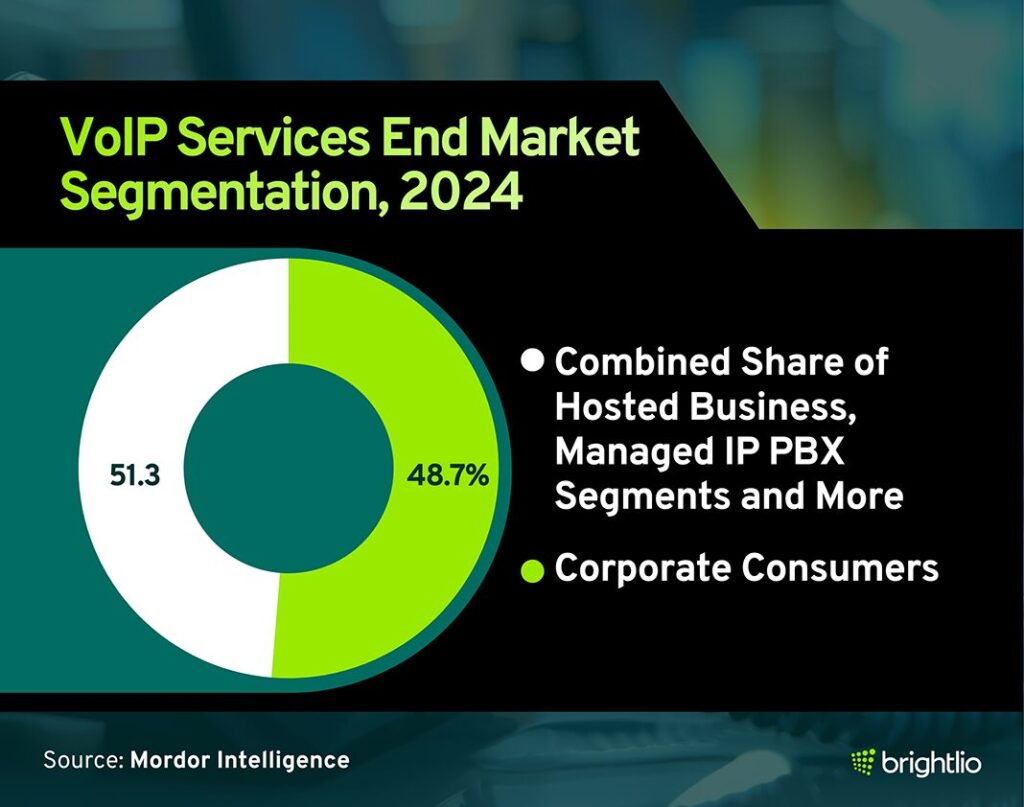

- Hosted/cloud PBX share: Hosted or cloud PBX represented 52.3% of global VoIP services revenue in 2024(Mordor Intelligence)

- Computer‑to‑computer configuration: Computer‑to‑computer VoIP accounted for 35.4 % of the market, while international long‑distance calls represented 60.1 % of VoIP traffic in 2024. (Mordor Intelligence)

- Residential vs. business: Corporate consumers held 48.7 % share of the 2024 VoIP services market, while the residential segment is growing quickly with rising adoption of app‑based services. (Mordor Intelligence)

- Cloud‑based services: Cloud‑based VoIP is the fastest‑growing deployment method, driven by scalability and the remote/hybrid work trend.(Intent Market Research)

- Largest end‑user industry: The banking, financial services and insurance (BFSI) sector demands secure, cost‑effective communications; Intent Market Research ranks it as the largest end‑user segment. (Intent Market Research)

- Largest application: Voice calling remains the largest application for VoIP, accounting for most usage among consumers and businesses. (Intent Market Research)

- Mobile VoIP segmentation: Voice service dominated mobile VoIP in 2018, but video service will grow fastest, reflecting increased video conferencing adoption. The Android operating system captured the largest share of the mobile VoIP market due to the high number of Android smartphone users. (Global Newswire)

- Enterprises vs. individuals: Mobile VoIP adoption is higher among enterprises; Market Research Future says the enterprise segment is expected to hold a larger share than individual consumers. (Global Newswire)

