Table of Contents

300+ Cloud Computing Statistics (October – 2025)

The cloud computing market is exploding. Brightlio has interesting facts about cloud computing to help you stay updated on the latest trends in the industry. In this article, you’ll find 295 verfied cloud computing stats, including:

- Global cloud computing market statistics

- Cloud adoption by country and by region, including Europe, North America, South America, Asia and the Pacific, and Africa

- Cloud adoption by industry

- Global cloud computing and infrastructure statistics by vendor

Let’s dive in!

Cloud Computing Market Size and Growth

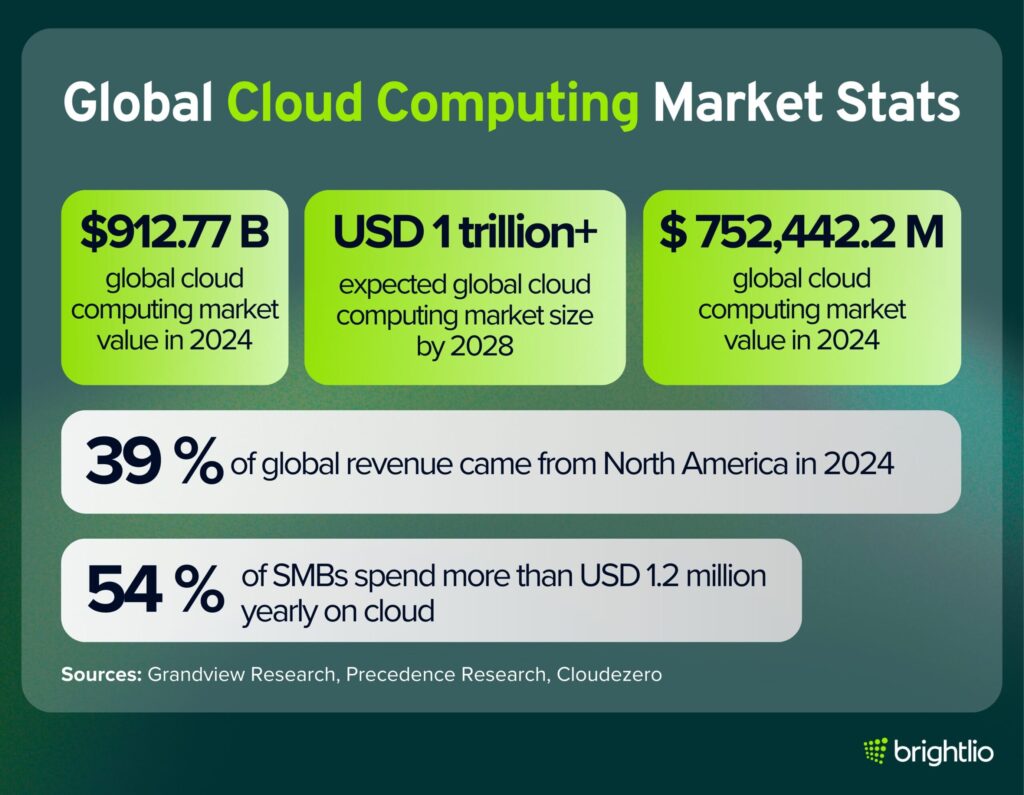

- The global cloud computing market generated $ 752,442.2 million in revenue in 2024 and is forecast to reach USD 2,390,184.5 million by 2030. (Grandview Research)

- Forecasts show that global cloud services will pull in $723.4 billion in end-user spending by 2025. ( Gartner )

- 90% of organizations will operate with a hybrid cloud model by 2027 (Gartner)

- All cloud segments will see double-digit growth in 2025 (Gartner)

- In 2024 the software‑as‑a‑service segment generated $ 505,342.8 million in revenue.

- Infrastructure‑as‑a‑service is the most lucrative cloud service and is expected to be the fastest-growing segment. (Grandview Research)

- North America accounted for 39 % of global cloud computing revenue in 2024. (Grandview Research)

- India is expected to record the highest growth rate in cloud computing between 2025 and 2030. (Grandview Research)

