Table of Contents

Louisiana Data Centers & Colocation

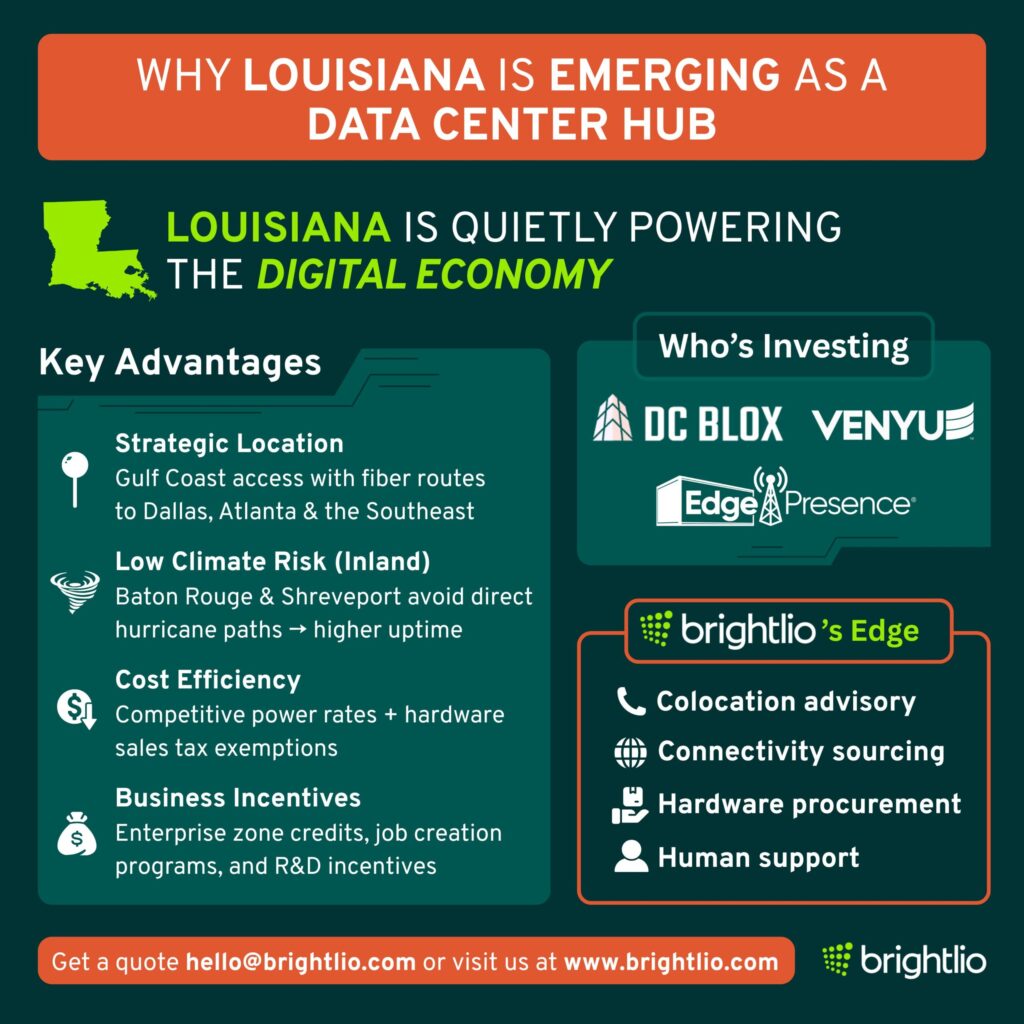

Louisiana is becoming a growing hub for data center expansion, with recent projects attracting attention from major players in artificial intelligence and cloud computing.

Its central location in the Gulf South, rising fiber availability, and a favorable tax package have positioned Louisiana as a viable alternative to saturated markets.

A combination of public infrastructure support and large-scale private investment is pushing the state’s data center profile to new levels.

Louisiana Data Center Infrastructure Overview

- Number of Data Centers: As of 2025, Louisiana has about 13 data centers, mostly in Baton Rouge, New Orleans, and Shreveport. Several large-scale projects under construction will significantly increase capacity. (Datacenters.com)

- Power Capacity: Existing centers currently draw 9 megawatts, with planned hyperscale projects adding hundreds more. The state uses natural gas and nuclear power (12–16% nuclear). Commercial electricity averages 12 cents/kWh; industrial users often pay around 7 cents.

- Average Temperature: Louisiana’s subtropical climate sees winter lows near 39°F (4°C) and summer highs above 95°F (35°C). High heat and humidity require strong cooling systems. Facilities must withstand hurricanes and flooding.

- Internet Speed: Statewide broadband averages 67 Mbps, placing Louisiana in the lower third nationally. Speeds are faster in Baton Rouge and New Orleans, with improvements expected from fiber expansion projects.

- Energy Cost per kWh: Commercial rates average 12 cents/kWh, with lower rates for industrial customers. Strong power generation and infrastructure upgrades make Louisiana attractive for hyperscale and enterprise facilities.