VoIP Platform, Service, and Pricing Trends

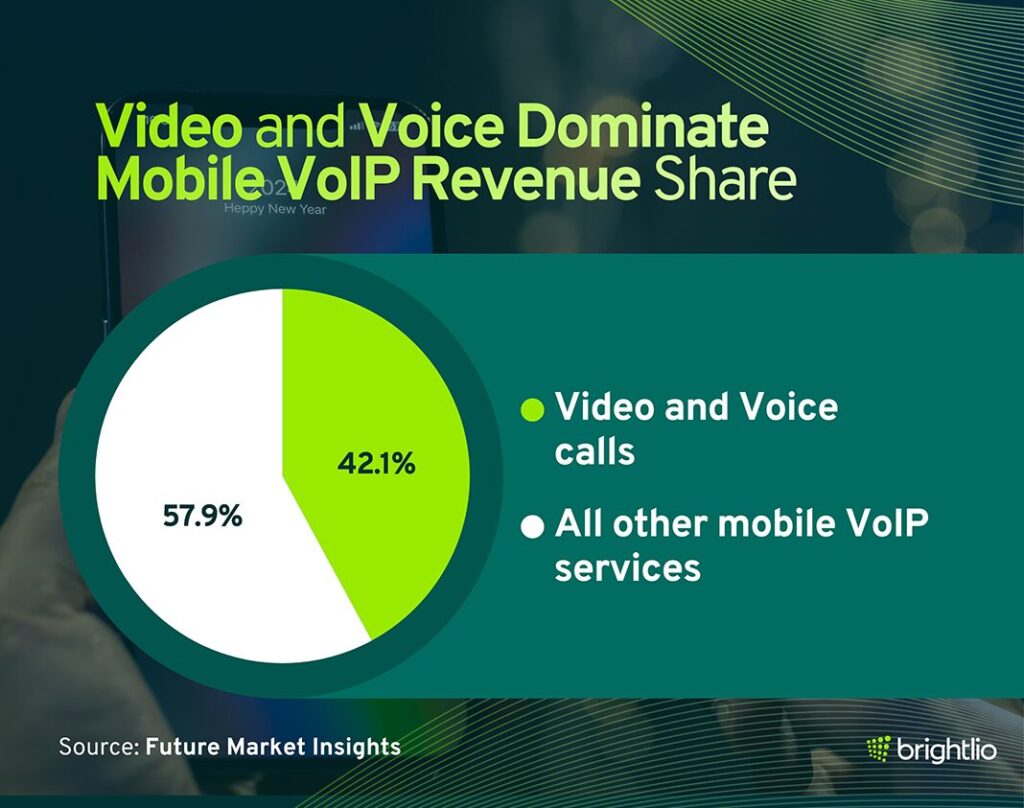

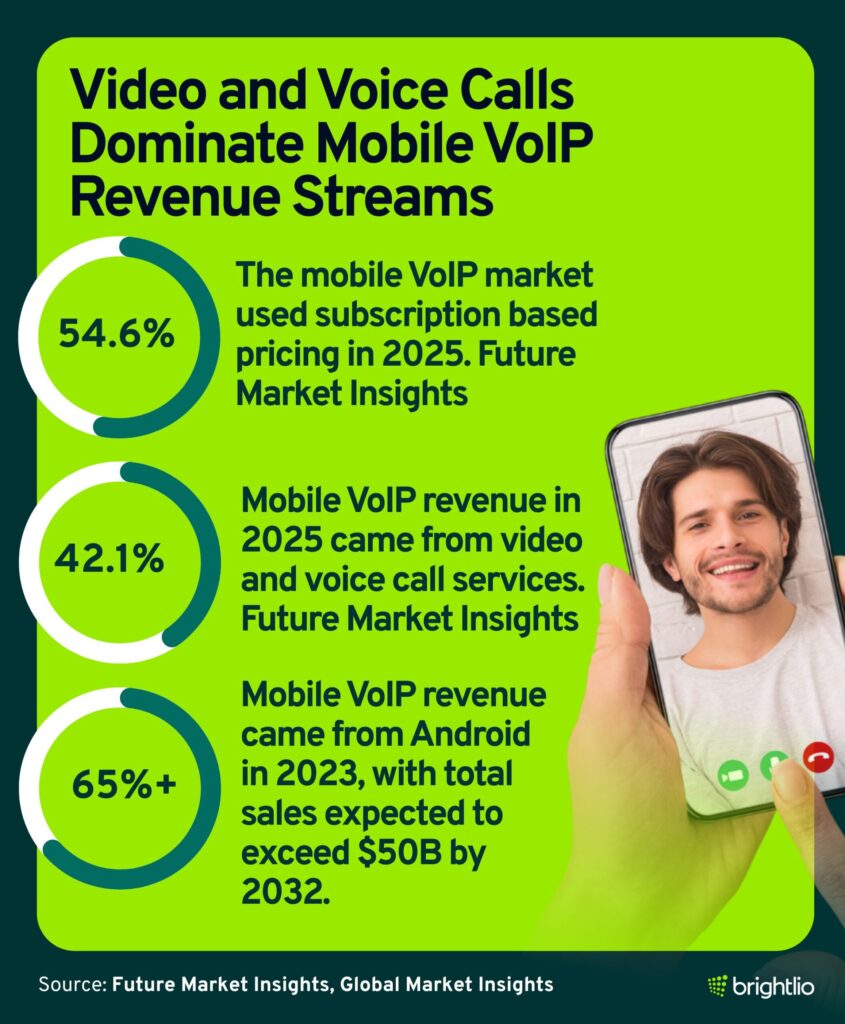

- Video/voice call segment accounts for 42.1% of mobile VoIP revenue in 2025, while subscription‑based pricing models hold about 54.6% of the market. (Future Market Insights)

- Android OS is expected to represent roughly 26.8% of mobile VoIP revenue in 2025. (Future Market Insights)

- Global Market Insights indicates that Android accounted for more than 65% of mobile VoIP revenue in 2023 and is projected to exceed $50 billion by 2032. (Global Market Insights)