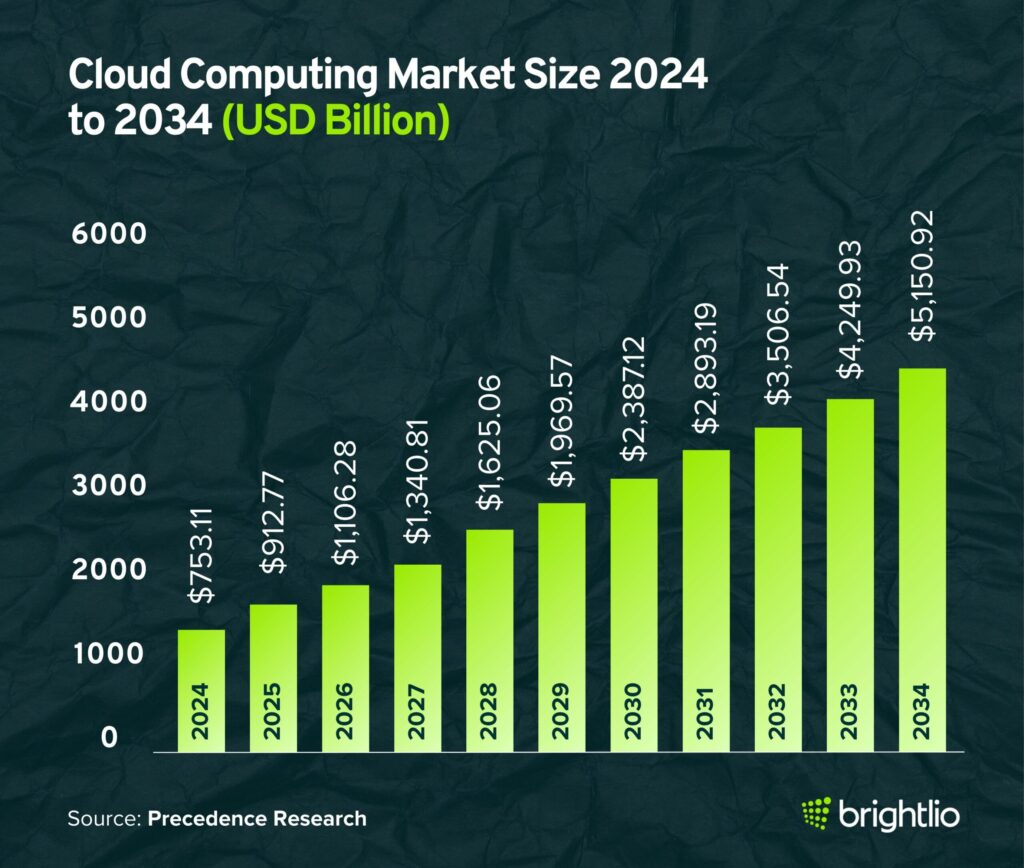

- The market was valued at $753.11 billion in 2024 and is projected to reach USD 5,150.92 billion by 2034. (Precedence Research)

- North America captured over 41 % of global revenue in 2024. (Precedence Research)

- Software‑as‑a‑service accounted for 55 % of global cloud revenue in 2024. (Precedence Research)

- Private cloud deployments represented 47 % of cloud revenue in 2024. (Precedence Research)

- Large enterprises generated 51.7 % of cloud computing revenue in 2024. (Precedence Research)

- The banking, financial services and insurance sector held 26 % of cloud revenue in 2024. (Precedence Research)

- The U.S. cloud computing market was USD 431.76 billion in 2024 and is expected to reach USD 2,992.81 billion by 2034. (Precedence Research)

- The North American market was $474.46 billion in 2024 and is forecast to grow rapidly. (Precedence Research)

- Asia Pacific is expected to witness the highest growth rate among regions. (Precedence Research)

- The global cloud computing market is expected to exceed USD 1 trillion by 2028. (Cloudzero)

- The market reached $912.77 billion in 2025, up from $156.4 billion in 2020. (Cloudzero)

- More than 20 % of organizations have little or no understanding of their cloud costs. (Cloudzero)

- Ninety‑seven percent of enterprise cloud applications are unsanctioned. (Cloudzero)

- Sixty‑five percent of surveyed leaders said cloud computing shortened time‑to‑market. (Cloudzero)

- Ninety‑four percent of IT professionals said cloud computing reduces startup costs and public‑cloud migrations can cut total cost of ownership by 30–40 %. (Cloudzero)

- Sixty percent of C‑suite executives see improved security as the top cloud benefit. (Cloudzero)

- Cloud‑based businesses resolve disaster‑recovery issues in 2.1 hours on average, compared with 8 hours for companies without cloud services. (Cloudzero)

- Sixty‑two percent of IT executives plan to move more workloads to the cloud for flexibility and scalability; 47 % cite cost control as a motive. (Cloudzero)

- Moving to infrastructure‑as‑a‑service can reduce carbon emissions by up to 84 % and energy use by up to 64 %. (Cloudzero)

- Small and medium‑sized businesses are projected to allocate more than half of their technology budgets to cloud services in 2025. (Cloudzero)

- Global end‑user spending on public cloud services is forecast to reach $ 723.4 billion in 2025, up from $ 595.7 billion in 2024. (Cloudzero)

- Thirty‑three percent of organizations spend more than USD 12 million a year on public cloud services, up from 29 % in 2024. (Cloudzero)

- Fifty‑four percent of small and mid‑size businesses spend more than USD 1.2 million annually on cloud services. (Cloudzero)

- Seventy‑one percent of organizations expect their cloud spending to increase while only 12 % expect a decrease. (Cloudzero)

- Organizations typically see significant returns from cloud adoption within one to three years. (Cloudzero)

- Only 30 % of organizations know exactly where their cloud budget goes; the rest lack clear cost attribution. (Cloudzero)

