Table of Contents

6 Data Center Market Trends for 2025

The global data center market is undergoing a significant transformation as enterprises and service providers respond to growing demand for cloud computing, artificial intelligence (AI), and edge computing. Market size is projected to reach USD 527.46 billion by 2025 and continue rising, driven by network infrastructure expansion, new workload types, and regulatory requirements for secure data handling.

Data centers are evolving from traditional enterprise facilities to complex ecosystems supporting hyperscale cloud, colocation, modular edge deployments, and high-performance computing workloads. Generative AI and advanced analytics are pushing compute density requirements higher, creating demand for advanced cooling technologies, power optimization strategies, and sustainable operations

6 Data Center Market Trends for 2025

The data center industry is transforming to meet rising demands from AI, cloud computing, edge deployments, and sustainability requirements.

These six trends show how operators are preparing for 2025 and beyond:

1. Cloud Computing Expansion

Cloud computing remains a central driver for data center growth as enterprises adopt public, private, and hybrid cloud models.

The surge in cloud services has resulted in a steady demand for hyperscale data centers, which are designed to handle large-scale workloads and provide reliable, high-capacity connectivity.

According to Technavio, the data center market is forecast to grow by USD 535.6 billion from 2024 to 2029, partly fueled by multi-cloud adoption and network upgrades.

The shift to distributed cloud architectures enables organizations to improve agility, reduce costs, and optimize performance, leading to increased investment in advanced data center infrastructure.

Hyperscale providers such as AWS, Microsoft, and Google are scaling their operations to support high-volume transactions, artificial intelligence (AI) workloads, and edge services.

Regional markets also reflect this trend. North America continues to lead cloud infrastructure expansion due to established hyperscale campuses and strong demand from enterprise cloud migrations.

In Asia-Pacific, demand for cloud services is accelerating, supported by rising digitalization initiatives and government-driven data localization policies

2. Artificial Intelligence and Machine Learning

The rapid adoption of artificial intelligence (AI) and machine learning (ML) is reshaping data center infrastructure needs. These workloads are compute-intensive, requiring high-performance GPUs, specialized networking, and advanced storage solutions.

According to JLL, AI demand is driving record data center construction levels and is expected to continue building momentum through 2025.

Generative AI applications, including large language models (LLMs), have amplified the need for GPU-based infrastructure. This has pushed operators to adopt high-density rack designs and advanced cooling solutions such as liquid cooling and immersion cooling.

The surge in AI workloads has also increased energy requirements, intensifying focus on power sourcing and sustainability strategies.

Industry leaders like NVIDIA, Dell, and Supermicro are delivering AI-specific hardware architectures, while hyperscale providers such as Microsoft, Google, and AWS are investing heavily in AI-optimized data centers.

This shift is not limited to hyperscale facilities; colocation and edge data centers are integrating AI-ready infrastructure to support enterprises deploying AI workloads at scale.

3. Edge Computing

Edge computing is driving a shift from centralized data processing toward distributed infrastructure positioned closer to end users and devices. This approach reduces latency, supports real-time analytics, and enables services like autonomous vehicles, smart manufacturing, and advanced IoT applications.

According to IDC, edge deployment strategies are now a core component of data center planning, with modular, micro, and containerized facilities increasingly deployed near population hubs and industrial zones.

This transition is pushing operators to design compact yet powerful facilities capable of supporting high-density computing. Edge data centers are often built with energy-efficient designs and automation tools for remote management, making them viable for distributed IT workloads.

Telecommunications providers are expanding edge footprints alongside 5G rollouts, ensuring that cloud and AI-driven applications deliver fast, reliable performance even in remote or bandwidth-constrained environments.

The edge model also aligns with regulatory trends requiring data to remain within regional boundaries, driving localized processing and storage.

As organizations move workloads to the edge, traditional core data centers are being complemented rather than replaced, creating a hybrid model of centralized and distributed infrastructure.

4. Green Data Centers

Sustainability has become a top priority for data center operators as energy consumption and environmental impact continue to grow. Green data centers focus on reducing power usage effectiveness (PUE), integrating renewable energy, and minimizing carbon emissions. According to IDC, data centers are working toward net-zero targets while adopting energy-efficient designs, advanced cooling technologies, and intelligent energy management systems.

