Table of Contents

10 Largest Data Centres in the UK

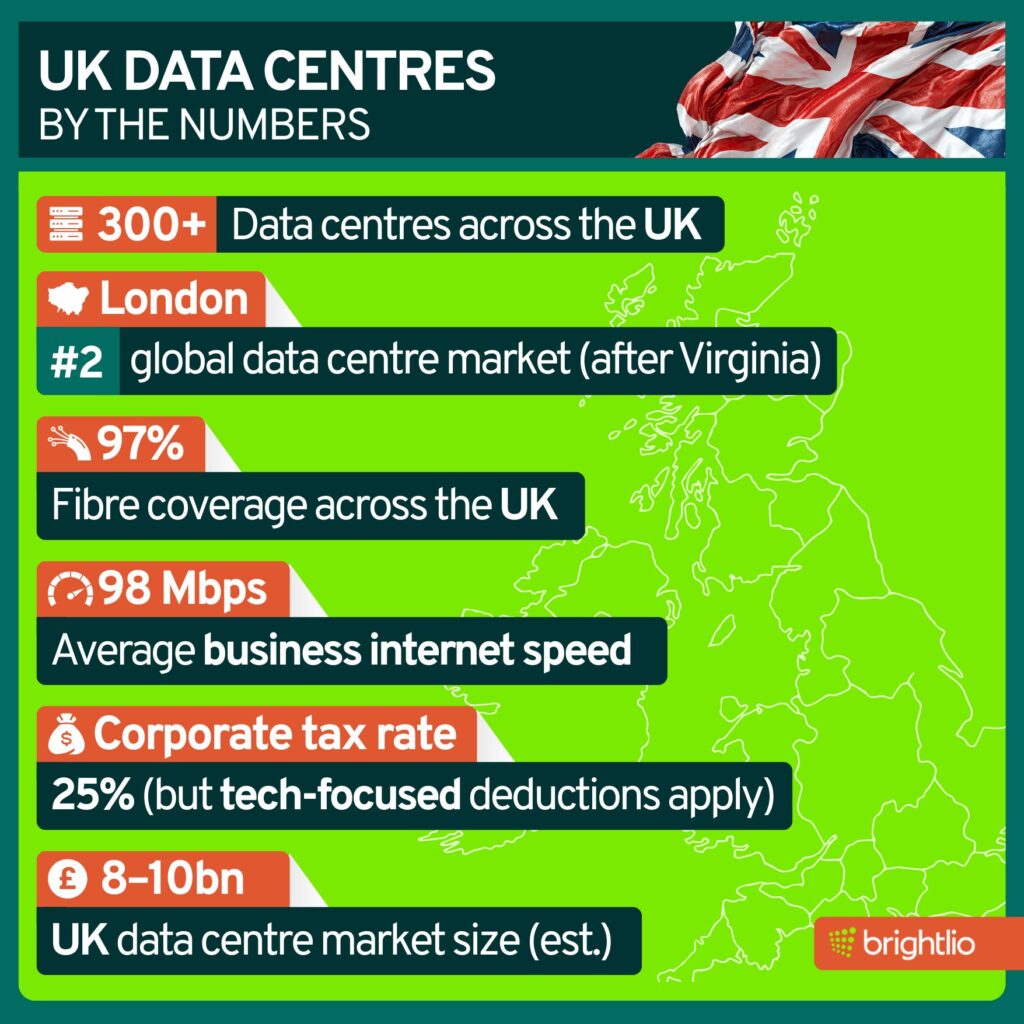

The UK hosts a group of data center companies that support finance, cloud services, and digital media across a market valued at about $10.69B in 2024. These operators run large facilities built for high capacity and strict regulatory needs, with national power demand near 1.6 GW and London holding about 65% of colocation supply.

This overview highlights the providers shaping the UK market today. Their footprints, service models, and growth plans show how enterprise and cloud infrastructure continue to expand across the region.

Largest Data Centers in the UK

This list breaks down the 10 biggest data centers across the United Kingdom, arranged from smaller to larger facilities. The final entry holds the top spot, so move through the list to see which site dominates the UK market.

You’ll also find a comparison table for a quick side-by-side view:

10 Largest Data Centers in the UK Table

| # | Campus | Location | Area | Cost | CEO | Summary |

| 10 | Kao Data | Harlow, Essex | About 150000 sq ft | More than £200 million | David Bloom | 15 acre site with four halls totaling about 40 MW and room to reach about 83 MW. |

| 9 | Ark Spring Park | Corsham, Wiltshire | About 200000 sq ft | Not disclosed | Huw Owen | Secure site near MOD Corsham with modular halls and sustainability focus. Expansion planned. |

| 8 | Telehouse North Two | Docklands, London | About 118400 sq ft new space | About £135 million | Hiroyuki Soshi | High rise expansion with indirect adiabatic cooling and a PUE near 1.16. Hosts LINX and more than 530 carriers. |

