Table of Contents

Data Centers in Maine – An Overview

Maine is drawing growing attention as a niche market for data centers, particularly for edge, enterprise, and sustainable builds. With a cold climate, high renewable energy penetration, and strategic fiber links to both U.S. and Canadian networks, Maine offers advantages for environmentally conscious and latency-sensitive operations.

Its repurposed industrial sites and military bases provide ready-made infrastructure, while state and local programs help offset high electricity rates. Though small in scale compared to larger tech hubs, Maine’s data center profile is evolving through targeted investment and public-private partnerships.

Data Center Infrastructure Overview – Maine

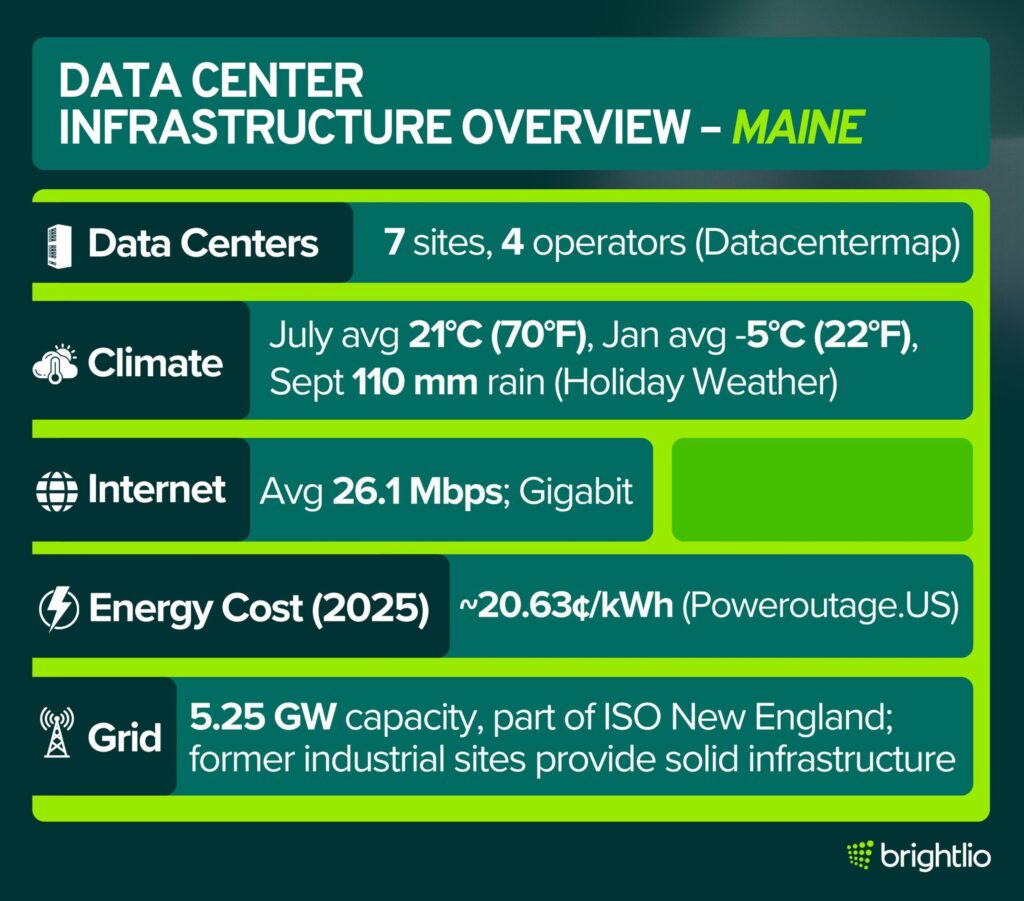

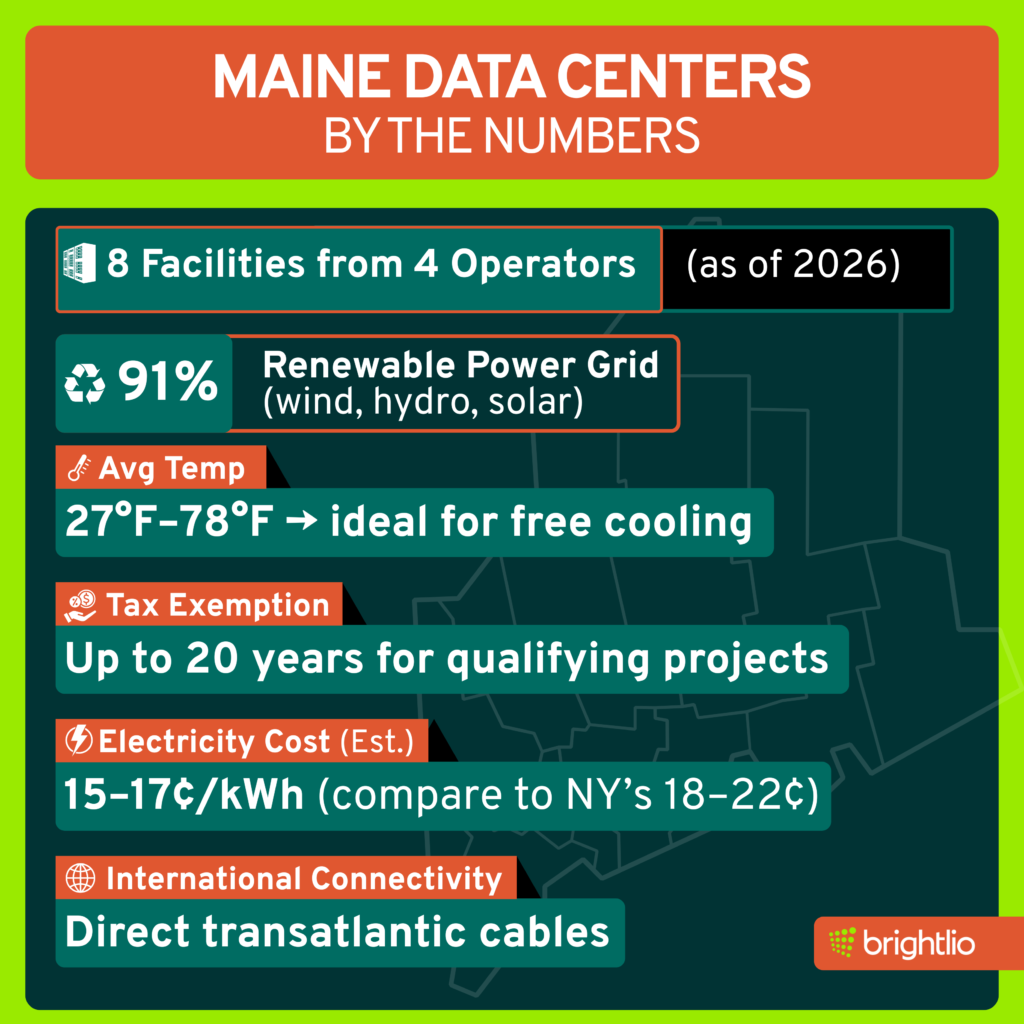

- Number of Data Centers: Maine hosts 7 data centers from 4 different operators. (Datacentermap)

- Average Temperature: Maine’s average weather is warmest in July at 21°C (70°F), coldest in January at -5°C (22°F), and wettest in September with around 110 mm of rain. (Holiday Weather)

- Internet Speed (Average & Maximum)

- Average speed: around 26.1 Mbps

- Maximum speed: Gigabit service (up to 1,000 Mbps) is available in select areas.

- Energy Cost per kWh (2025)

- Maine’s average commercial electricity rate is approximately s 20.63 cents per kWh (Poweroutage.US)