- The same report shows that the video and voice call service category held around 48% of the mobile VoIP market in 2023, making it the largest service segment. (Grand View Research)

- Grand View Research data reveal that instant‑messaging services are likely to see the highest growth in mobile VoIP because consumers increasingly rely on real‑time messaging. (Grand View Research)

Call Quality, Network Stability, and VoIP Security

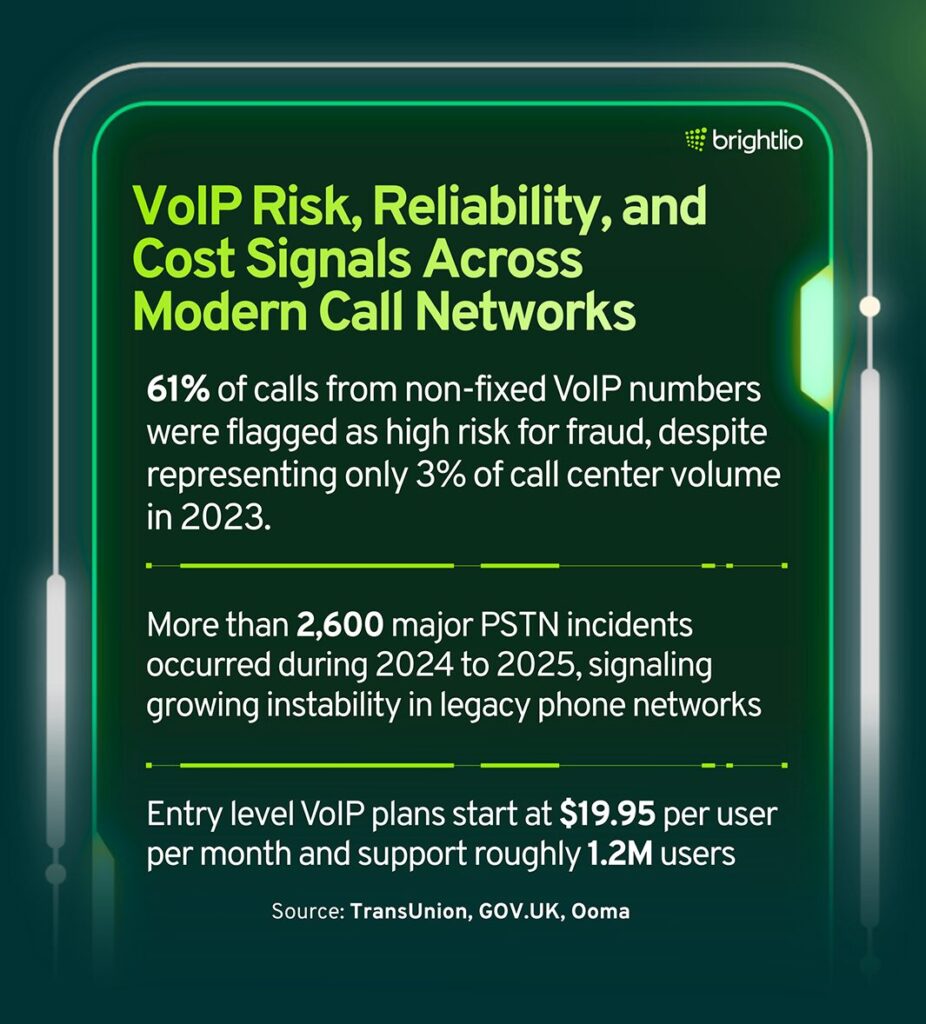

- High risk calls: Non fixed VoIP numbers represented only 3% of call center volume in 2023, yet 61% of those calls were flagged as high risk for fraud. (TansUnion)