| 7 | VIRTUS Stockley Park | Hayes, West London | About 376750 sq ft | Hundreds of millions of pounds | Neil Cresswell | Four building Tier III campus near Heathrow with free cooling and strong cloud and carrier options. |

| 6 | Equinix Slough (LD4 to LD10) | Slough, Berkshire | More than 408000 sq ft | LD6 $79 million | Adaire Fox Martin | Important UK trading hub with LINX access, more than 200 carriers and strong redundancy. |

| 5 | Ark Cody Park | Farnborough | About 1.57 million sq ft | Not disclosed | Huw Owen | Large modular campus with low PUE, renewable energy and strong security. Used widely for government and enterprise workloads. |

| 4 | Ark Union Park | Hayes, West London | About 560000 sq ft | More than £600 million | Huw Owen | New modular site built for high density compute and AI with solar and HVO power support. |

| 3 | Telehouse Docklands | London Docklands | About 786000 sq ft | North Two $175 million, West Two 275 million GBP | Takayo Takamuro, Kenkichi Honda | One of Europe’s top connectivity hubs with LINX, major carrier presence and strong power diversity. |

| 2 | Global Switch London (East, North, South) | London Docklands | Nearly 1.2 million sq ft | Not disclosed | Ashley Muldoon | Multi building Docklands cluster with high density capability, LINX access and a PUE target below 1.2. |

| 1 | Vantage Newport | Newport, Wales | About 2 million sq ft | Valued above $200 million | Sureel Choksi | Former NGD site with a 400 kV grid link. Opened in 2010 for LG and now expanding under Vantage. |

UK Data Centers Overview

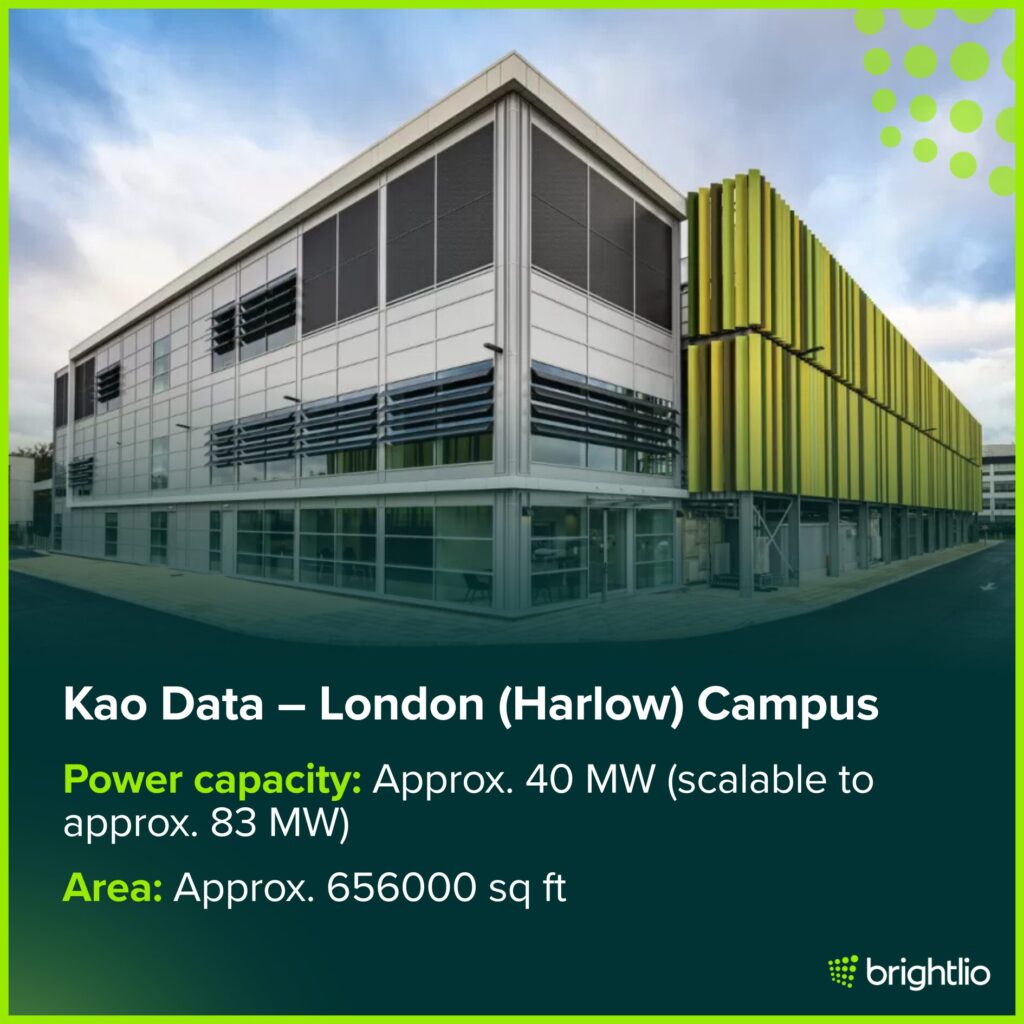

10. Kao Data – London (Harlow) Campus (Harlow, Essex)

- Company: Kao Data

- Location: London Road, Harlow, Essex, United Kingdom

- Power capacity: Four modular data centres engineered for approximately 8.8 MW each, delivering around 40 MW of total IT load when fully built. The campus is fed by a dedicated, redundant 43.5 MVA power supply and has expansion capability up to roughly 83 MW