Liquid cooling, particularly direct-to-chip and immersion cooling, is gaining traction to support high-density workloads such as AI and high-performance computing (HPC) while lowering energy consumption.

Operators are also exploring on-site renewable energy sources and microgrids to mitigate power availability risks and stabilize long-term energy costs.

Regulatory pressures and corporate ESG commitments are accelerating this shift. In Europe, strict energy efficiency and environmental standards are driving adoption of renewable energy contracts and waste heat reuse programs.

In North America and Asia-Pacific, hyperscale cloud providers and colocation companies are investing in renewable-powered facilities to meet sustainability goals and improve operational resilience

5. Liquid Cooling Solutions

The growth of AI, high-performance computing (HPC), and other dense workloads is accelerating the adoption of liquid cooling technologies. Traditional air cooling methods struggle to manage the heat output of high-density racks and GPU-intensive environments, prompting data center operators to invest in advanced alternatives.

According to IDC, liquid cooling is forecast to grow significantly, with methods such as direct-to-chip cooling and immersion cooling gaining market share.

Direct-to-chip cooling delivers coolant directly to processors, providing higher thermal efficiency and supporting increased rack density.

Immersion cooling, where servers are submerged in a non-conductive liquid, offers even greater efficiency and has been successfully deployed in AI training environments and crypto mining facilities.

These technologies reduce energy consumption associated with traditional cooling, lowering operational costs while supporting sustainability initiatives.

Major providers are already implementing these solutions at scale. Hyperscale companies like Microsoft and Google have launched pilot deployments, while colocation firms are beginning to retrofit existing sites to accommodate liquid cooling technologies.

As AI-driven demand increases, liquid cooling adoption is expected to expand rapidly, becoming a core component of future-ready data center design.

6. Automation and AI Operations

Automation and AI-driven management have become vital for modern data centers as their complexity grows and power demand rises.

These technologies support real-time monitoring, predictive maintenance, and intelligent workload distribution. They help cut downtime and improve resource use in single facilities and across multiple locations.

Data center infrastructure management (DCIM) platforms now include AI features that allow operators to forecast capacity needs, detect anomalies, and optimize power and cooling systems.

This helps data centers run more efficiently and improves storage system performance, which is important for cloud service providers and enterprises with distributed digital infrastructure.

IDC research notes that these smart technologies support remote operations and enable proactive maintenance strategies, both of which are important for edge and hybrid cloud deployments.

AI-driven workload orchestration is also playing a key role. It analyzes traffic patterns and application demands, automatically shifting workloads or adjusting compute resources to improve performance and reduce energy use. This automation lowers operational costs, helps address the shortage of skilled labor, and supports better responses to data breach risks.