- Electric Grid Capacity: Maine has 5.25 GW of electric capacity and is part of ISO New England. It typically produces as much power as it uses. Former industrial sites often have strong existing infrastructure suited for data centers.

Fiber and Connectivity Access in Maine

Maine plays a key role in linking Atlantic Canada and U.S. hubs. While it lacks a submarine cable landing station, traffic between Halifax or Saint John and Boston often moves through Maine fiber routes. The Three Ring Binder and other networks support this cross-border connectivity.

Terrestrial Fiber Infrastructure

Maine has invested heavily in fiber infrastructure to improve connectivity statewide. A pivotal project was the Three Ring Binder, a 1,100-mile open-access fiber optic network completed in the early 2010s with federal stimulus funds. This middle-mile network forms three rings traversing rural and urban areas, dramatically expanding high-capacity backhaul in Maine.

Initially run by the nonprofit Maine Fiber Company, the network was acquired in 2019 by FirstLight Fiber, an Albany-based telecom operator. Under grant obligations, the fiber remains open-access for all carriers, ensuring that even remote communities and data center sites can lease dark fiber on neutral terms.

Regional and International Connectivity

Maine connects indirectly to transatlantic systems through terrestrial routes from Canada. Portland serves as the state’s carrier hub, with its 340 Cumberland Street facility hosting at least seven providers. FirstLight and Centra offer interconnection and colocation with links up to 100 Gbps.