- Area: About 656000 sq ft on 15 acres, with about 146000 sq ft of technical space across sixteen suites of roughly 9150 sq ft each

- Cost: Development investment exceeds £200 million

- Chief executive: David Bloom (Founder and Executive Chairman, assuming leadership from 2025)

The Kao Data London Campus, located in Harlow along the London–Stansted–Cambridge innovation corridor, stands on the historic site where Sir Charles Kao pioneered fibre-optic cable technology in the 1960s. The campus covers 15 acres and is designed as one of the UK’s largest high-performance colocation platforms, offering four purpose-built, carrier-neutral data centres.

Together, the facilities provide about 40 MW of IT load, with each building delivering around 8.8 MW. Future development phases allow the campus to scale beyond this footprint to approximately 83 MW. Technical space spans about 150,000 square feet, arranged into sixteen high-density technology suites tailored for artificial intelligence, high-performance computing, and enterprise deployments.

Sustainability and efficiency are central to the campus design. All facilities use indirect evaporative cooling to achieve a low PUE near 1.2 without mechanical refrigeration. The site operates entirely on renewable energy and incorporates BREEAM Excellent architectural standards, supported by low-carbon backup systems powered by hydrotreated vegetable oil.

Security follows enterprise and government expectations, including biometric controls, CCTV, and cage-level access options. The campus offers strong connectivity with a wide range of carriers, cloud on-ramp providers, and high-speed interconnects. Its infrastructure supports GPU-dense computing environments and hosts major systems such as NVIDIA’s Cambridge-1 supercomputer.

With David Bloom leading the organisation, the campus continues to grow as one of the UK’s cornerstone hubs for AI, scientific research, and industrial-scale computing.