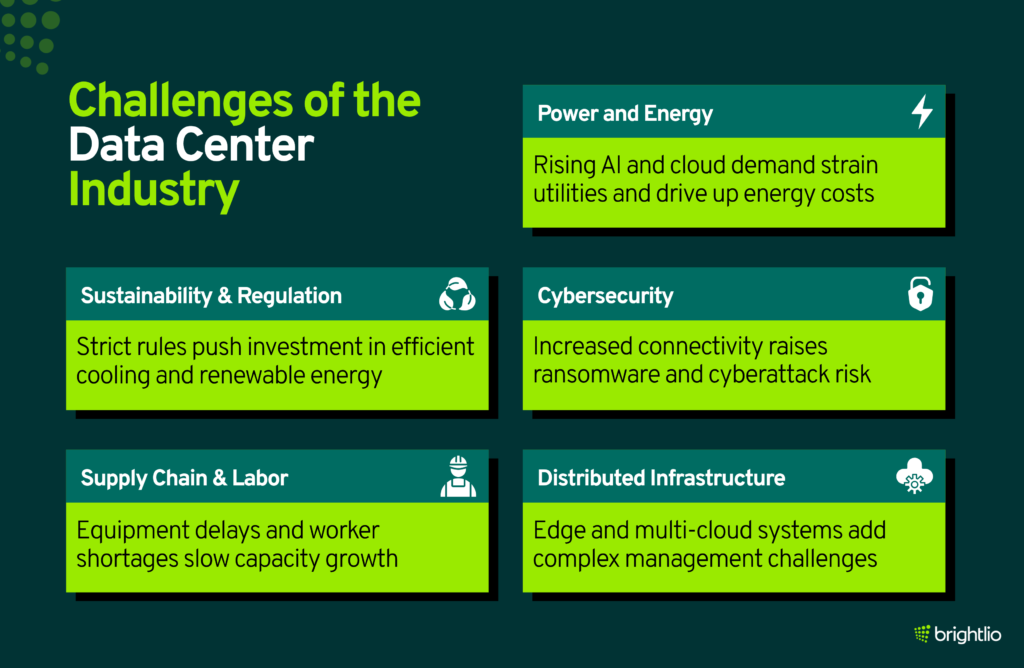

Challenges of the Data Center Industry

Despite rapid growth and innovation, data centers face several critical challenges. Some of the challenges data center industry faces are discussed below:

1. Power and Energy Constraints

Rising demand for AI, HPC, and cloud workloads has increased power density requirements, straining utility infrastructure and driving up energy costs. Some regions are experiencing grid limitations, making it difficult to expand capacity quickly. Operators are turning to on-site generation, microgrids, and renewable power agreements to mitigate these constraints.

2. Sustainability and Regulatory Pressure

Data centers must meet stringent environmental regulations and achieve corporate net-zero targets. This requires significant investment in energy-efficient infrastructure, advanced cooling solutions, and renewable energy sourcing. Compliance with regional energy-efficiency mandates, especially in Europe, adds complexity to expansion plans.

3. Cybersecurity Risks

Increased connectivity and hybrid deployments have expanded the attack surface, making data centers prime targets for ransomware and nation-state cyberattacks. Ensuring physical and logical security at scale remains a constant challenge as operators integrate automation and remote management technologies.

4. Supply Chain and Skilled Labor Shortages

The construction of new facilities and retrofitting of existing ones are affected by delays in equipment availability and a lack of skilled technicians. This slows time-to-market for new capacity and increases operational costs.

5. Managing Distributed Infrastructure

With the rise of edge computing and multi-cloud ecosystems, operators must manage increasingly complex and geographically dispersed infrastructure. Coordinating these environments requires advanced monitoring, AI-driven orchestration, and skilled IT personnel.

Data Center Industry Geographical Trends

This section looks at how data centers are growing in three key regions: North America, Europe, and Asia. Each has its own trends, challenges, and opportunities shaping how the industry is developing.

1. North America

Let’s take a closer look at North America, where data center growth is accelerating. Growth is fueled by hyperscale cloud providers, new power solutions, and state-level incentives, attracting heavy investment.

Hyperscale Expansion

North America, especially the U.S., continues leading the global data center surge. The North America hyperscale market is forecast to reach nearly USD 138 billion in 2025, growing at 22% CAGR through 2030, largely driven by hyperscale cloud giants such as AWS, Microsoft, Google, Meta, and Oracle. Quarterly data center pipelines in leading U.S. metros (Northern Virginia, Chicago, Phoenix, Atlanta) leaped by 43% year‑over‑year by early 2025, with ~1,668 MW net absorption in Q1 alone.

Sustainable Energy & Power Strategies

Power scarcity has become the chief operational constraint. As AI-driven demand accelerates, utilities and developers are partnering on power solutions. In Texas, projects like Fermi America’s proposed “Hypergrid” will combine nuclear, solar, natural gas, and battery storage to feed AI campuses. Tech giants are also signing long-term renewable PPAs—collectively holding tens of gigawatts—and exploring small modular reactors to secure reliable, low-carbon baseload energy.

Operational and Environmental Tensions

Data centers may soon consume more electricity than entire countries, as shown by projections that U.S. data center energy demand could match or surpass Poland’s consumption by 2030, straining grids and raising public health costs tied to infrastructure expansion. In water-stressed regions like Arizona and Illinois, consumption logic has drawn criticism while rising energy costs weigh on residents.

Private Capital and Market Momentum

Alongside hyperscale builds, colocation and modular campuses are scaling rapidly. Over 60% of hyperscale market growth in 2024 came from leased colocation space. Vacancy rates in top U.S. markets have sunk to new lows (~0.76% in Northern Virginia; ~2.6% region‑wide), with much of the nearly 6.5 GW under construction already pre‑leased.