- Migration improves reliability: New digital phone lines offer clearer and higher quality calls, greater reliability, and improved energy efficiency. (GOV.UK)

- PSTN incident rise: More than 2600 major PSTN incidents occurred in 2024 to 2025, reinforcing the need for stronger digital networks.(GOV.UK)

- Satisfaction ratings: One VoIP service scored 8.6 out of 10 for overall satisfaction, which was 0.5 points higher than second place and 1.2 points above the average across 17 providers. Service plans start at $19.95 per user per month and support about 1.2M users. (OOMA)

Hosted PBX and Unified Communications Services Stats in VoIP

- The global hosted PBX market was valued at about $12.8B in 2024 and is projected to reach roughly $30.4B in 2030, growing at about 15.2% per year. (Strategic Market Research)

- Within hosted PBX systems, the solutions segment held more than 65% of revenue in 2024, and large enterprises are expected to grow at over 17% annually. (Strategic Market Research)

- Another estimate places the hosted PBX market at about $11.20B in 2023 with projected annual growth near 16.7% from 2024 to 2030. (Grand View Research)

- Service oriented hosted PBX offerings are expected to grow at roughly 17.2% per year, while the small and midsize segment is projected to expand at about 18%. (Grand View Research)

- Large enterprises accounted for about 57% of hosted PBX revenue in 2023, and the call center application segment is projected to grow around 17.6% annually. (Grand View Research)

- Unified communication and collaboration applications represented about 38.06% of hosted PBX revenue in 2023, and IT and telecom end users held roughly 26.90%. (Grand View Research)

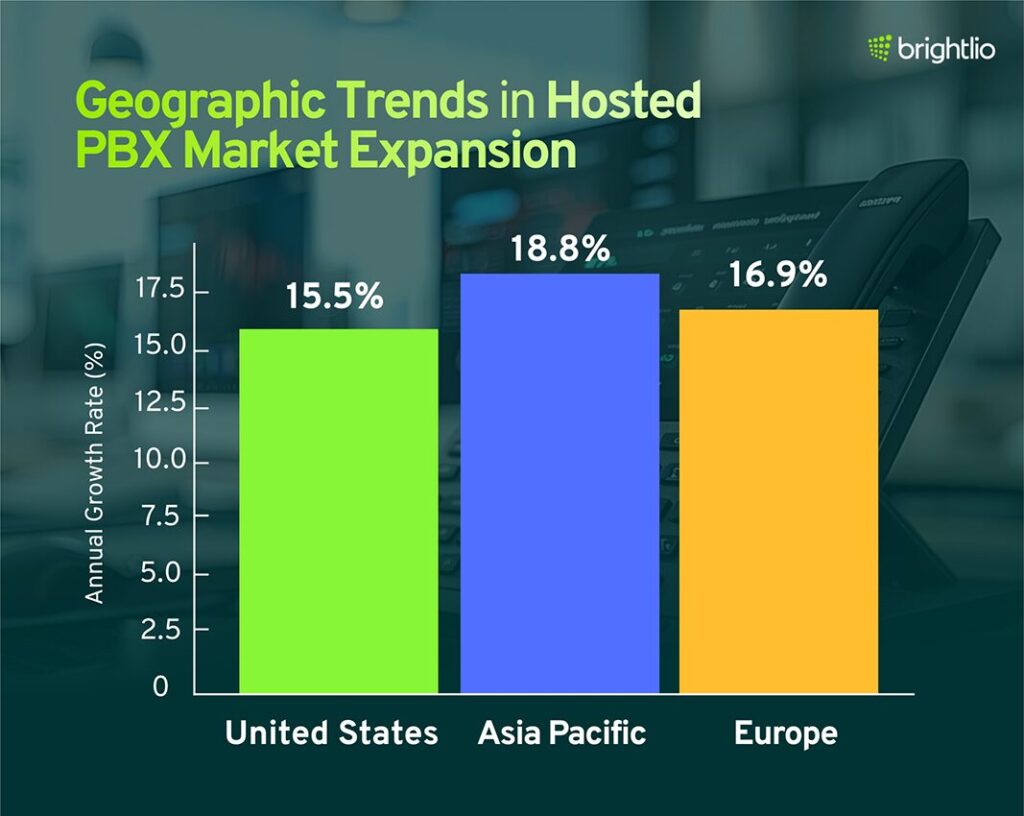

- Regionally, hosted PBX markets are projected to grow at about 15.5% per year in the United States, 18.8% in Asia Pacific, and roughly 16.9% in Europe. (Grand View Research)