- Seventy‑eight percent of organizations detect cloud cost anomalies late; only 22 % notice anomalies quickly. (Cloudzero)

- Forty‑nine percent of business leaders cite measuring value as a major barrier to cloud return on investment, and 24 % measure value based on faster innovation and delivery. (Cloudzero)

- Fifty‑nine percent of organizations use three or more tools to manage and optimize cloud resources. (Cloudzero)

- More than 90 % of organizations use cloud services; about two‑thirds operate in public clouds and 45 % use private clouds. (Cloudzero)

- Forty‑eight percent plan to move at least half of their applications to the cloud within a year and 20 % intend to move all their applications. (Cloudzero)

- Sixty percent of organizations run more than half of their workloads in the cloud, up from 39 % in 2022. (Cloudzero)

- Cloud adoption among enterprises with more than 1,000 employees exceeds 94 %, and 54 % plan to move workloads to the public cloud within 12 months. (Cloudzero)

- Forty‑four percent of traditional small businesses use cloud infrastructure, compared with 66 % of small tech companies and 74 % of enterprises. (Cloudzero)

- The public cloud is expected to host 63 % of workloads and 62 % of data for small and medium‑sized businesses within the next years. (Cloudzero)

- The United States and Western Europe together account for 82 % of global cloud adoption. (Cloudzero)

- In developing regions, 40 % of organizations are evaluating cloud strategies, 30 % currently use cloud services, and about half of larger companies plan or evaluate cloud strategies. (Cloudzero)

- Digital adoption via cloud computing increased revenue by up to 15 % and profitability by up to 4 % for finance executives. (Cloudzero)

- Small and medium‑sized businesses using cloud computing posted 21 % higher profit and 26 % faster growth. (Cloudzero)

- Moving workloads to the cloud can raise profit growth by 11.2 % per year, and organizations need at least 60 % of their workloads in the cloud to realize significant financial gains. (Cloudzero)