2. Europe

Now, let’s turn to Europe, where data centers are growing fast but with a unique focus on sustainability and regulation:

Hyperscale and Colocation Growth

The Europe hyperscale data center market was valued around USD 31.4 billion in 2023, rising to approximately USD 48 billion in 2024, with a projected surge to USD 45–60 billion by 2029, depending on the source, at a CAGR around 6–26%. Colocation services also show rapid growth: worth USD 56.7 billion in 2024 and forecast to exceed USD 200 billion by 2034, at ~13–14% CAGR.

Top metro markets—Frankfurt, London, Amsterdam, and Dublin (FLAP‑D)—accounted for nearly 50% of new capacity in 2025, with ~9% vacancy rates, as demand continues to outpace construction. Germany and the UK are leading capital inflows and innovation in green infrastructure and AI‑ready facilities.

Sustainability and Regulation

Europe is pushing ahead with policies that prioritize energy-efficient, low‑carbon data centers. Under the Climate Neutral Data Centre Pact, signatories must operate using 100% renewable energy by 2030, shaping design and energy sourcing strategies. Operators are also adopting eco-friendly techniques such as modular construction, liquid cooling, and district heating systems that recapture waste heat for local use. For instance, a data center in Espoo now supplies waste heat to a nearby retail site, cutting CO₂ emissions by over 200 tonnes yearly.

Further support comes from legacy infrastructure: companies including Microsoft and Amazon are converting old coal or gas power plants into data centers, using existing grid and water access while accelerating build timelines and benefiting from renewable energy partnerships.

Power and Supply Constraints

Europe lags behind the U.S. in development speed due to complex permitting and limited grid capacity. Grid access delays can stretch over a decade, slowing new builds even as demand rises. Reports show that 2025 began with only 31 MW of new supply added—its slowest start since early 2022—despite the development pipeline remaining strong (e.g., 702 MW pre‑leased).

Constraints on available land and power have pushed developers to emerging markets—Spain, Portugal, Greece, and the Nordics—which offer cooler climates, renewable energy incentives, and lower land costs for AI‑ready capacity.

Market Drives & Demand

Demand is driven by digital transformation, AI deployments, edge and 5G rollouts, and increased cloud adoption across industries including finance, healthcare, and retail. Capacity in MW terms is expected to climb from about 13.6 GW in 2025 to over 21 GW by 2030 (~9% CAGR). Growth rates across markets remain high, with hyperscale projects expanding rapidly, especially in Western Europe and the Nordics.

3. Asia‑Pacific

Finally, let’s look at Asia-Pacific, one of the fastest-growing regions for data centers. Driven by AI, cloud services, and strong national investments, this region is rapidly building new capacity while adopting green energy and innovative infrastructure strategies:

Hyperscale & Market Growth

Asia‑Pacific is among the fastest‑growing regions in the global data centre market. In 2025, total capacity is expected to reach about 20,320 MW, rising to 37,580 MW by 2030, at a CAGR of around 13.1 %. The hyperscale data centre market alone is projected to hit USD 106.7 billion in 2025, growing at an estimated 24.5 % CAGR to around USD 319 billion by 2030. Annual expansion is accelerating, driven by demand in AI, cloud services and sovereign‑cloud mandates in India, Indonesia, Malaysia and China.

Emerging National Markets

India is quickly becoming a regional hub. Its capacity is expected to exceed 4,500 MW by 2030, supported by $20–25 billion in planned investments. Airtel’s Nxtra plans to double its capacity to 400 MW by 2027 through a roughly $600 million investment. Meanwhile Google is committing $6 billion to build a 1 GW data centre in Andhra Pradesh, with $2 billion earmarked for renewable energy infrastructure.

Sustainability & Energy Strategies

Green energy adoption is rising in the region. Malaysia’s YTL Green Data Center Park near Johor plans to be powered by a 500 MW solar farm, with collaboration from NVIDIA on AI infrastructure and supercomputing facilities. Singapore is deploying stringent energy efficiency mandates, such as PUE under 1.3, water usage effectiveness targets, and green‑mark certifications for new builds. SEA countries also explore cross‑border power sharing through the ASEAN Power Grid to secure clean energy access for data infrastructure.