Growth Segments in VOIP Unified Communications

- The mobile unified communications and collaboration market was valued at about $116.51B in 2024 and is projected to reach roughly $1.50T in 2032, which implies a CAGR near 44% during 2026 to 2032. (Verified Market Research)

- On-premises unified communications solutions accounted for more than 47% of revenue, while hosted offerings are projected to grow at over 20% per year. (SkyQuestt)

- Regional projections show the unified communications market in the Asia Pacific growing nearly 20% annually through 2032. (SkyQuestt)

VoIP Industry Events and Shifts in Market Competition

- The mobile unified communications and collaboration market was valued at about $116.51B in 2024 and is projected to reach roughly $1.50T in 2032, which implies a CAGR near 44% during 2026 to 2032. (Mordor Intelligence)

- The global unified communications market measured about $141.3B in 2023 and is expected to rise from $164.9B in 2024 to roughly $567.26B in 2032, with a CAGR near 16.7%. (Mordor Intelligence)

- On premises unified communications solutions accounted for more than 47% of revenue, while hosted offerings are projected to grow at over 20% per year. (Mordor Intelligence)

- Regional projections show the unified communications market in Asia Pacific growing nearly 20% annually through 2032. (Mordor Intelligence, Broadband USA)

- Sector level forecasts indicate that on premises deployments contributed more than 47% of revenue in 2024, with hosted solutions expected to record the fastest growth. (Mordor Intelligence)

VoIP Regional Trends

- North America leads: North America accounted for about 48% of global VoIP revenue in 2024, while separate estimates place the region at roughly 40.9% of the worldwide VoIP services market. (Mordor Intelligence, Precedence Research)

- U.S. growth: North America held about 48% of global VoIP revenue in 2024, and other estimates place the region at roughly 40.9% of the worldwide VoIP services market. (Precedence Research, IBISWorld)

- Europe fixed voice revenues reached about £1.09B in Q1 2025 and continue to fall as analog services shift to IP. More than two-thirds of UK landlines have already moved to VoIP, and all remaining PSTN services are scheduled to transition before January 2027. (Gov.UK)

- Asia Pacific is identified as the fastest growing region, with projections near a 12.6% CAGR. Multiple forecasts indicate that Asia Pacific is expected to surpass North America in overall growth momentum for VoIP and related services. (Precedence Research, Mordor Intelligence)

- Other regions: Intent Market Research states North America will remain the largest region while Europe will experience the most substantial growth until 2030. (Cognitive Market Research)

- PSTN lines declined from about 1.22B in 2006 to roughly 407M at the end of 2024. IP based voice subscriptions reached about 447M in 2024 with 9% year over year growth, passing PSTN volume for the first time. Fixed voice penetration in Africa remains near 9 to 10%, with individual rates around 6% in Algeria and Egypt, 23% in Gabon, and 15% in Mali. In India, combined PSTN and VoIP subscriptions grew about 23% in 2024 to more than 39M. (TeleGeoGraphy)

- China’s mobile VoIP market is projected to grow at about 14% annually from 2025 to 2035. India is expected to grow at roughly 13%, Germany at 12%, France at 10.9%, the United Kingdom at 9.9%, and the United States at about 8.8% over the same period.(Future Market Insights)

- The United States held about 68.3% of the North American mobile VoIP market in 2023. Europe accounted for roughly 32.3% of global mobile VoIP revenue during the same year. (Grand View Research)

- Global Market Insights adds that North America’s mobile VoIP market exceeded $10.3 billion in 2023 and is expected to surpass $25 billion by 2032. (Global Market Insights)

- Asia Pacific’s unified communications market is projected to grow at nearly 20% per year through 2032. India supported this growth with about $10B in 5G investment in 2024. (SkyQuestt)

- The global unified communications market is valued at about $138.44B in 2024 and is projected to reach roughly $535.54B in 2033, with a CAGR near 16.22%. (Global Newswire)

Additional VoIP Insights and Emerging Trends

- Mobile economy: Asia Pacific’s mobile economy contributed about $880B to regional GDP in 2023, which supported rising demand for mobile VoIP services. (Mordor Intelligence)

- Remote and hybrid work: Mobile softphone adoption is projected to grow at roughly 13.2% CAGR, driven by remote work activity and wider smartphone use. (Mordor Intelligence)

- Security risks: More than 50% of enterprises have reported voice-related security incidents since 2021, reflecting increased exposure to telephony-based threats. (Mordor Intelligence)

- AI and unified communication integration: Adoption continues to rise as organizations add AI-supported features such as transcription and voice bots to communication platforms. (Precedence Research)

- Emergency calling features: Emergency calling capabilities introduced in 2020 provided direct contact with public safety services and improved regulatory compliance. (Coherent Market Insight)

- Organizational deployment survey: 53.85% of organizations were fully deployed or in the process of deploying VoIP, 28.85% had limited deployment, 14.42% were evaluating, and 3% reported no action. (Nemertes)

Final Thoughts

VoIP adoption continues to accelerate as organizations and households migrate away from aging PSTN infrastructure. The market is worth well over $130 billion today and is forecast to more than triple by the early 2030s. North America remains the largest region, but Asia–Pacific and Europe are growing rapidly.