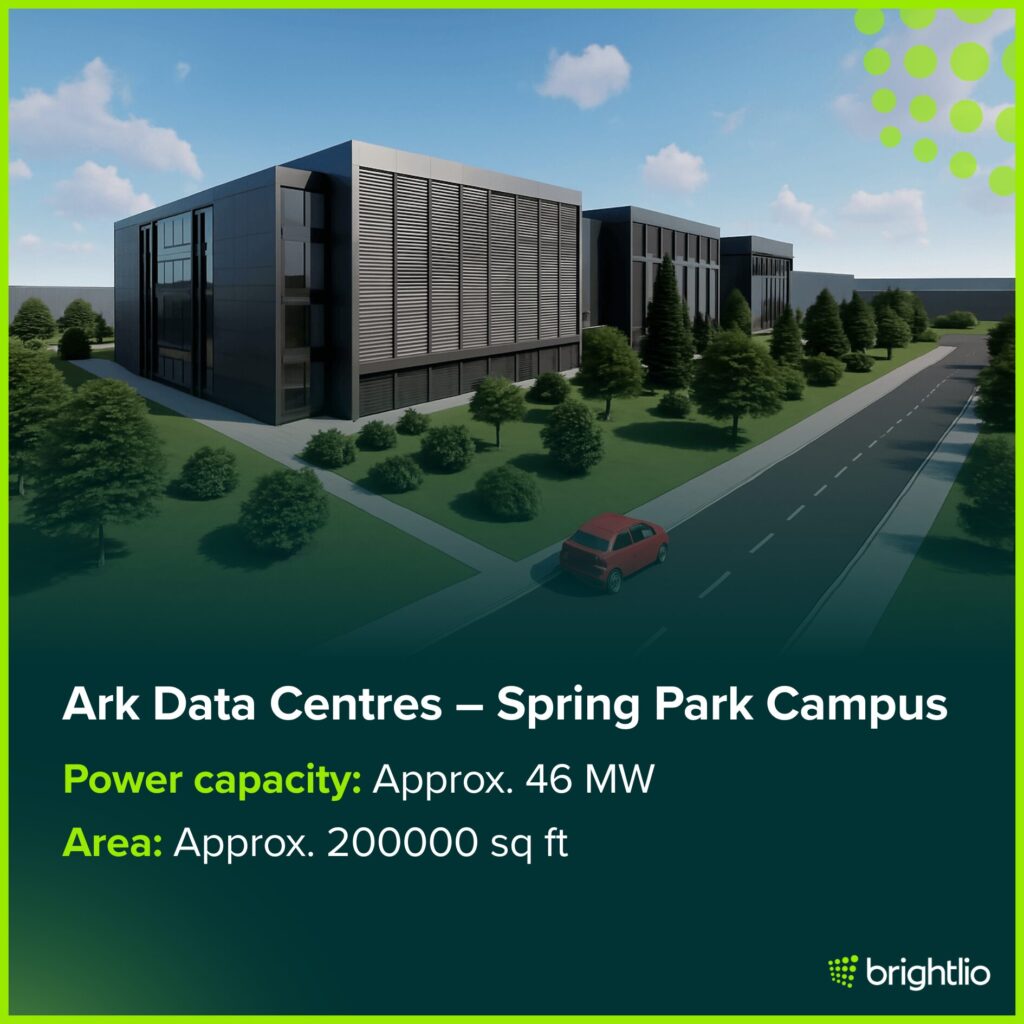

9. Ark Data Centres – Spring Park Campus (Corsham, Wiltshire)

Spring Park – high security modular campus near MOD Corsham

Attributes

- Company: Ark Data Centres

- Location: Westwells Road, Corsham, Wiltshire, United Kingdom

- Power capacity: Designed for 46 MW across five buildings, with a new three-floor expansion approved

- Area: About 200000 sq ft of IT space on a 38-acre campus

- Cost: Not publicly disclosed

- Chief executive: Huw Owen

Summary

Spring Park is Ark Data Centres’ first major site and sits directly across from the Ministry of Defence’s operations in Corsham. The campus spans about 38 acres and contains five independent buildings with 27 data halls. The full site is designed for about 46 MW of IT load and includes resilience features suited for government and defense use.

Each modular building functions independently while sharing central utilities. Early phases delivered 12 MW across 24 halls. Later phases add 4.5 MW halls with about 31000 sq ft of technical space. Two new buildings are under construction, and a three-floor expansion will add more than 22000 m². Power arrives through five 33 kV feeds from two substations and the design targets a PUE near 1.2.

Sustainability features include recyclable steel structures, mixed cooling methods, rainwater harvesting, green roofs, and hydrotreated vegetable oil generators. Security includes fences, staffed access points, biometrics, and CCTV. Huw Owen positions Spring Park as a secure option outside London for government, defense, and enterprise customers needing resilient and low-carbon facilities.