Edge and Middle-Mile Performance

Low-latency fiber routes keep Portland-to-Boston round-trip times under 10 ms. The middle-mile structure supports rural ISPs and municipal networks, such as Sanford’s 10 Gbps community broadband. However, some remote areas still need last-mile fiber builds. State grants and local projects are addressing those gaps.

Tax and Incentive Environment for Data Centers in Maine

- State-Level Programs: Maine lacks a permanent data center tax exemption law but previously offered sales tax refunds for large facilities (20,000+ sq ft, 20+ jobs). These expired in 2021 but may be revived.

- Business Incentives: Programs like Pine Tree Development Zones (PTDZ) and federal Opportunity Zones offer income tax relief and capital gains deferral. PTDZ is being phased out and replaced by the Dirigo Business Incentive in 2025.

- Local Incentives: Municipalities offer Tax Increment Financing (TIF), discounted land, and expedited permitting. Notable examples include Millinocket and Limestone, which have marketed hydro-powered and turnkey facilities with multi-decade tax deals.

- Policy Outlook: Lawmakers are considering tying future incentives to energy efficiency or clean energy commitments. Maine offers case-by-case negotiated packages instead of blanket tax waivers.

Energy Source in Maine – Renewables vs. Fossil Fuels

Maine generated about 67% of its electricity from renewable sources in 2023. Hydropower was the single largest contributor, supplying roughly 29–31% of total generation.

Wind energy accounted for about 18–20%, and biomass contributed close to 14%, one of the highest biomass shares among U.S. states. Solar power provided around 9%.

The remainder of Maine’s electricity came mainly from natural gas plants, which supplied about 30–32%, while petroleum and coal played only a minimal role (less than 1%).

This renewable-heavy mix supports Maine’s policy targets, which include reaching 80% renewable electricity by 2030 and achieving 100% clean electricity by 2040.

Utility Providers and Policies

Maine’s electricity service is split between Central Maine Power (CMP) in the south and Versant Power in the north. The state maintains a deregulated market for supply, while delivery remains under these two utilities.

Supply Rates

The average commercial electricity rate in Maine is 20.63 cents per kWh, according to United States Power Outage Map. This figure can vary depending on your specific electricity provider and your business’s energy consumption.

Policy / Legislative Developments

In 2025, the Maine Legislature passed LD 912 (“An Act to Limit the Amount of Electricity That May Be Provided to Data Centers on a Certain Commercial or Industrial Site”) as an emergency law, which was signed by the Governor on May 23, 2025.

Key provisions of LD 912:

- It prohibits a generation service provider within the state from supplying more than 25% of its total electricity sales in a calendar year to data centers, with an exception for “behind the meter” generation located adjacent to the data center.

- The law requires quarterly reporting to the PUC by generation service providers, with details on electricity supplied to data centers vs. total sales.

- The law is now in effect (Emergency) as Public Law Chapter 85.

During legislative hearings, the Office of the Public Advocate offered testimony neither in favor nor against the bill, urging caution about whether the approach is the best method for protecting ratepayers

Low Natural Disaster Risk

Maine offers a relatively stable environment with few natural disasters. The region sees no regular earthquakes (the state is in a geologically quiet zone) and is outside Tornado Alley.

Hurricanes rarely reach Maine – by the time tropical systems come this far north, they usually weaken to tropical storms. While coastal Maine can experience the tail end of Atlantic hurricanes or nor’easter storms, serious wind damage is infrequent and largely confined to immediate shorelines.

Inland and northern Maine are considered geographically stable areas with minimal risk of wildfires, extreme heat, or seismic events.

The main weather threats are winter storms: heavy snowfall and ice can pose challenges, potentially causing power line damage or transportation issues. Data centers mitigate this with hardened power infrastructure (underground lines, on-site generators) and robust roof loading designs for snow.

Flood risk is generally limited – coastal sites must account for storm surge and gradual sea level rise, but most existing data centers (e.g. in Portland and Brunswick) sit on elevated ground.

Overall, Maine’s lack of earthquakes and rare severe storms means fewer disruptions; this is a selling point for uptime-reliant facilities.

Abundant Water and Cooling Resources

With its numerous rivers, lakes, and aquifers, Maine has ample water for cooling, though environmental regulations apply. Data centers that choose water-cooled chillers or direct water loop systems can draw from local sources at relatively low cost.

A notable attempt to leverage this was Nautilus’s planned facility in Millinocket, which intended to use water from an adjacent reservoir in a gravity-fed cooling system.

Maine’s Department of Environmental Protection would oversee large water uses to ensure aquatic ecosystems aren’t harmed – but compared to arid western states, Maine’s water supply is plentiful.