Advanced features, AI integration, 5G networks, and hybrid‑work demands all contribute to growth. Meanwhile, the decline of the PSTN, cost savings, and government broadband investments create powerful incentives to adopt digital voice.

At the same time, rising fraud risks—particularly from non‑fixed VoIP numbers—underline the need for strong security. As these statistics show, VoIP is not simply a replacement for traditional telephony; it has become a critical platform for modern communication and collaboration.

Modern Cloud VoIP Solutions for Teams

Our VoIP services use a cloud-based platform that brings together voice calls, video meetings, messaging and collaboration. Your team can access everything from desk phones, computers or mobile devices.

With our service you get a cloud PBX, voicemail, contact-center tools and soft-phone access. There is no need for bulky phone hardware on site.

This gives businesses a flexible, scalable phone system that supports remote work, simplifies communication and grows with their needs.

What is VoIP?

VoIP is short for Voice over Internet Protocol, and the broader field of VoIP technology covers the methods that let voice calls travel across IP networks. It is a phone method that sends voice calls over IP networks, usually your broadband internet connection, instead of over traditional phone systems that rely on copper lines in the public switched telephone network.

In practice, that means you can make and receive business calls from a computer, smartphone, IP desk phone, or adapter connected to regular handsets, as long as the device has an internet connection and a VoIP service behind it. Many teams also use mobile VoIP solutions when they need flexibility outside the office.

What VoIP Does in Technical Terms?

VoIP turns a traditional phone call into digital data that moves across IP networks. The process fits within voice-over-Internet-Protocol principles and can be viewed in four main stages:

1. Voice is captured and digitized: Your voice starts as an analog signal. The device samples it and uses a codec such as G.711, G.729, or Opus to compress it.

2. Audio becomes packets: The device divides the audio into small IP packets that include timing and addressing information.

3. Signaling and media handling: SIP sets up and ends the call, while RTP carries the audio. SRTP can add encryption and RTCP reports quality metrics. Modern deployments often include artificial intelligence AI features that assist with quality scoring or diagnostics.

4. Packets travel, then rebuild into sound: Routers and switches move the packets across your network and your provider. The receiving device reorders them, smooths jitter, fills gaps when possible, decodes the audio, and plays it out. Gateways convert to the traditional phone network when needed. Growth in cloud adoption has made these processes accessible to companies that need scalable solutions.

How a VoIP Call Feels from a User’s Point of View

From the user side, a VoIP call usually works like this:

- You open a softphone app or pick up an IP phone.

- You dial a number or click a contact.

- The VoIP service sets up the call with SIP.

- Once the other party answers, audio flows over RTP between your device and theirs, or between each device and the provider’s media servers.

The experience can match or surpass traditional phone quality when the network has enough bandwidth, proper QoS for voice, and suitable security controls such as SRTP encryption and firewalls that understand VoIP protocols. These improvements track with current voip trends and the need for smoother customer interactions.

FAQs

Recent research places the global VoIP market around $145–151B in 2024, with projections that rise to about $161B in 2025 and pass $400B in 2034. These key VoIP statistics appear often in VoIP market statistics reports that treat VoIP, voice and video conferencing, and unified communication tools as the primary choice for new systems and phone deployments.