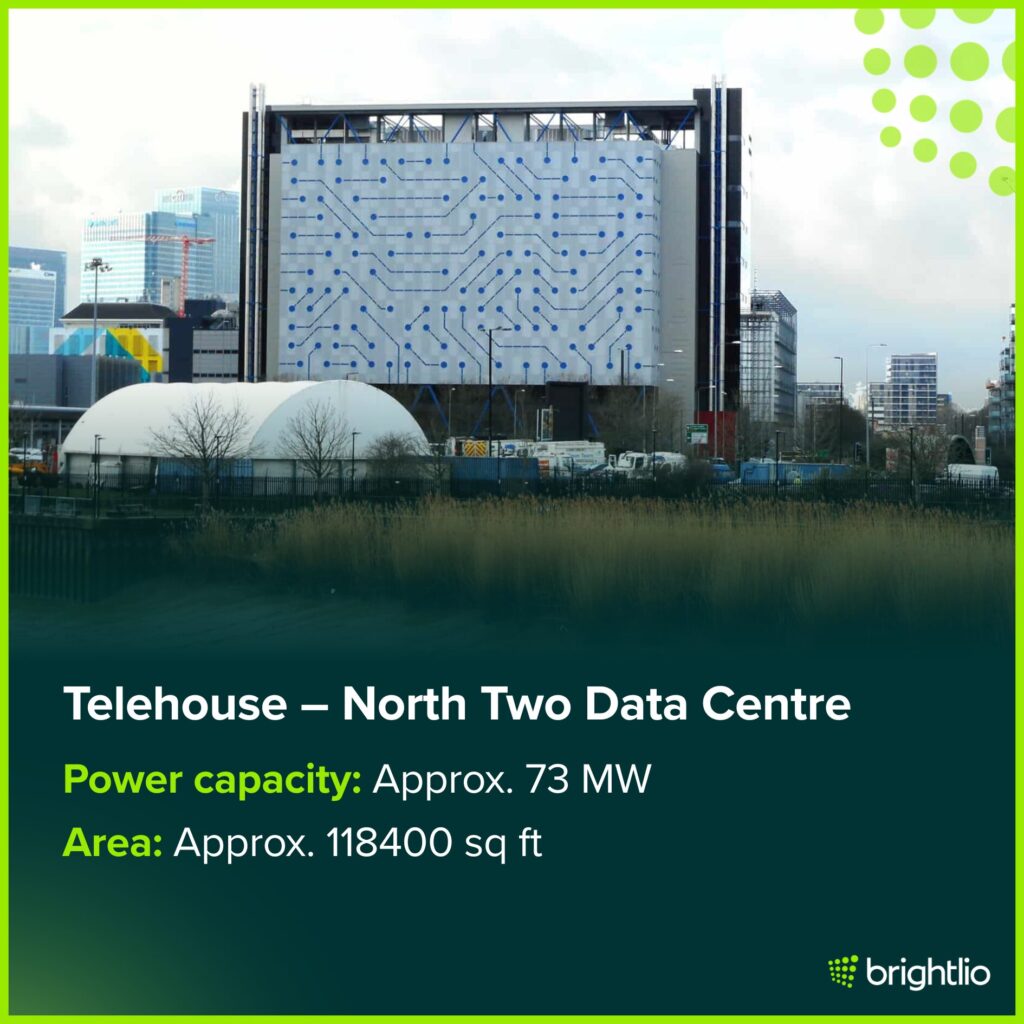

8. Telehouse – North Two Data Centre (London Docklands)

North Two – multi-storey flagship within Telehouse’s Docklands campus

Attributes

- Company: Telehouse International Corporation of Europe

- Location: Coriander Avenue, Docklands, London, United Kingdom

- Power capacity: Up to 73 MW total power, including a 50 MW on-site substation and 18.5 MW of N+1 generator capacity

- Area: About 118,400 sq ft of new space within a campus that totals roughly 790,300 sq ft.

- Cost: About £135 million

- Chief executive: Telehouse does not use one global leader. Telehouse Europe is led by Managing Director Takayo Takamuro. Telehouse America is led by CEO Satoshi Oishi. In Canada, Atsushi Kubo serves as President and CEO as of April 2025.

Summary

North Two opened in 2016 as a high-rise expansion to the Docklands campus. The building adds about 11000 m² of technical space and brings the campus to about 73400 m². It hosts the London Internet Exchange and provides access to more than 530 carriers and service providers. The campus delivers low-latency connectivity to international markets.

The site is engineered for high-density work. An on-site 132 kV substation delivers up to 73 MW of power, and dual feeds support rack densities around 4.5 kW. Eight N+1 generators provide 18.5 MW of standby capacity. A multi-storey indirect adiabatic cooling system achieves a PUE near 1.16. The building holds a BREEAM Excellent rating and includes advanced smoke detection and two-stage fire suppression. Security includes manned entrances, perimeter protection, and extensive CCTV coverage.

Six vertical cooling floors draw and reject air through opposing faces of the building. The exterior uses a printed circuit board-inspired pattern and serves as a visual landmark. Under Hiroyuki Soshi’s leadership, the site continues to attract cloud, media, and financial customers.

7. VIRTUS – Stockley Park Campus in United Kingdom

Stockley Park Campus – large colocation development in West London

Attributes

- Company: VIRTUS Data Centres

- Location: Stockley Park, Hayes, West London, United Kingdom

- Power capacity: Up to 85 MW of IT load across four buildings

- Area: About 376,750 sq ft of data hall space. LONDON5 provides more than 107,640 sq ft and LONDON8 provides about 64,583 sq ft

- Cost: Estimated industry investment in the hundreds of millions of pounds

- Chief executive: Neil Cresswell

Summary

Stockley Park sits near Heathrow Airport and includes four retrofitted warehouses converted into data center buildings. LONDON5, LONDON6, LONDON7, and LONDON8 together supply up to 85 MW of IT load across about 35000 m². Each building follows a Tier III design and is connected to a 66 kV grid supply with three substations, forming one of the stronger hub locations in Great Britain. Mezzanine levels add significant technical floor area.

LONDON5 offers more than 10000 m² of technical space and 24 MW of load. It uses N+N UPS, N+1 generators, free cooling chillers, high-pressure water mist protection, and targets a PUE below 1.3. LONDON8 provides about 6000 m² and 16 MW with the same high availability approach. Security includes perimeter fencing, vehicle barriers, staffed gatehouses, biometrics, and CCTV. The campus holds ISO 27001, PCI DSS, and other certifications often referenced across England for comparable builds.

The design aims to reduce environmental impact. Free cooling chillers use local climate conditions to lower energy use. Carrier links and cloud connectivity support hybrid colocation and private suites. Neil Cresswell positions the campus as a major addition to London’s colocation capacity and a key resource for hyperscale and enterprise customers, with site selection factors that give operators a clear advantage when planning long term deployments.

6. Equinix – Slough Campus (LD4, LD5, LD6 and LD10)

Equinix Slough Campus – multi-building hub for London’s financial trading community

Attributes

- Company: Equinix, Inc.

- Location: Slough Trading Estate, Slough, Berkshire, United Kingdom

- Power capacity: About 67 MW across LD4 (about 16 MW), LD5 (about 25 MW), LD6 (about 16 MW) and LD10 (about 10 MW)

- Area: More than 408000 sq ft of technical space. LD4 includes about 107639 sq ft of colocation space

- Cost: LD6 costs $79 million. Total campus cost not publicly released

- Chief executive: Adaire Fox Martin

Summary

The Equinix Slough campus forms a cluster of four interconnected facilities that operate as a single environment. The group of LD4, LD5, LD6, and LD10 supplies more than 408000 sq ft of technical space and about 67 MW of IT power. Each building came online between 2007 and 2015. Dark fiber links create a unified high-performance campus for customers.