Additionally, Maine’s air quality is excellent (lots of forest and low pollution), which is beneficial for data centers using outside-air economization; there’s less risk of airborne contaminants fouling equipment.

One environmental consideration is that Maine is heavily forested (89% forest cover), so any new greenfield data center may require tree clearing – developers often have to work with forestry and wetlands regulations.

On the flip side, the forest cover provides natural buffering and opportunities for green campuses; some data centers have even explored reusing waste heat to support local agriculture (e.g. greenhouses) in Maine’s cold climate, although no major projects are online yet.

Climate and Environmental Considerations

Maine’s climate is pretty well suited for Let’s check out Maine’s climate for data centers:

Cool Climate for Efficiency

Maine’s climate is generally cool-temperate, which is favorable for data center operations. Average temperatures range from about 15 °F in winter to 70 °F in summer, with coastal areas slightly milder and northern areas a bit colder.

The state is one of the 10 coldest in the U.S.. This means for much of the year, data centers can use free cooling strategies – drawing in cold outside air or using water-side economizers – to chill servers with less mechanical refrigeration.

Even in summer, Maine’s nights are cool, and peak daytime highs are moderate compared to the southern U.S. For example, Portland’s July mean temperature is only around 68–70 °F. This climate can significantly reduce cooling energy costs and improve PUE for facilities in Maine, giving it an efficiency edge over hot-climate locations.

Seasonal and Climate Change Factors

Maine has four seasons, with cold winters and mild summers. Data centers must plan for sub-zero operations: keep generators and fuel systems functional, and account for snow removal and ice on cooling towers.

The state is trending warmer and wetter; rising average precipitation could increase spring floods in river valleys. Coastal sites should plan for 1 to 2 feet of sea level rise by mid-century, while inland sites such as Bangor or northern Maine face minimal sea level risk.

Maine’s strict environmental rules mean large facilities undergo site plan reviews for stormwater and habitat impact. Northern latitude adds slightly higher cosmic ray exposure, but typical elevations keep risk low.

Renewable Energy and Sustainability

Maine suits sustainability goals. Hydro, wind, and solar in the grid keep data center carbon per kWh low. ESG-focused firms can use green power programs or add on-site renewables; large campuses suit solar or wind, including reuse of Loring AFB or mill lands.

Green 4 Maine at Loring plans on-site solar and wind to power the campus and lower costs. Cool weather enables heat reuse, such as routing server waste heat to nearby buildings in winter; the state climate plan encourages this.

Rules are strict: air permits for backup generators, diesel allowed for emergencies, emissions controls possible with routine testing, and cooling discharges need permits. Overall, Maine offers an efficient, supportive setting for data centers.

Key Companies and Major Projects

Maine offers a mix of carrier, enterprise, and edge data centers, supported by renewable energy and available sites. Key projects and operators include the following:

1. FirstLight Fiber – Maine Data Centers

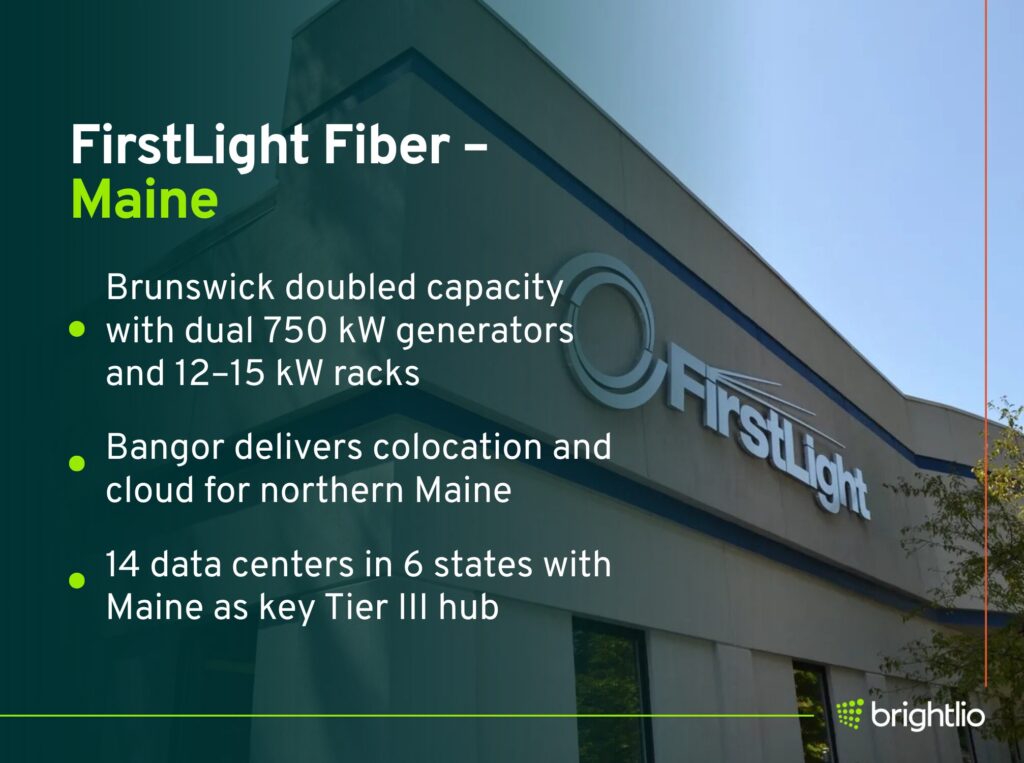

FirstLight Fiber operates two major multi-tenant data centers in Maine, supported by its regional fiber network. These facilities serve enterprise, government, and disaster recovery needs across New England, while additional presence in Portland provides carrier interconnection capabilities.

A. Brunswick Data Center

Located at Brunswick Landing (the former Naval Air Station), this facility was originally constructed by Oxford Networks in a hardened NATO command bunker. FirstLight completed a significant expansion in 2024–2025, doubling the power capacity and upgrading infrastructure.

Key features include:

- High-density racks (12–15 kW) with liquid cooling support

- Dual 750 kW backup generators providing 2N power redundancy

- Secure, bunker-grade construction

- Low-latency connectivity through FirstLight’s fiber network

The Brunswick site attracts customers throughout New England as both a primary IT environment and a disaster recovery hub.

B. Bangor Data Center

Located at 60 Summer Street, the Bangor facility supports businesses and government organizations in northern Maine. It offers colocation and cloud services, with reliable power and connectivity designed for regional workloads.

C. Portland Carrier Hotel Presence

FirstLight maintains space at 340 Cumberland Avenue in Portland, Maine’s primary carrier hotel, to facilitate interconnections and expand network reach.

D. Regional Portfolio

Beyond Maine, FirstLight operates a total of 14 data centers across six states. The Maine facilities remain key assets within its portfolio, benefiting from secure sites such as the Brunswick bunker, and delivering Tier III-like levels of redundancy and reliability.

2. Deep Edge – Portland Hub

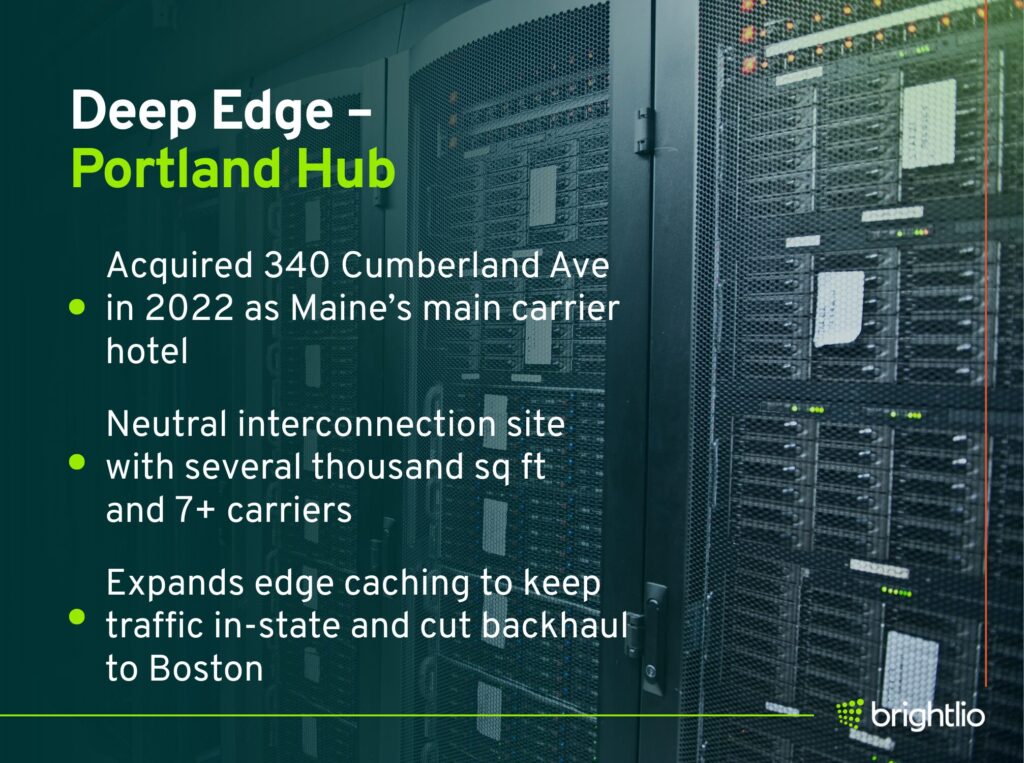

In February 2022, Deep Edge Realty entered the Maine market through the acquisition of 340 Cumberland Avenue in Portland, the state’s primary carrier hotel and Internet gateway. Deep Edge specializes in operating edge data centers in Tier-2 markets, with a focus on enabling local content distribution and connectivity.