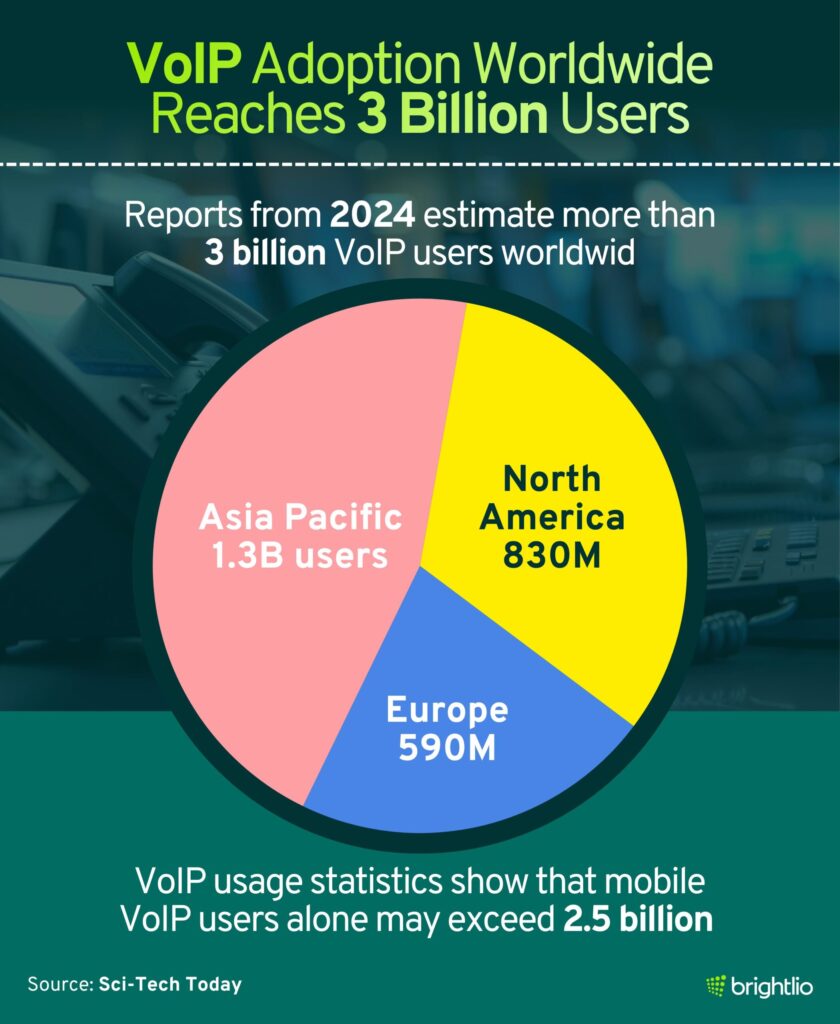

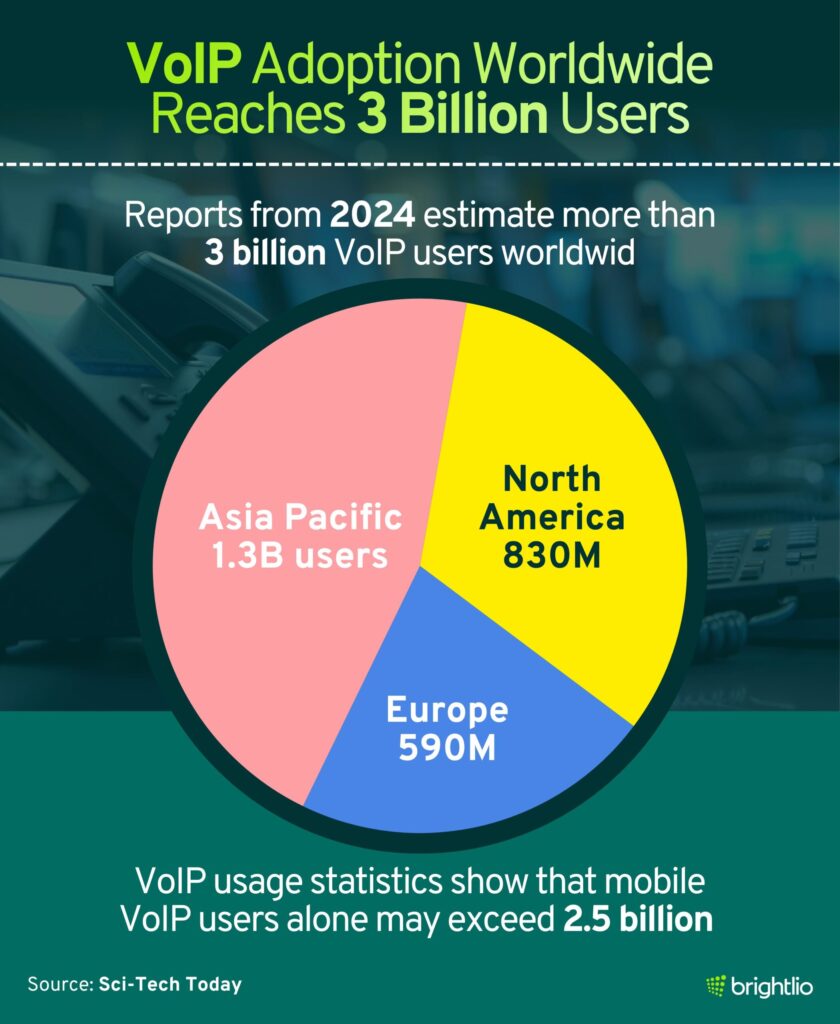

Reports from 2024 estimate more than 3 billion VoIP users worldwide. Asia Pacific holds roughly 1.3B users, North America about 830M, and Europe around 590M. VoIP usage statistics show that mobile VoIP users alone may exceed 2.5B as global communication needs expand and customers expect flexible communication through mobile apps.