The site is a major location for London’s trading community. Exchanges, matching engines, and financial firms use the environment for ultra-low latency connectivity. LD4 hosts the London Internet Exchange, and the buildings support extensive cross-connects. LD4’s specifications highlight redundant cooling and power systems, N+1 generators, controlled entry paths, and permanent on-site security.

Sustainability programs include renewable energy sourcing and LEED Gold certification for LD6. The campus houses more than 200 network providers and offers diverse space options from private cages to business continuity suites. Strong utility redundancy supports extremely high uptime. The Slough campus remains one of the most important connectivity hubs in the country.

5. Ark Data Centre – Cody Park Campus

- Company: Ark Data Centres

- Location: Cody Technology Park, Farnborough, Hampshire, United Kingdom

- Power capacity: About 50 to 51 MW of compute capacity across six modular data centers

- Area: About 1,571,500 sq ft

- Cost: Not publicly disclosed

- Chief executive: Huw Owen

Summary

Cody Park opened in 2011 and serves as Ark Data Centres’ longest-running campus. The site spans roughly 36 acres next to the former Ministry of Defence research site. Six modular data centers operate on the campus, supporting about 51 MW of compute capacity and a range of digital services for enterprise and public sector requirements.

A typical facility includes multiple halls, diverse power connections and a rated capacity near 50 MW supplied from several 33 kV feeds.

The buildings use modular steel construction manufactured off-site and assembled on location. This method shortens build times and supports high-density deployments that allow strong scalability for growing workloads.

The campus maintains PUE values below 1.3, with some facilities reporting figures near 1.14. Cooling options include direct air, indirect air, liquid cooling, free air systems, and evaporative methods.

Renewable electricity, rainwater harvesting, and hydrotreated vegetable oil for backup systems support strong sustainability goals. Features such as green roofs, beehives, and electric vehicle charging points add to the environmental profile.

Cody Park provides Tier III resilience with dual substation feeds, diverse fiber routes, and low latency paths to London, giving clients confidence in long-term stability. Clients can select wholesale suites as small as 500 kW with scale to multi-megawatt deployments in close proximity to major network routes.

Security controls include biometric access, strong perimeter measures, and continuous monitoring. The campus serves enterprise, government, and cloud organizations that need secure replication into London and want facilities designed with operational efficiency and environmental considerations in mind.

4. Ark Data Centre Digital Services – Union Park Campus (Hayes, London)

- Company: Ark Data Centres

- Location: Bulls Bridge Industrial Estate, Hayes, West London, United Kingdom

- Power capacity: About 99 MW of compute capacity across four modular data centers

- Area: 560000 sq ft campus.

- Cost: Total investment exceeds £600 million

- Chief executive: Huw Owen

Summary

Union Park is Ark Data Centres’ newest development in West London. The site spans about 56000 m² and includes a dedicated substation and administrative areas. Four modular data centers will deliver close to 99 MW of compute capacity.

Ark expects the full campus to enter service in 2024 and notes that total investment will surpass £600 million.

Sustainability has guided the entire design. The site incorporates solar arrays, advanced air cooling, rainwater harvesting, and green surfaces that support biodiversity.

Power is sourced from renewable energy, and backup systems use hydrotreated vegetable oil to cut emissions significantly. The modular steel structures allow expansion phases without prolonged construction cycles.

Union Park aims to support high-density compute and AI workloads. It will provide direct links to cloud platforms and carrier partners, while offering hybrid colocation and private suites.

The campus follows security and compliance frameworks such as ISO 27001 and PCI DSS. Chief executive Huw Owen has stated that the project addresses rising demand from both public and private sector clients for secure and low-carbon infrastructure.

Once complete, Union Park will add large-scale capacity to the London market and demonstrate practical methods for reducing environmental impact.

3. Telehouse London Docklands Campus

- Company: Telehouse (KDDI Corporation)

- Location: London Docklands, United Kingdom

- Power Capacity: About 40 MW across North, East, and West. The private 132 kV substation delivers up to 73 MVA. The planned West Two facility adds 33 MW

- Area: The Docklands campus provides about 786000 sq ft of colocation space. Telehouse West includes about 53820 sq ft. Telehouse North Two is an 11-story building with 259000 sq ft

- Cost: Telehouse invested about $175 million in North Two. The upcoming West Two project is a 275 million GBP development with 32000 m² of gross area

- Leadership: Takayo Takamuro serves as European Bloc Chief and European Chief Executive of KDDI Europe. Kenkichi Honda became Managing Director of Telehouse Europe in 2024

Summary:

Telehouse operates one of Europe’s most connected colocation hubs in the Docklands area. The campus includes North, East, West, and North Two, delivering about 786000 sq ft of space and around 40 MW of capacity.