Cloud Computing Usage and Adoption Statistics

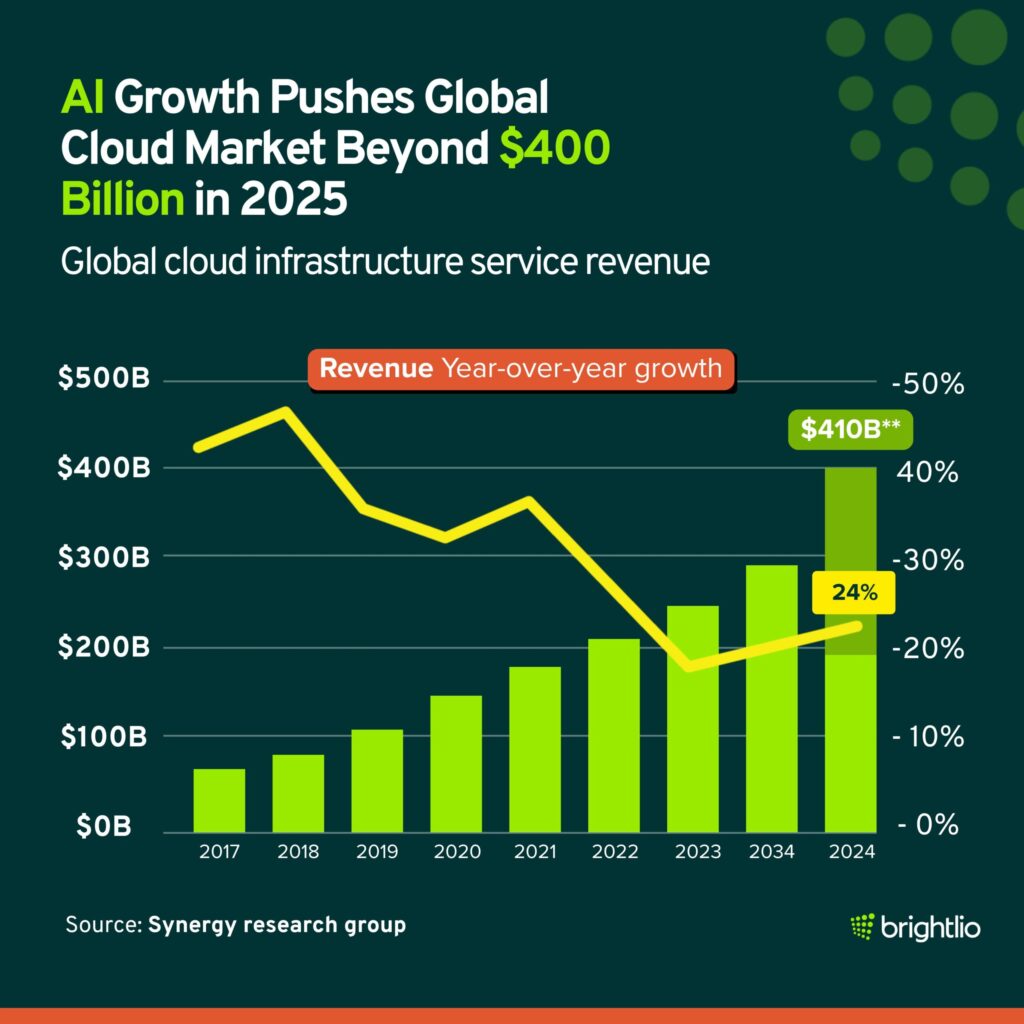

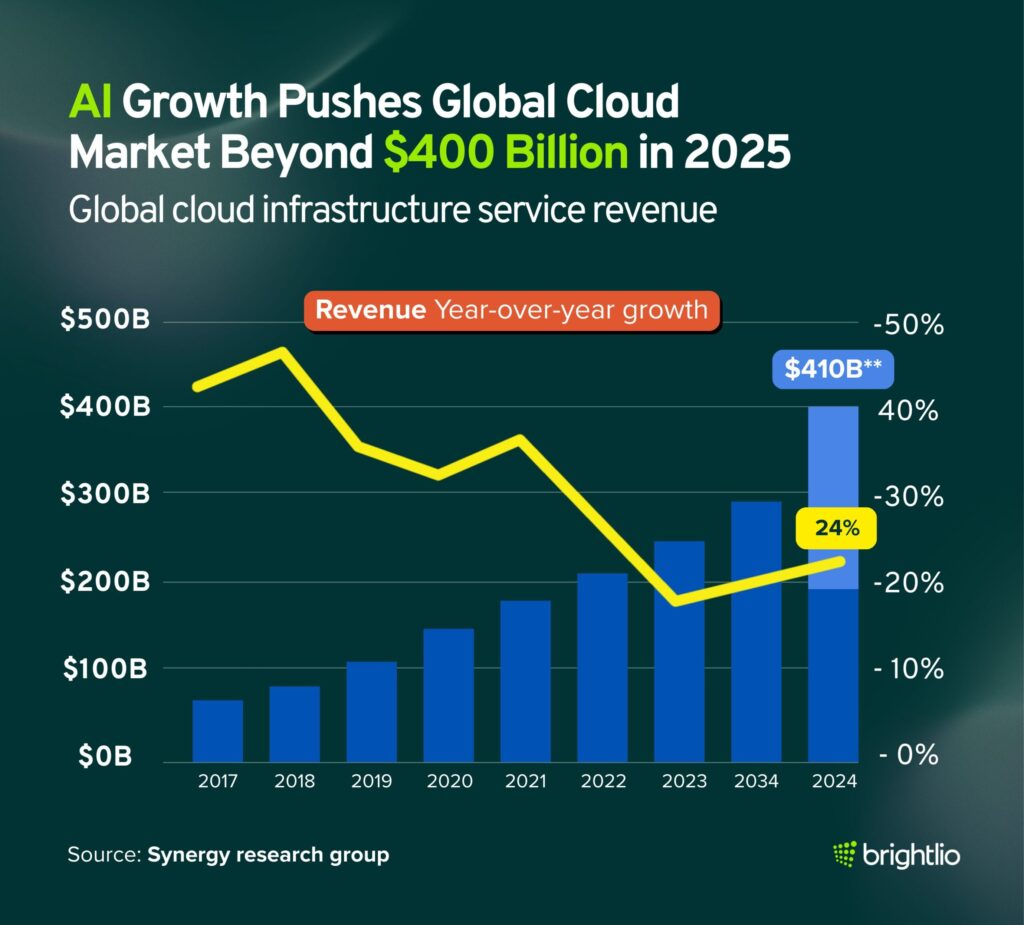

- Enterprise spending on cloud infrastructure services reached US$91 billion in Q4 2024, which was US$17 billion (22 %) more than Q4 2023. (SRG Research)

- For full‑year 2024 the cloud infrastructure market totalled US$330 billion, up US$60 billion versus 2023 and US$102 billion versus 2022. (SRG Research)

- Synergy Research notes that generative AI accounted for at least half of the increase in cloud service revenues since ChatGPT was launched at the end of 2022. (SRG Research)