Supply & Regulatory Constraints

Land and power availability remain tight in core markets like Singapore and Hong Kong, pushing some developers to secondary cities across Malaysia, Thailand, and Indonesia. In Australia, major cities face similar land scarcity, prompting reuse of older properties by providers like NextDC to host AI‑density centres.

Operational & Market Dynamics

Major players, including AWS, Microsoft, Google, Alibaba, Equinix and NTT GDC, are scaling global investment in APAC. E‑commerce tenants are accelerating demand faster than cloud alone, with growth in e‑commerce services projected at ~24.6 % CAGR through 2030. Pre‑leasing remains common, with strong demand backed by limited supply and rising rental values. Bank of America forecasts the region’s data centre capacity will double within five years, adding roughly 2 GW per year across markets such as Japan, South Korea, Indonesia, Malaysia, Thailand and the Philippines.

Latest Data Center Trend News

Let’s find out what’s new in the world of data centers, where major investments and AI-driven innovations are rapidly changing how infrastructure is built and powered.

1. Google to Build $6 Billion Data Center in Andhra Pradesh

Google plans to invest $6 billion to develop a 1‑gigawatt data center and renewable power infrastructure in Visakhapatnam, Andhra Pradesh. The project includes $2 billion dedicated to renewable energy to power the facility, marking Google’s first data center investment in India.

The center will be the largest in Asia by capacity and investment size and is part of Google’s broader expansion across the region, including projects in Singapore, Malaysia, and Thailand.

Andhra Pradesh aims to add 6 GW of data center capacity over the next five years, with 1.6 GW already secured for development. The state is also planning new cable landing stations to improve global network connectivity and expects data center growth to drive up to 10 GW of power demand, primarily from green energy sources. (Source: Reuters)

2. NVIDIA Unveils Vision for AI Factories at Data Center World 2025

At Data Center World 2025, NVIDIA unveiled its vision for “AI factories”, large-scale data centers designed for accelerated computing with advanced power and cooling systems.

A key example is the Lancium Clean Campus in Texas, scaling from 200 MW to 1.2 GW by 2026, hosting up to 50,000 GPUs per building and using on-site power generation and liquid cooling.

NVIDIA also highlighted converting existing sites, such as malls and newer colocation facilities, into AI-ready centers. Using its Omniverse digital twin platform for planning, NVIDIA aims to optimize efficiency and sees AI factories as a major productivity shift, with potential to boost global productivity by 10% and add $100 trillion to the world economy. (Source: Tech Republic)

3. New Data Center Developments: July 2025

Data center development continues to accelerate worldwide, with several major projects announced this past month, reflecting how critical infrastructure investment remains a top priority for providers.

In North America, Google committed $7 billion to expand its Iowa facilities and develop a new data center in Cedar Rapids. Amazon announced a $10 billion campus in Richmond County, North Carolina, and a record $20 billion AI campus investment in Pennsylvania.

Northern Data Group revealed a 20 MW Pittsburgh facility for AI model training, and EdgeCore Digital Infrastructure announced a 1.1 GW campus in Virginia, emphasizing reliable connectivity to support high performance operations. Other highlights included a 3 GW campus in Texas from MSB Global Services, AI-driven design for a Colorado facility, and Microsoft’s new power supply agreement at Three Mile Island.

In Europe, investment momentum remains strong despite supply chain constraints that continue to challenge construction timelines. Spain will see a 300 MW facility outside Pamplona, while the UK’s SWI Group announced a 330 MW data center between Cambridge and Peterborough. Scotland’s Ravenscraig is set for a £3.9 billion green data center project, and Germany’s Hochtief is expanding its data center strategy. Austria welcomed its first Microsoft Azure region, and Germany’s Jupiter supercomputer achieved top global performance rankings.