Telehouse West supports high-density racks with a private 132 kV substation and eight diesel generators. North Two, completed in 2016, is an 11-story facility tied directly into the National Grid.

The campus hosts the London Internet Exchange, which places it at the center of UK internet traffic.

Telehouse announced the West Two project in 2025, a 32000 m² building with 33 MW of new capacity and two additional substations.

The leadership team, led by Takayo Takamuro and Kenkichi Honda, continues to grow the site to support enterprise, cloud, and network exchange customers.

2. Global Switch London Data Centers(East & North)

- Company: Global Switch

- Location: London Docklands, United Kingdom

- Power Capacity: London East provides 87 MW. London North offers about 18 MW. The approved London South facility adds 40 MW and brings the campus to about 126 MVA of proposed utility capacity

- Area: London East contains 450,000 sq ft of net technical space. London North adds about 252,000 sq ft. The upcoming London South building contributes roughly 290625 sq ft. The full campus reaches nearly 1.2 million sq ft

- Cost: Global Switch has not disclosed detailed construction costs. London South is part of a large expansion program

- CEO: Ashley Muldoon

Summary:

Global Switch operates a major data center campus in the Docklands, consisting of the East, North, and future South buildings. London East provides 450,000 sq ft of technical space across 11 floors with capacity for high-density workloads.

London North adds roughly 252,000 sq ft. London South, now approved, increases the total to more than 1.2 million sq ft and prepares the campus for higher-density equipment and liquid cooling systems.

The site uses redundant power feeds, adaptable floor layouts, and energy-efficient infrastructure with a target PUE below 1.2. Its proximity to the City of London and the London Internet Exchange helps support financial services and cloud connectivity.

Ashley Muldoon took on the CEO role in 2024 and now directs the growth strategy for the London portfolio.

1. Vantage Newport Campus (Europe’s Largest Data Center Campus)

- Company: Vantage Data Centers

- Location: Newport, Wales, United Kingdom

- Power Capacity: Existing 72 MW of critical power with expansion up to 150 MW

- Area: About 2 million sq ft of data hall space across a 50-acre site

- Cost: Vantage acquired Next Generation Data in 2020. Earlier transactions valued the asset at more than $200 million, with a controlling interest sold for $130 million in 2016

- CEO: Sureel Choksi

Summary:

The Vantage Newport campus began as the Next Generation Data facility and later became part of Vantage Data Centers. The site spans nearly 2 million sq ft and uses a 400 kV super grid connection that supports heavy compute demand.

Its design supports hyperscale colocation with large floor plates, high security, and diverse fiber routes. The campus uses renewable power and benefits from the cool climate of South Wales.

The original facility opened in 2010 for LG and now supports major cloud and enterprise tenants. Vantage’s purchase of the site helped strengthen its UK presence.

Under the guidance of CEO Sureel Choksi, the company continues to grow its European platform and plans additional development across the Newport property.

Who is the Largest Data Centre Operator in the UK?

The largest data center operator in the UK right now is VIRTUS Data Centres, which continues to attract attention from organizations comparing London data centers and regional footprints.

Two independent 2025 market studies on the UK data center sector both list VIRTUS as the top operator in the UK, ahead of Equinix and Digital Realty, based on total capacity and portfolio size supported through a wide mix of colocation facilities.

Equinix is still described as the world’s largest data center operator overall, and the UK is its second biggest market, but within the UK, recent data puts VIRTUS in first place on installed and planned capacity across a mix of campuses tied to network services requirements.

At the same time, the largest data center campus in the UK in physical size is Vantage Data Centers’ Cardiff / Newport CWL1 campus (often called the Newport campus). Vendor and neutral listings describe it as:

- Around 2,000,000 sq ft of total campus space

- 148 MW of critical IT load at full build-out

- Sited on a 46 acre plot between Cardiff and Newport

This campus is marketed as one of Europe’s largest data center campuses, which makes it the biggest single campus in the UK on footprint and a key part of wider European markets for hyperscale growth.

What is the Biggest Data Centre in Ireland?

The biggest single data center facility in Ireland is Meta’s Clonee data center campus in County Meath, a site often referenced when discussing reliability expectations for long-term hyperscale builds.

Public sources describe the Clonee campus as having roughly 925,700 sq ft of data center space, making it the largest individual facility listed in Ireland. Architectural material for the project gives a total built area of about 97,000 m² (around 1,040,000 sq ft) across the data halls and support buildings on the 227-acre campus, which matches that scale.

For comparison, other major Irish sites such as Microsoft’s Grange Castle data center in Dublin are reported at around 303,000 sq ft, and Google’s largest listed Irish facility is about 501,600 sq ft, both smaller than Clonee on a per campus basis. These differences show how certain operators build for growth tied to reduce latency strategies across regions that host multiple hubs.