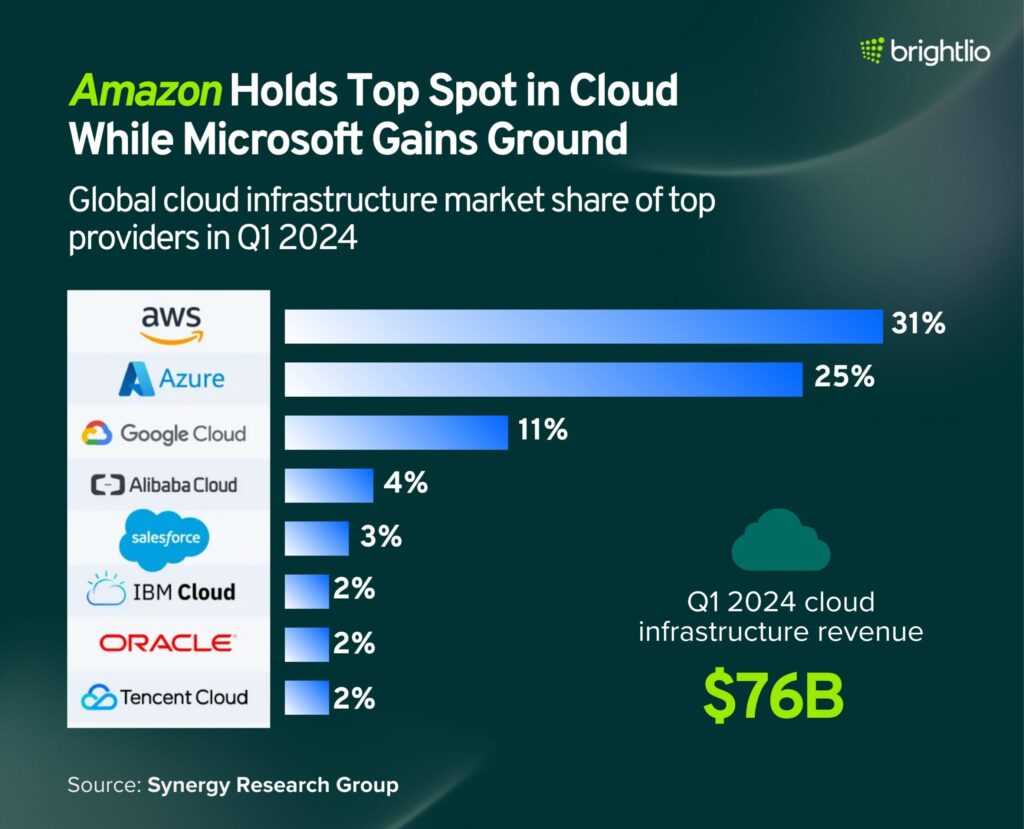

- In Q4 2024, Amazon Web Services held 30 % of the cloud infrastructure market, Microsoft Azure 21 % and Google Cloud 12 %. (SRG Research)

- Public infrastructure‑as‑a‑service and platform‑as‑a‑service (IaaS and PaaS) revenue grew 24 % in Q4 2024, and the top three providers together captured 68 % of that public cloud market. (SRG Research)

- Synergy Research observed strong growth in Brazil, Spain, Italy, India and Japan, while the United States remained the largest cloud market with 23 % growth in Q4 2024. (SRG Research)

- Tier‑two providers such as CoreWeave, Oracle, Snowflake, Cloudflare and Databricks experienced high growth in Q4 2024. (SRG Research)

- About 60 % of corporate data is stored in the cloud, compared with about 30 % in 2015. (Exploding Topics)

- More than 50 % of companies place business records in the public cloud. (Exploding Topics)

- 44 % of organisations store employee data in the public cloud. (Exploding Topics)

- 44 % of companies keep customer data in the public cloud. (Exploding Topics)

- The share of companies storing corporate financial data in the cloud increased from 26 % in 2019 to 35 % in 2022. (Exploding Topics)

- The share storing intellectual property or trade secrets rose from 16 % to 23 % between 2019 and 2022. (Exploding Topics)

- The proportion storing patient or protected health information climbed from 10 % to 14 % during the same period. (Exploding Topics)

- About 89 % of companies follow a multi‑cloud approach. (Exploding Topics)

- 80 % of respondents use a hybrid cloud model. (Exploding Topics)

- 97 % of IT leaders intend to expand their cloud systems. (Exploding Topics)

- As of 2022, 34 % of businesses used one cloud provider and 27 % used two providers. (Exploding Topics)

- 61 % used either one or two clouds in 2022. (Exploding Topics)

- The share of businesses using three clouds fell from 20 % in 2019 to 11 % in 2022. (Exploding Topics)

- Cloud infrastructure service revenue for the 12 months to September 2022 reached US$217 billion, rising to US$247 billion during Q3 2022 to Q2 2023. (Exploding Topics)

- Q2 2023 alone generated US$65 billion in cloud infrastructure service revenue. (Exploding Topics)

- In mid‑2023 AWS held roughly 32 % market share, Microsoft Azure 22 % and Google Cloud 11 %, giving the top three providers around two‑thirds of the cloud market. (Exploding Topics)

- Flexera’s 2024 survey (summarised by Cloudera) reports that 89 % of respondents use multiple clouds, up from 87 % in 2023. (Cloudera)

- Fewer than 20 % of organisations plan to move sensitive data to the cloud, preferring to keep it on‑premises because of regulatory concerns. (Cloudera)

- IDC forecasts worldwide public cloud spending will reach about US$805 billion in 2024 and is expected to double in size by 2028, reflecting a five‑year compound annual growth rate of 19.4 %. (Monitor Daily)