Studies show that roughly 31–60% of businesses use VoIP, with more than 60% relying on it for phone calls. About 78% of US small businesses and about 70% of large enterprises use VoIP platforms supported through cloud services. These VoIP industry statistics highlight the shift toward cloud systems for customer service operations as companies reduce dependence on the desk phone.

Forecasts show consistent double-digit annual growth. One segment is projected to grow from about $161.8B in 2025 to $415.2B in 2034, close to 11% CAGR. Broader estimates place overall VoIP and cloud growth near 10–12% each year through 2030, confirmed through ongoing voip market statistics research.

Businesses that shift from legacy phone systems to VoIP often reduce communication costs 25–50%, and some scenarios report savings as high as 75%. New companies that adopt VoIP from the start can cut initial communication spend up to 90%. Surveys show small business phone bills dropping from about $250 to $150 after a switch that depends on a stable internet connection.

North America often leads in revenue share, commonly near 35–48% of the global market. Asia Pacific holds the largest user base and is projected to take about 38% of the global telephony VoIP market, with revenue that moves toward $60B and higher. Europe follows with roughly one quarter of the global share.

VoIP usage rose alongside remote work, with one dataset noting 45% growth since the 2020 shift. Surveys show that 59% of professionals use at least 3 devices for communication, 74–87% use mobile VoIP apps, and 64–74% of companies operate hybrid models. These findings tie directly to remote and hybrid work demand, where workers rely heavily on voice and video conferencing and flexible tools.

Corporate users generate about 78–79% of all VoIP activity across service and connection types. Small and medium-sized businesses represent more than 45% of all VoIP customers. About 60% of users now choose cloud-based solutions instead of legacy landlines for more reliable communication. These key VoIP statistics illustrate how firms prioritize uptime and flexible communication models.

Top VoIP providers commonly advertise 99.99% uptime service commitments. Surveys show that close to 85% of VoIP users list voice quality as their highest priority. HD-voice codecs, low-latency networks, and AI-driven routing support strong MOS scores across internet protocol traffic.

VoIP platforms face growing DDoS and signaling threats, and recent summaries indicate VoIP-related DDoS activity more than doubled. Broader data shows that nearly one third of unknown calls worldwide in early 2024 counted as spam or fraud. These VoIP industry statistics continue to push stronger VoIP security controls and authentication methods as customers expect safer connections.

Important figures include expected significant cost savings such as 25–50% lower monthly phone bills, a typical per-user cost of $20–$50 per month, common uptime targets of 99.9–99.99%, and adoption rates showing that more businesses already use cloud systems as companies increasingly rely on VoIP as a primary communication tool. Usage of call recording and softphone clients on a mobile phone also helps shape decisions for firms that want reliable communication.

Useful KPIs include uptime percentage, jitter, packet loss, MOS scores, call setup success rate, and dropped-call rate. Operational metrics such as cost per call, average handle time, first-call resolution, and activity in a contact center environment show how well the system supports teams. These metrics also reveal compelling reasons businesses switch to cloud based communication solutions when the global average cost of legacy telephony rises.

About 80% of contact center agents use VoIP systems. Integrated VoIP and CRM environments often report up to 30% better first-call resolution and as much as 40% reduction in handle time. More than half of customers expect constant availability, so cloud based communication solutions help support customer experience across regions as more businesses modernize service operations.

Mobile VoIP continues strong growth. Roughly 74% of employees use mobile VoIP apps for work calls. Globally, mobile VoIP users already number in the billions, and Asia Pacific alone is projected to reach more than $35B in mobile VoIP revenue in 2030 at roughly 14% CAGR. These patterns reflect how mobile workers save time and cost through flexible tools that support reliable communication.

Recent numbers point to steady market expansion, rapid movement to cloud platforms, rising mobile-first traffic, and expanded AI features such as transcription, analytics, and call routing. Encrypted, compliance-focused calling grows in sectors like healthcare and financial services as more businesses adopt cloud based communication solutions for reliable communication and stronger support for modern operations.

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

10 Largest Data Centres in the UK

Let's start

a new project together