A. Facility Overview

The Portland site, sometimes referred to as “Centra” or CADC Portland under previous owners, serves as Maine’s premier interconnection hub. It hosts multiple telecom carriers and provides the critical role of keeping regional traffic in-state.

Key features include:

- Several thousand square feet of whitespace for colocation

- Neutral interconnection point for at least 7 carriers

- Designed for edge deployments, including cache nodes for streaming and cloud providers

- Neutral colocation racks available to ISPs and enterprises in southern Maine

Under Deep Edge, the site is positioned to expand content caching and interconnection functions, reducing the need to backhaul data traffic to Boston. This strengthens Maine’s digital ecosystem by improving performance for end-users and lowering costs for regional providers.

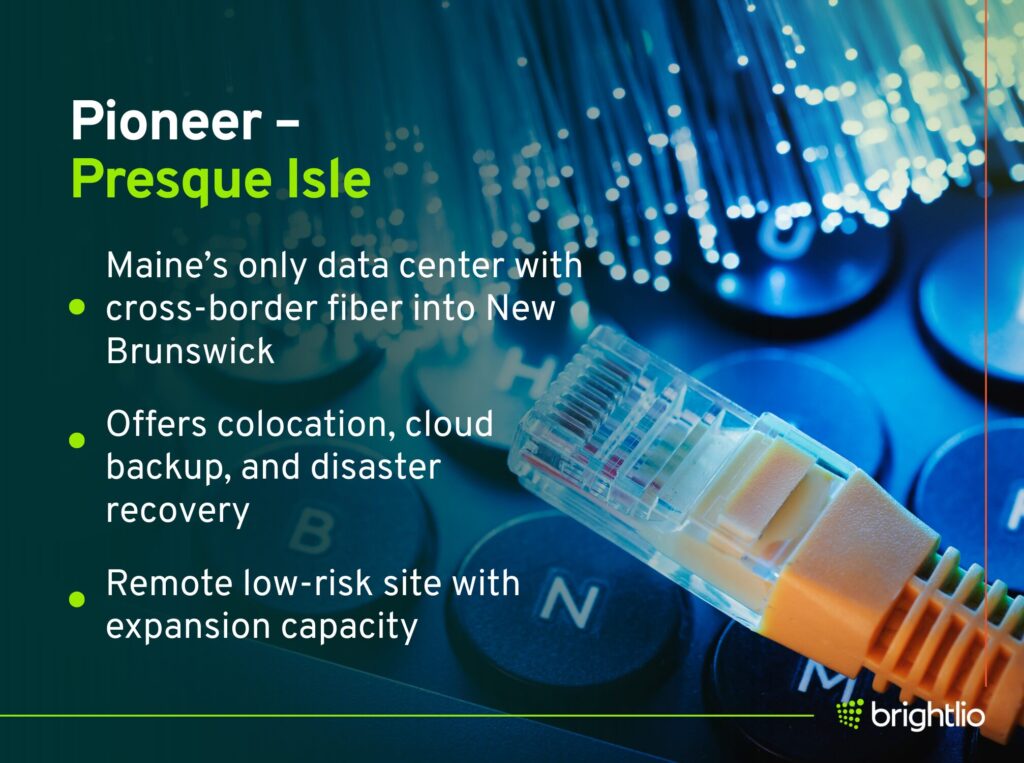

3. Pioneer Broadband (Presque Isle)

Pioneer Broadband, an ISP headquartered in Houlton, operates a regional data center in Presque Isle, Maine (480 Main Street). This facility extends services across northern Maine while also supporting cross-border clients in Canada.

The Presque Isle data center is often described as “Maine’s only internationally connected data center.” It uses dedicated fiber links into New Brunswick, providing unique cross-border reach.