- The banking, software/information services and retail industries are expected to spend US$190 billion on public cloud services in 2024. (Monitor Daily)

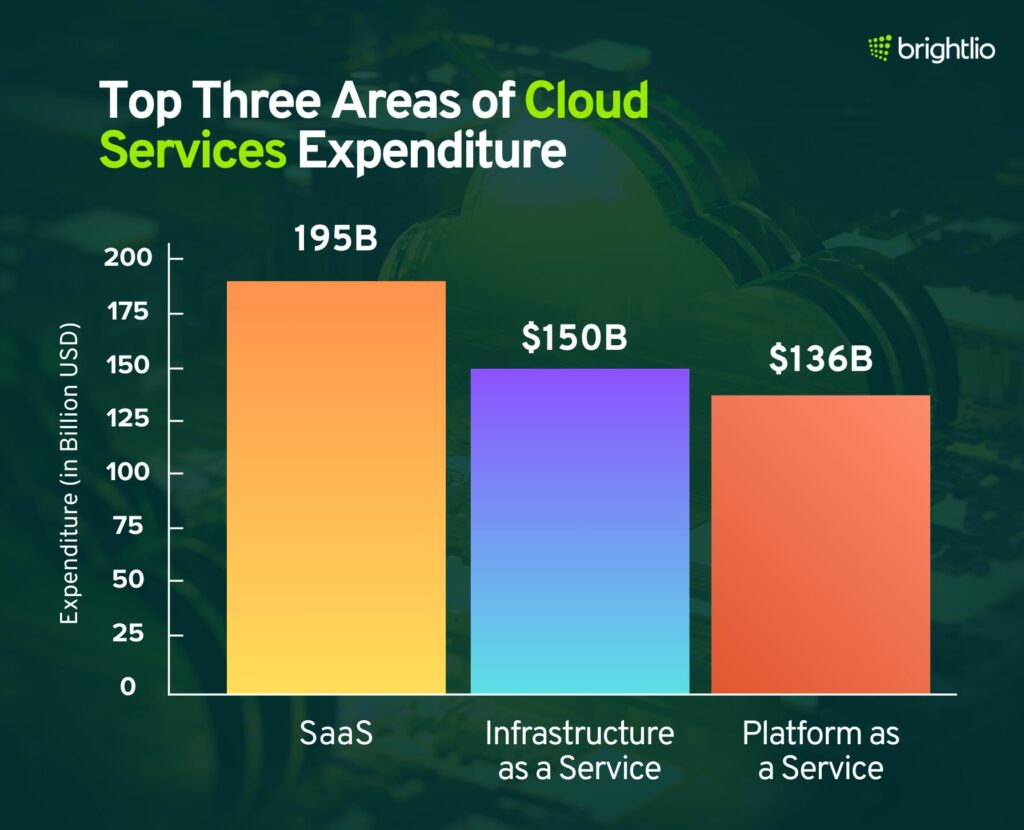

- Software‑as‑a‑service (SaaS) applications will account for over 40 % of public cloud spending in 2024. (Monitor Daily)

- Platform‑as‑a‑service (PaaS) and infrastructure‑as‑a‑service (IaaS) will each capture nearly 20 % of public cloud spending. (Monitor Daily)

- PaaS is the fastest‑growing category; AI platforms are projected to achieve a five‑year compound annual growth rate of 51.1 %. (Monitor Daily)

- SaaS system infrastructure software will be the smallest category, representing a little over 16 % of public cloud spending. (Monitor Daily)

- The United States is expected to be the largest public cloud market in 2024, with spending exceeding US$432 billion. (Monitor Daily)

- Industries such as capital markets, life sciences and insurance are projected to see around 23 % compound annual growth in public cloud spending; all industries except consumer are forecast to deliver double‑digit growth from 2023 to 2028. (Monitor Daily)

- Gartner’s forecast (cited in an NTT Data guide) expects worldwide end‑user spending on public cloud services to grow 20.4 % from US$561 billion in 2023 to US$675.4 billion in 2024. (NTT Data)

- A 2023 report from Zippia, referenced in the same guide, notes that 94 % of enterprises use cloud services and that 67 % of enterprise infrastructure is cloud‑based. (NTT Data)

- Netskope’s 2019 Cloud Report, summarised by ChiefMartec, found the average enterprise uses 1 295 cloud services; marketing departments use about 120 services, human resources about 100, finance 51 and development teams 38. (Chiefmartec)

- Average company uses 2.2 public clouds. (Spacelift)

- Organizations store 48% of their data in the public cloud. (Spacelift)

- 7.743 billion smartphones expected worldwide by 2028. (Spacelift)

- In 2020, roughly 2.3 billion individuals relied on personal cloud services. (AAG IT)

- Back in 2018, iCloud counted around 850 million users, with about 170 million subscribed to paid plans. (AAG IT)

- That same year, Google Drive recorded nearly 1 billion total users and about 800 million daily active accounts. (AAG IT)