In Asia-Pacific, India’s Anant Raj will invest $2.1 billion in new data centers, while Amazon announced a $13 billion Australia investment focused on Sydney and Melbourne. Singapore-based DayOne secured $3.5 billion for Malaysian green data centers, East Jakarta approved a Tier 4 facility with 7,000 racks, and Digital Edge partnered with B.Grimm Power to develop $1 billion hyperscale campuses in Thailand. Japan saw ST Telemedia open its first data center with integrated solar power, and Alibaba expanded its regional presence with new facilities in Malaysia and the Philippines. ( Source: Data Center Knowledge)

4. Google to Limit AI Data Center Power Use During Grid Strain

Google has signed agreements with Indiana Michigan Power and Tennessee Power Authority to reduce power consumption at its AI data centers during times of high electricity demand. The move comes as energy-intensive AI workloads place increasing strain on U.S. power grids, raising concerns over potential blackouts and higher consumer costs tied to power systems performance.

These agreements are part of demand-response programs, allowing Google to temporarily scale back power use when utilities request it, freeing up capacity on the grid. Google said the initiative helps avoid building new transmission infrastructure, improves grid efficiency, and supports renewable energy integration while also addressing power constraints in regions with rapidly growing AI deployment. (Source: Telecom)

5. Electricity Prices Rise Amid Data Center Boom

Average U.S. residential electricity prices rose 6.5% from May 2024 to May 2025, with sharp increases in states like Maine (+36.3%), Connecticut (+18.4%), and Utah (+15.2%), while a few states, including Nevada (-17.7%), saw decreases. Analysts point to the rapid growth of power-hungry data centers, especially those supporting AI, as a key driver of rising costs.

Grid operators are investing in new transmission infrastructure to support expanding data center demand, passing billions in costs to customers. In PJM’s Mid-Atlantic and Midwest region, data centers accounted for more than 60% of capacity market price increases, adding $9.3 billion in costs. Virginia studies project local residential bills could rise $14–$37 monthly by 2040 due to data center-driven demand.

The surge highlights the financial strain of powering the AI boom, with federal energy policy focusing on coal, natural gas, nuclear, and hydropower, while new generation and infrastructure investments continue to push up consumer bills. (Source: Axios)

6. Meta Plans Massive Data Center and AI Spending

Mark Zuckerberg announced Meta will spend hundreds of billions of dollars on artificial intelligence and build data centers nearly the size of Manhattan. The first facility, Prometheus, is set to go online in 2026, while Hyperion will scale up to 5 GW over time. Meta aims to be the first AI lab to operate a gigawatt-plus supercluster, according to industry analysis.

The company reorganized its AI efforts under “Superintelligence Labs” after challenges with its Llama 4 model and talent departures. This division will focus on the Meta AI app, advertising tools, and smart glasses. Meta’s aggressive AI investment follows a surge in ad revenue aided by AI, and includes recruiting top industry talent and raising 2025 capital expenditure to $64–72 billion to compete with OpenAI and Google. (Source: The Guardian)

7. Cheyenne to Host Gigantic AI Data Center

Cheyenne, Wyoming, will soon host an AI data center projected to use more electricity than all the state’s homes combined, with plans to eventually scale to five times its initial size. The project, a collaboration between Tallgrass and Crusoe, will start at 1.8 GW of capacity and could expand to 10 GW, supported by dedicated gas generation and renewable energy sources.

Wyoming’s cool climate, inexpensive power, and strong energy production make it attractive for large-scale computing. The city already hosts Microsoft and Meta data centers, including Meta’s $800 million facility nearing completion.

Experts note such projects could impact electricity bills as utilities adapt to massive new demand, though renewable energy could help offset environmental effects. The Cheyenne site has not been confirmed as part of OpenAI’s “Stargate” initiative, though Crusoe has partnered with OpenAI on other large-scale AI data center efforts in Texas.

What are the Top 10 data centre companies?

The data centre industry is powered by some of the biggest names in technology and infrastructure. Leading the field is AWS, with its global cloud platform supporting businesses in over 190 countries. The top data center companies include:

- AWS (Amazon Web Services) – Largest cloud provider with over 200 products and services, supporting businesses in 190+ countries with scalable computing, storage, and AI solutions.

- Microsoft Azure – Global cloud platform operating 160+ data centres across 60 regions, known for secure, scalable, and sustainable cloud services.

- Google Cloud Platform – Cloud services built on Google’s infrastructure, focusing on energy-efficient, carbon-neutral data centres.