Key features include:

- Colocation services for local and regional businesses

- Cloud backup and disaster recovery offerings

- Geographic stability with low natural disaster risk

- Cool northern climate suitable for energy-efficient operations

- Ample space for expansion on cost-effective land

The location serves as a redundancy and backup site far from major metropolitan areas, making it attractive for enterprises that value remote secondary hosting options. Its international connectivity allows Canadian firms to exchange traffic in the U.S. with improved latency on routes to Boston and New York.

4. EnablesIT/Nexus (Brunswick)

Alongside FirstLight’s larger Brunswick Landing campus, a smaller data center in Brunswick is operated by Nexus Management (EnablesIT). The facility is located at 4 Industrial Parkway and primarily supports managed services for enterprise clients.

The Brunswick site is an enterprise-focused data center designed to host customer systems and provide managed IT services.

Key features include:

- Cloud hosting and colocation for small to mid-sized organizations

- Managed services and global helpdesk support

- Operated by Nexus Management, later merged with UK-based EnablesIT

- Facility size ranging from a single room to several thousand square feet

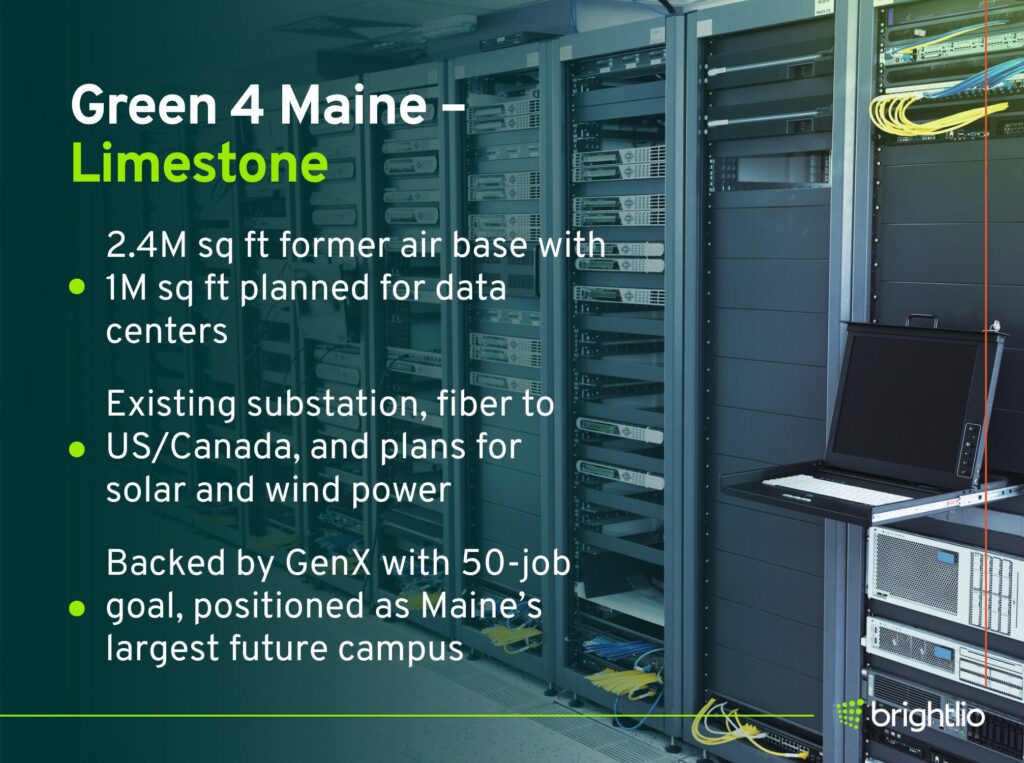

5. Green 4 Maine – Loring Commerce Centre (Limestone)

At the former Loring Air Force Base in Limestone, private developers are advancing Green 4 Maine, a large-scale data center and technology campus. The 2.4 million sq ft Cold War-era base is being repositioned with a focus on AI and high-performance computing.

Project Vision

- Conversion of 1 million sq ft of existing structures into data center space

- Infrastructure already in place: substation, heavy power grid capacity, fiber links to New England and Canada

- Repurposed hangars and buildings to cut construction costs and timelines

- Plans for on-site solar and wind generation

Economic Impact

- Backed by GenX Capital Partners with equity raising ongoing

- Incentives tied to creating at least 50 jobs, including tax credits and local approvals

- Strategic position near the Canadian border to serve cross-border demand

As of mid-2025, developers led by Tom Manning and Scott Hinkle are seeking tenants. If realized, Green 4 Maine would be the largest data center campus in the state, transforming a decommissioned military base into a digital hub for northern New England.