- Dropbox has surpassed 700 million registered users worldwide. (AAG IT)

Global Cloud Computing and Infrastructure Statistics

- 50% of all data worldwide will be stored in the cloud by this year. ( Spacelift )

- The term “cloud computing” was coined by George Favaloro of Compaq in 1996. (MIT)

- 96% of companies use at least one public cloud. (G2)

- The total volume of data globally is expected to hit 200 zettabytes, that’s a trillion gigabytes this year. ( Cybercrime Magazine)

- Despite economic uncertainties, 80% of enterprises still plan to ramp up their cloud investments. (G2)

- Over 60% of all corporate data is in cloud storage. (G2)

- The top priorities for clients used cloud based services are cloud spending (82%), security concerns (79%), lack of expertise (78%), and cloud migrations (71%). (AAG)

- The cloud application market is currently worth over $150 billion and is expected to reach a value of $168.6 billion by 2025. (Exploding Topics)

- Global public cloud revenues are estimated to grow at a CAGR of 21%, amassing a market volume of $525 billion. (Statista)

- 94% of businesses have reported improved security after making the move to the cloud. ( Spacelift )

- The AI market within cloud computing is expected to reach $97.9 billion by the end of 2025. (Business Wire)

- The cloud system infrastructure service market is forecasted to grow by 30% in 2023. (Statista)

- Software as a Service (SaaS) currently constitutes approximately one-third of overall expenditure on public cloud services. (Exploding Topics)

- 40% of companies will take a cloud-native strategy in 2023. (Forrester)

- 85% of organizations will be cloud-first by 2025. (G2)

- 56% of SMB data resided in public clouds in 2022, with 6% planning to move to cloud computing services in the next 12 months (AAG).

- The cloud storage market is expected to reach $241.6 billion by 2029, up from $66.95 billion in 2021. (Yahoo! Finance)

- 80% of customers use hybrid cloud services. (AAG)

- 89% of companies use multiple clouds. (Exploding Topics)

- Just 2% of customers use a single private cloud solution. (AAG)

- Cloud application service is estimated to grow at 17.81%, compared to 16.06% in 2022. (Statista)

- The top three areas of expenditure for cloud services are SaaS ($195 billion), Infrastructure as a Service ($150 billion), and Platform as a Service ($136 billion). (Exploding Topics)

- The global IaaS market is expected to grow at 53% and reach values of $234 billion in 2025, compared to $117 billion in 2022. (Cloud Tech)

- The global PaaS market segment is expected to grow to a valuation of $113 billion in 2023, compared to $83 billion in 2022. It is also likely to reach a valuation of $164 billion by the year 2025. (Cloud Tech)

- Cloud data centers consume 3% of the world’s energy. (Exploding Topics)

- The cloud infrastructure services industry generates an annual revenue of $178 billion. (Exploding Topics)

- Global spending on public cloud services is projected to hit $1.35 trillion by 2027, according to the latest figures from the International Data Corporation. (IDC)

- Public cloud services accounted for 55% of the 2022 market share. (GM Insights)

- Cloud-based data warehouses have more than doubled in size over the past few years. (

- In 2023, public cloud services spending could reach almost $600 billion. (Gartner)

- 31% of enterprises spend over $12 million yearly on public cloud services. (Exploding topics)

- 66% of tech-based small businesses use cloud infrastructure. (Exploding Topics)

- 74% of enterprise companies use cloud infrastructure services. (Exploding Topics)

- 44% of traditional small businesses use cloud infrastructure. (Exploding Topics)

- 63% of Small and Medium enterprises are expected to host their workloads on the cloud. This is a significant increase from 57% in 2022. (AAG)

- 62% of SMEs are projected to host their data on cloud services in 2023, compared to 56% in 2022. (AAG)

- Desktop as a service (DaaS) is expected to experience a growth rate of 23.68% in 2023 compared to 26.59% in 2022. (Statista)

- Cloud management and security services are forecasted to grow at 15.8% compared to 14.7% in 2022. (Statista)

- 85% of enterprises have either adopted or are planning to adopt multi-cloud strategies to support their big data initiatives. ( Security Magazine )

- Cloud business process services (BPaaS) are expected to grow by 9% in 2023 compared to 8.15% in 2022. (Statista)

- The cloud security market is expected to grow from $40.8 billion in 2022 to $77.5 billion by 2026, a compound annual growth rate of 13.7%. (MarketsandMarkets)

- The cloud computing industry is projected to reach a value of $947.3 billion by 2026. ( Spacelift )

- The cloud gaming market value is expect to grow from $3.24 billion in 2022 to $40.81 billion by 2029, an astounding 43.6% growth rate. (AAG)

- Hyberscale cloud data center revenue was $170.6 billion in 2023. (Cushman & Wakefield)

- 84% of businesses rely on the private cloud for some part of their operations. ( Spacelift )

- The SaaS market was valued at around $250 billion in 2023 and is expected to grow to $299 billion by 2025. (Statista)