Data Centers in Louisiana Gain Access to Global Fiber Routes

Louisiana data centers benefit from growing fiber-optic infrastructure and proximity to regional and international fiber routes. Its central Gulf location provides low-latency access to major U.S. markets while also enabling indirect links to international bandwidth via nearby submarine cable hubs.

Terrestrial Fiber Infrastructure

Key national carriers with extensive infrastructure in Louisiana include Lumen Technologies, AT&T, and Zayo. Lumen maintains a major long-haul backbone that crosses the state and connects to national data center markets. Regional providers like REV/EATEL and LUS Fiber also support local networks. Interstate 10 (south) and Interstate 20 (north) form dense fiber corridors connecting Baton Rouge, New Orleans, Monroe, and Shreveport to Dallas, Houston, and Atlanta.

Regional and International Connectivity

While Louisiana has no subsea landing site of its own, it links directly to submarine cable landings in Texas, Mississippi, and Florida through terrestrial extensions. New Orleans hosts a neutral exchange point for local peering. This strategic position allows operators to provision redundant or international routes through multiple providers without hosting the landing station directly.

Strategic Connectivity

Emerging data center campuses are interconnecting with national cloud backbones and forming dark fiber routes into regional cloud zones. For example, Hut 8’s West Feliciana development leverages direct proximity to Baton Rouge’s infrastructure and connections into Atlanta and Dallas, enhancing regional and national reach for high-performance workloads.

Tax Environment for Data Centers in Louisiana

Louisiana offers multiple incentives to support data center growth. A dedicated rebate program for high-investment projects and broader tax credits for job creation are among the tools the state is using to stay competitive.

Sales Tax Rebates

In 2024, the state passed a sales tax rebate program for data centers investing at least $200 million and creating a minimum of 50 jobs. This program covers server hardware, electrical equipment, cooling systems, and materials, effectively waiving up to 9% in tax liability. The incentive lasts for 20 years, with a possible 10-year renewal.

Payroll and Job Creation Credits

Operators hiring above-average wage earners qualify for grants covering 18–22% of wages under the High Impact Jobs Program. Prior incentives like Quality Jobs still apply to smaller expansions, giving companies flexibility when seeking payroll support.

Property and Local Incentives

ITEP abatements and PILOT agreements are available at the parish level. Meta and Hut 8 both received local infrastructure grants for water, road, and utility upgrades. In rural areas, these incentives are helping attract some of the largest digital projects ever announced in Louisiana.

Energy Policy and Utility Costs

Louisiana’s regulators are working with utilities to protect consumers from the cost burden of building new power generation. Large data center operators must now enter long-term contracts to fund dedicated capacity, including Entergy Louisiana’s proposed 2.25 GW natural gas plant for Meta.

Major Data Center Developments

Some of the major data centers both currently existing and being built are as follows:

1. Meta: $10 Billion Richland Parish Campus

Meta is investing $10 billion in a new AI data center in Richland Parish, Louisiana. Spanning 4 million square feet, it will be Meta’s largest and support platforms like Facebook and Instagram. The project is expected to bring over 6,500 jobs and $200 million in local infrastructure upgrades.

The facility will start with natural gas power but transition to 100% clean energy through a partnership with Entergy Louisiana. Meta is also exploring nuclear energy, seeking up to 4 GW of capacity to meet long-term AI demands.

To support the workforce, Delta Community College will expand training programs in construction and data center operations. This project blends tech expansion with rural economic growth and clean energy goals. ( Data Center Frontier)

2. Hut 8: $2.5 Billion West Feliciana Campus

Hut 8 will build a $2.5 billion AI data center on 611 acres in West Feliciana Parish, Louisiana. The project begins with two 450,000-square-foot buildings, set for completion by late 2025 and 2026. The site will be leased to a tenant expected to invest $10 billion in equipment.

The center will create thousands of construction jobs and over 50 permanent roles. Future phases could triple its size and add a power plant. The location was chosen for its elevation, strong fiber lines, and proximity to River Bend’s 974 MW capacity. Initial phases will require 300 MW, with long-term demand exceeding 1,000 MW. This is Louisiana’s second major AI data center project in two months. (The Advocate)

3. DartPoints (formerly Venyu): Regional Edge Facilities

DartPoints has acquired Louisiana-based Venyu, adding three data centers—two in Baton Rouge and one in Shreveport—to its portfolio. This move brings DartPoints to 11 facilities across 10 U.S. markets, totaling over 325,000 square feet and 20MW of capacity.

Venyu’s Shreveport site spans 87,000 square feet and meets Tier III standards. In Baton Rouge, BTR2 offers 7,300 square feet of data hall space in Bon Carré Business Park. The acquisition strengthens DartPoints’ presence in the South Central region and supports its focus on edge markets. (Data Center Dynamics)

Data Center Services in Louisiana with Brightlio

Brightlio supports clients seeking colocation and IT infrastructure in Louisiana. We maintain a wide network of trusted data center partners across the state and region, enabling us to provide competitive colocation quotes that match your goals and budget.