Economic and Workforce Impact

Beyond infrastructure and climate, data centers in Maine carry clear economic and workforce implications, shaping jobs, training, tax revenues, and community benefits. The following sections highlight jobs, training, local benefits, community ties, and the balance between costs and long-term growth:

1. Job Creation

Data centers bring large capital spend and modest headcount. A big site usually supports a few dozen to a couple hundred permanent roles. Nautilus’s planned 60 MW project in Millinocket expected ~30 full-time jobs before the project was canceled.

Apple’s $1 billion Maiden, North Carolina facility launched with about 50 full-time positions, a typical figure for the sector. Maine officials frame data hubs as high-wage anchors that add tax base, while not a one-stop fix for mill-town job losses.

2. Workforce Development

Maine’s community colleges offer short programs in IT, HVAC, electrical, and cybersecurity through the Harold Alfond Center.

Southern Maine Community College runs a cybersecurity degree that includes data center topics. UMaine supplies CS and ECE talent through SCIS and ABET-accredited engineering programs.

3. Economic Benefits

Construction phases can employ hundreds over 12 to 24 months, with spending on local trades and suppliers, then long-term property-tax contributions after commissioning.

Studies highlight that data centers tend to be sizable property taxpayers even with low staffing counts.

4. Educational and Community Partnerships

Operators in Maine promote visibility through tours and outreach; FirstLight showcases its Brunswick data center and recently doubled its power capacity. K-12 efforts like MLTI and NGSS adoption promote tech-skills exposure that pipelines into IT roles.

5. Balancing Costs and Benefits

Leaders weigh grid impacts and incentives against jobs and tax base. A 2025 bill (LD 912) sought to cap how much electricity suppliers can sell to data centers and require reporting, with the Public Advocate citing ratepayer risk concerns.

Maine’s Jobs & Recovery Plan and MCA broadband programs invest ARPA funds in connectivity that supports digital industry growth.

Final Thoughts

Maine offers clear strengths for data centers: naturally cool weather, abundant water, strong renewable energy, and a regulatory system that balances development with environmental protection.

Coastal sea level rise, strict permitting, and limited workforce depth present challenges, but inland sites and ongoing training programs help offset these risks.

For operators willing to plan carefully for winter resilience and energy needs, Maine provides a stable, sustainable setting that supports long-term data infrastructure growth.

Brightlio provides expert data center consultation services in Maine, helping you access reliable facilities, optimize costs, and connect with trusted providers for your infrastructure needs.

FAQs

Yes. Industry directories list 7 facilities across Portland, Bangor, Brunswick, Millinocket and Northern Maine.

Virginia. Reports from the state and CBRE describe Northern Virginia as the largest data center market in the world and the top US state market.

Among public colocation operators, Digital Realty reports 124 US data centers as of December 31, 2023, the largest disclosed US footprint. Equinix has the largest global platform, with 268 facilities worldwide as of early 2025, but a smaller disclosed US count. Hyperscalers like Amazon, Microsoft and Google also own many US facilities, although exact US site counts are not publicly tallied.

Common triggers include high electricity demand, potential pass-through costs to ratepayers, water use in water‑stressed regions, noise, diesel generator emissions, and land-use changes. Recent examples include a court ruling that voided rezoning for the Prince William Digital Gateway in Virginia and controversy over power plant upgrades tied to a Meta facility in Louisiana.

Key impacts include rising electricity demand and associated emissions, local noise and air pollution from backup generators, and significant direct and indirect water use for cooling and power generation. Federal and international analyses project sharp load growth through 2026 to 2030, and note generator emission constraints and water footprints that vary with grid mix and cooling design.

Strong long‑haul and subsea fiber, proximity to major cloud customers, comparatively reliable power, large tracts of suitable land, and state tax incentives in most states all contribute. A recent 50‑state survey counted incentives in 36 states, and Virginia’s own review highlights fiber density and incentives as core advantages.

Often yes. Many sites use evaporative cooling that draws municipal or other freshwater, though some tap reclaimed water and newer designs use closed‑loop liquid or refrigerant systems that minimize or eliminate cooling water use. Microsoft has announced a design intended to use zero water for cooling.

The United States, with roughly 5,300 to 5,400 facilities as of March 2024, far ahead of Germany and the United Kingdom. The counts come from Cloudscene data commonly summarized by Statista and Visual Capitalist.

AI growth has pushed large tech firms’ water use higher, and case studies show sizable footprints during model training and serving. Google reported about 6.1 billion gallons used at its data centers in 2023, and academic work estimates hundreds of thousands of liters for training a single large model instance, with impacts that depend on local water stress and cooling choices. At the same time, operators are shifting to non‑potable sources and zero‑water cooling at new sites.

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

10 Largest Data Centres in the UK

Let's start

a new project together