Reliable Data Center Options Across the UK

If you need retail colocation services in the UK, our team can support that search. We work with a wide range of cloud service providers across major hubs such as London, Manchester, Birmingham, and Edinburgh. This approach gives customers strong flexibility for power, space, and network needs across the country.

Along with colocation, we help clients with connectivity, cloud services, unified communications, hardware procurement, and technical advisory support. These additions give organizations a single partner for several core infrastructure requirements, including site selection for a new data centre.

Our goal is to serve as a trusted point of contact with clear guidance and quick follow up. Reach out if you want to discuss your UK data center plan or explore options for a new data centre deployment.

Read More Similar Posts:

- 15 Largest Data Centers in the US

- 15 Largest Data Centers in the World

- 10 Largest Underground Data Centers

- 5 Largest Underwater Data Centers

FAQs

DataCenterMap, which tracks colocation and many enterprise sites, currently lists 513 data centers in the United Kingdom, with comparisons often drawn to similar tracking across other countries.

A practical top-10 list, combining power and white space:

• Vantage Newport Campus

• Global Switch London Campus

• Telehouse London Docklands Campus

• Ark Data Centres Union Park Campus

• Ark Data Centres Cody Park Campus

• Equinix Slough Campus

• VIRTUS Stockley Park Campus

• Telehouse North Two

• Ark Data Centres Spring Park Campus

• Kao Data London Campus

Rankings shift as new capacity opens.

Several sources still point to the former Next Generation Data facility in Wales, now Vantage CWL1, as the UK’s largest campus, at about 1.5M sq ft with up to roughly 180–270 MW of power.

Other rankings focus on VIRTUS London5 as the largest single UK data center by current footprint and power, at roughly 50,000 m² and around 90 MW.

The answer depends on whether you compare campuses or individual buildings.

Most of the biggest sites sit around London and the South East, particularly Slough, Docklands, Hayes, Farnborough, and Harlow, areas often highlighted on UK infrastructure map reviews.

Wales hosts the very large Vantage CWL1 campus near Cardiff/Newport.

GTP3 in Birmingham gives the Midlands a major facility, and Manchester is emerging as another hotspot for large sites.

Approximate figures from public sources:

• Vantage CWL1: about 1.5M sq ft and up to 180 MW live, with design up to around 270 MW.

• VIRTUS London5: ~50,000 m² and ~90 MW.

• Telehouse North Two: ~24,000 m² and ~73 MW.

• Ark Cody Park: 45,000+ m² and 70+ MW.

• Kao Data Harlow campus: roughly 150,000 sq ft technical space and about 40 MW IT load.

AWS London region and GTP3 are as large as multi-site/campus footprints, but full numbers are less public.

Key operators behind these big sites include:

• Vantage Data Centers

• VIRTUS Data Centres

• Telehouse

• Ark Data Centres

• Global Switch

• Kao Data

• AWS

• Google

Across the whole UK market, VIRTUS now leads in total colocation capacity, ahead of Equinix and Digital Realty.

Counts vary because different datasets track different types of facilities:

• Bauhaus cited 461 UK data centers as of mid-2022.

• DataCenterMap lists more than 500 UK facilities today.

• Research & Markets databases track about 227–232 existing colocation data centers and 45–54 upcoming sites.

So a realistic range is roughly 230–500, depending on the definition you use.

Recent market studies estimate current UK capacity at about 1.7 GW, with upcoming projects pushing total capacity toward 3.5–4 GW on full build, roughly doubling the market.

Construction spending is forecast to jump from about £1.75B in 2024 to £10B a year by 2029, creating major revenue expectations for operators driven by AI demand and cloud growth.

Sources use different metrics:

• TechBehemoths ranks top 5 on power, floor space, and estimated server count.

• Bauhaus looks at energy use, surface area, and server numbers.

• Optrium singles out the former NGD facility in Wales based on footprint and power.

Some lists treat multi-building campuses or cloud regions as one “data center,” which shifts who ranks first.

These sites mainly serve hyperscale cloud, SaaS platforms, financial services, government, telecoms, and large enterprise workloads.

London and its commuter belt still dominate, with strong clustering in Greater London and the South East. This reflects proximity to financial markets and the country’s economic capital.

Planned sites include a $13B Northumberland AI campus, Equinix South Mimms, a Tritax Heathrow-area build, a £1B Park Royal campus, and Colt’s Hayes expansion.

Approaches include renewable power, efficient cooling, water-saving measures, carbon-neutral roadmaps, and BREEAM-certified designs.

Risks include grid strain, water use, land conflict, noise, and dependency concerns.

Mega-sites size their power, cooling, and interconnects for high-density GPU clusters and long-term AI growth.

Key points include latency profiles, rack density, sustainability, compliance requirements, expansion options, and operator stability.

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

10 Largest Data Centres in the UK

Data Centers in Maine – An Overview

Let's start

a new project together