- Digital Realty – Operates 300+ data centres in 27 countries, providing colocation and interconnection for global businesses.

- Equinix – Runs 248 data centres on five continents, enabling enterprises to interconnect networks, clouds, and IT providers.

- Oracle Cloud – Offers cloud infrastructure, autonomous databases, and enterprise applications to drive business innovation and security.

- Meta – Advanced, energy-efficient data centres powering Facebook, Instagram, WhatsApp, and metaverse initiatives with renewable energy focus.

- IBM Cloud – Hybrid cloud and AI solutions with a secure, enterprise-grade data centre network serving key industries.

- SAP BTP – Data centres running 100% on renewable energy, supporting intelligent and sustainable enterprise operations.

- Iron Mountain – Specializes in secure colocation with compliance, sustainability, and physical security for regulated industries.

What is the Global Data Center Market Size?

The global data centre market was valued at approximately USD 347.6 billion in 2024, and it is expected to reach around USD 652 billion by 2030, growing at a compounded annual growth rate (CAGR) of roughly 11.2%.

Other sources offer similar forecasts:

- USD 269.8 billion in 2025, growing to USD 584.9 billion by 2032 at ~11.7% CAGR.

- USD 456.9 billion in 2023, rising to USD 1,189.5 billion by 2032 at ~11.5% CAGR.

- USD 213.6 billion in 2024, projected to reach USD 494.5 billion by 2033 at ~9.3% CAGR.

Consensus across reports suggests that the global data centre market is growing steadily—with consistent annual growth in the 9–12% range depending on timeframe and methodology.

Final Thoughts

The data center market is evolving faster than ever, driven by AI, cloud adoption, and the push for sustainability.

From hyperscale expansion to renewable energy strategies and advanced cooling technologies, data centers are becoming smarter, greener, and more critical to global digital infrastructure.

As demand grows, so do opportunities for innovation, efficiency, and collaboration across regions and industries.

The coming years will define how these facilities meet rising expectations while supporting a connected, data-driven world.

FAQs

Data centers are scaling infrastructure to handle artificial intelligence and machine learning workloads.

These applications require powerful GPUs and high bandwidth networks. Operators are investing in advanced power and cooling systems to support these high density environments and maintain operational efficiency.

This trend is reshaping facility design and increasing demand for specialized infrastructure focused on computational efficiency and speed.

AI and high performance computing workloads generate far more heat than traditional IT systems. Liquid cooling provides better thermal management and energy efficiency compared to air cooling.

In 2025 more operators are adopting liquid cooling to support dense server racks, lower operating costs, and extend hardware life while also preparing for significant challenges related to future workload density and sustainability goals.

Edge data centers are growing as 5G and Internet of Things deployments increase. Placing compute and storage resources closer to end users reduces latency and improves application performance.

In 2025 industries such as autonomous vehicles, smart manufacturing, and smart cities are driving demand for edge facilities that support real time data processing and also require digital transformation initiatives to integrate distributed architectures effectively.

Environmental responsibility is becoming a core focus for data center operators. Companies are investing in renewable energy sources, advanced energy storage, and efficient cooling technologies to meet carbon neutral and regulatory requirements.

Clients increasingly choose providers based on environmental performance. In 2025 sustainability is a competitive differentiator and a key factor in new facility design and operations, with some firms emphasizing robust infrastructure to support renewable power adoption.

Modular and prefabricated data centers reduce construction time and allow scalable deployments. In 2025 these solutions help cloud providers and enterprises meet sudden growth demands more quickly and at lower cost.

Prefabricated designs are delivered to sites preassembled, accelerating installation and ensuring predictable quality.

This flexibility supports faster technology adoption and geographic expansion, enabling facilities to adapt to emerging technologies without extensive redesigns.

The increase in ransomware, supply chain attacks, and insider threats makes security critical. Data center operators are implementing zero trust architectures, stronger physical security, and advanced monitoring systems.

In 2025 the focus is on preventing unauthorized access and protecting data across hybrid and multi cloud environments, ensuring business continuity and customer trust.

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

Data Centers in Kentucky and Colocation Opportunities

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

Let's start

a new project together