Our services come at no cost to you. We also help source internet service, unified communications, and public cloud connectivity, so your entire technology footprint can be managed through a single channel.

Whether you are expanding in-state or launching in Louisiana for the first time, Brightlio offers vendor-neutral guidance backed by market insight and local relationships. Contact us to discuss how we can assist with your data center strategy in Louisiana.

Frequently Asked Questions Regarding Colocation and Data Centers in Louisiana

As of July 2025, Louisiana has 10 operational data centers, with 4 under construction and 8 announced projects. These facilities are primarily located in Baton Rouge, New Orleans, and Shreveport. (Source: Aterio)

Entergy Louisiana plans to construct three combined-cycle combustion turbine plants with a total capacity of approximately 2,260 megawatts to support data center operations in Richland Parish. (Sources: butlersnow.com, New Orleans Newswire, The Register)

As of July 2025, the average commercial electricity rate in Louisiana is 13 cents per kilowatt-hour (kWh). Industrial users, such as data centers, often negotiate lower rates, typically around 7 cents per kWh.

Louisiana provides a sales and use tax rebate for data center projects that invest at least $200 million and create a minimum of 50 new direct, permanent jobs. This incentive, effective from July 2024 to July 1, 2029, can last for 20 to 30 years. (Sources: DataCenterDynamics, NAIOP)

As of early 2025, Louisiana’s average broadband download speed is approximately 67 Mbps, placing it in the lower third among U.S. states. However, urban areas like Baton Rouge and New Orleans experience higher speeds due to ongoing fiber expansion projects.

Major technology companies select Louisiana due to its central Gulf Coast location, affordable electricity rates, expanding fiber-optic infrastructure, attractive tax incentives, and strong public and private investments in infrastructure. These factors provide cost savings and reliable connectivity.

Louisiana’s subtropical climate requires data centers to use powerful cooling systems to handle heat and humidity. Due to hurricane and flooding risks, companies carefully choose locations with higher elevation, robust infrastructure, and reliable disaster-preparedness measures.

Louisiana is rapidly expanding its fiber-optic networks, with major providers like Lumen, AT&T, and Zayo building extensive terrestrial fiber routes. This infrastructure supports high-speed, low-latency connections to key regional markets and international hubs, significantly improving data center performance and reliability.

Data center projects significantly impact Louisiana’s economy, generating thousands of construction and permanent jobs, boosting local infrastructure development, and stimulating regional economic activity. Major projects like Meta and Hut 8 contribute billions in investment, increasing workforce training opportunities and community growth.

Brightlio assists businesses seeking data center services in Louisiana by providing vendor-neutral guidance, colocation solutions, IT infrastructure sourcing, unified communications, and public cloud connectivity at no additional cost.

Louisiana attracts data centers because of its strategic Gulf South location, improving fiber-optic connectivity, favorable tax incentives, lower electricity rates, and large-scale infrastructure investments.

As of 2025, Louisiana has approximately 13 data centers, mainly located in Baton Rouge, New Orleans, and Shreveport, with several significant new facilities currently under construction.

Commercial electricity rates average around 12 cents/kWh, but industrial users frequently pay approximately 7 cents/kWh, making the state appealing for large-scale data center operators.

Louisiana’s subtropical climate features summer temperatures over 95°F (35°C) and high humidity, requiring powerful cooling solutions. Facilities also need design considerations for hurricanes and flooding risks.

Louisiana has extensive fiber infrastructure provided by carriers like Lumen, AT&T, and Zayo, complemented by regional providers like REV/EATEL and LUS Fiber. Although lacking direct submarine cable landings, terrestrial networks link the state to international cable hubs in nearby states.

Louisiana provides incentives such as payroll credits under the High Impact Jobs Program, covering 18–22% of wages, property tax abatements through local programs, and infrastructure grants from local governments for roads, utilities, and water systems.

Major ongoing projects include Meta’s $10 billion Richland Parish campus and Hut 8’s $2.5 billion AI data center in West Feliciana Parish. DartPoints has also expanded regional edge facilities through acquiring Venyu.

Louisiana’s Gulf Coast location offers low-latency terrestrial fiber connections to major U.S. markets, such as Dallas, Houston, and Atlanta, and indirect access to global submarine cable networks through hubs in Texas, Mississippi, and Florida.

Yes, data centers in Louisiana face hurricane and flooding risks due to the region’s weather patterns. Consequently, facilities incorporate resilient infrastructure and strategic site selection to mitigate these threats.

Louisiana partners with institutions like Delta Community College to provide specialized training programs in construction, data center operations, and related technology fields. These programs ensure a qualified local workforce to support current and future data center investments.

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

10 Largest Data Centres in the UK

Let's start

a new project together