- The PaaS market is forecasted to double in size—growing from $117 billion in 2023 to over $244 billion by 2028, marking a CAGR just shy of 16%. ( Web FX )

- The public cloud market was valued at $300 billion in 2022 and is projected to soar to $1.7 trillion by 2032. ( Market Research Future )

- The global private cloud market was valued at approximately $222 billion in 2022 and is expected to exceed $500 billion by 2030, growing at a compound annual rate near 15% (Grand View Research)

- In 2021, the hybrid cloud market was worth $85 billion. Projections show it could grow to $128.01 billion by 2025 and surge to $262 billion by 2027, based on Statista data. ( Statista )

- Around 71% of IT leaders say their organizations plan to increase cloud spending in the coming years. ( Web FX )

- Roughly half of all businesses struggle to keep their cloud expenses under control. ( Anodot )

- Even with growing interest in cloud investments, 42% of CIOs cite cloud waste as their biggest concern. ( Web FX )

- 93% of companies worry that human error during manual cloud security checks could lead to accidental data exposure. ( Expert Insights )

- 85% of people identify security as the biggest challenge in cloud computing. ( Expert Insights )

- Only 20% of businesses have a specialist or team focused solely on cloud security. ( Expert Insights )

- Data security remains a major concern, with 69% of users fearing potential loss or exposure. ( Expert Insights )

- The cloud accounts for about 45% of reported data breaches. ( Expert Insights )

- 45.2% of EU enterprises used cloud computing services in 2023. That’s an increase of 4.2 percentage points from 2021. ( Eurostat )

- 99% of EU enterprises with 10+ employees have internet access. ( Eurostat )

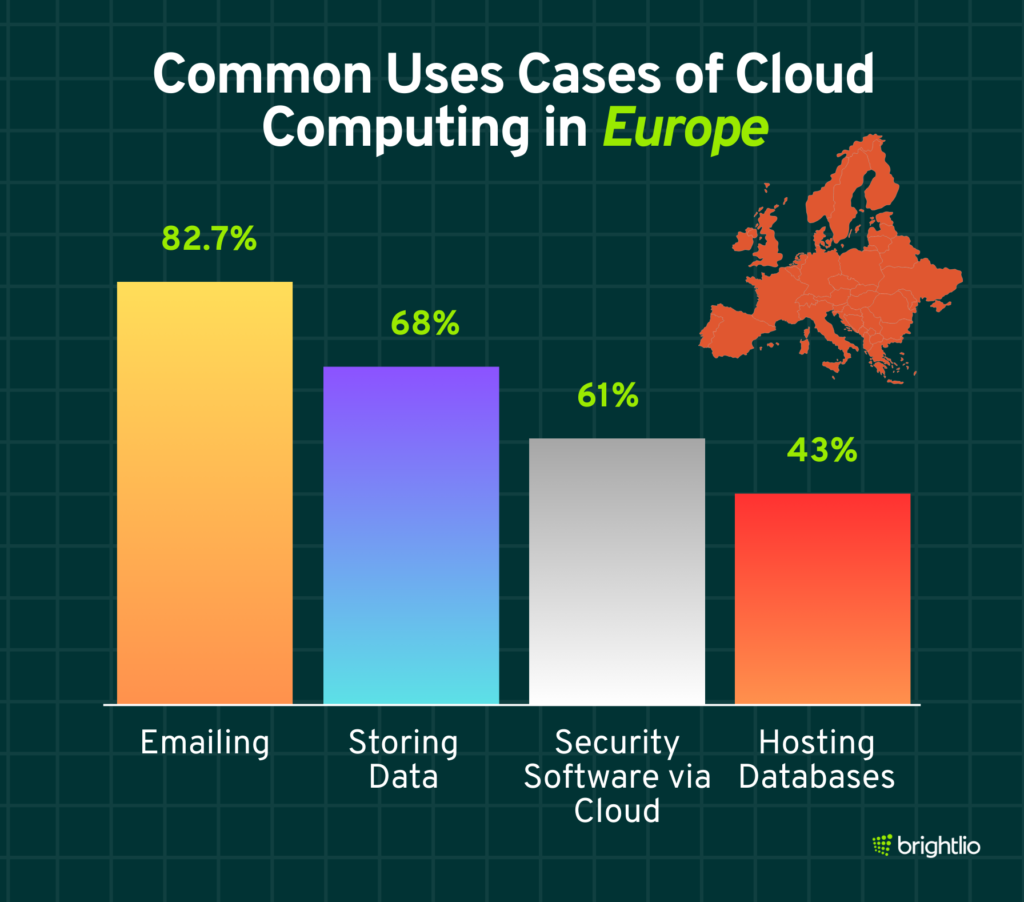

- Common uses cases of cloud computing in Europe

- 82.7% used it for email

- 68% used it for file storage

- 66.3% bought office software (e.g., word processors, spreadsheets)

- 61% used security software via cloud

- 43% hosted databases on the cloud ( Eurostat )

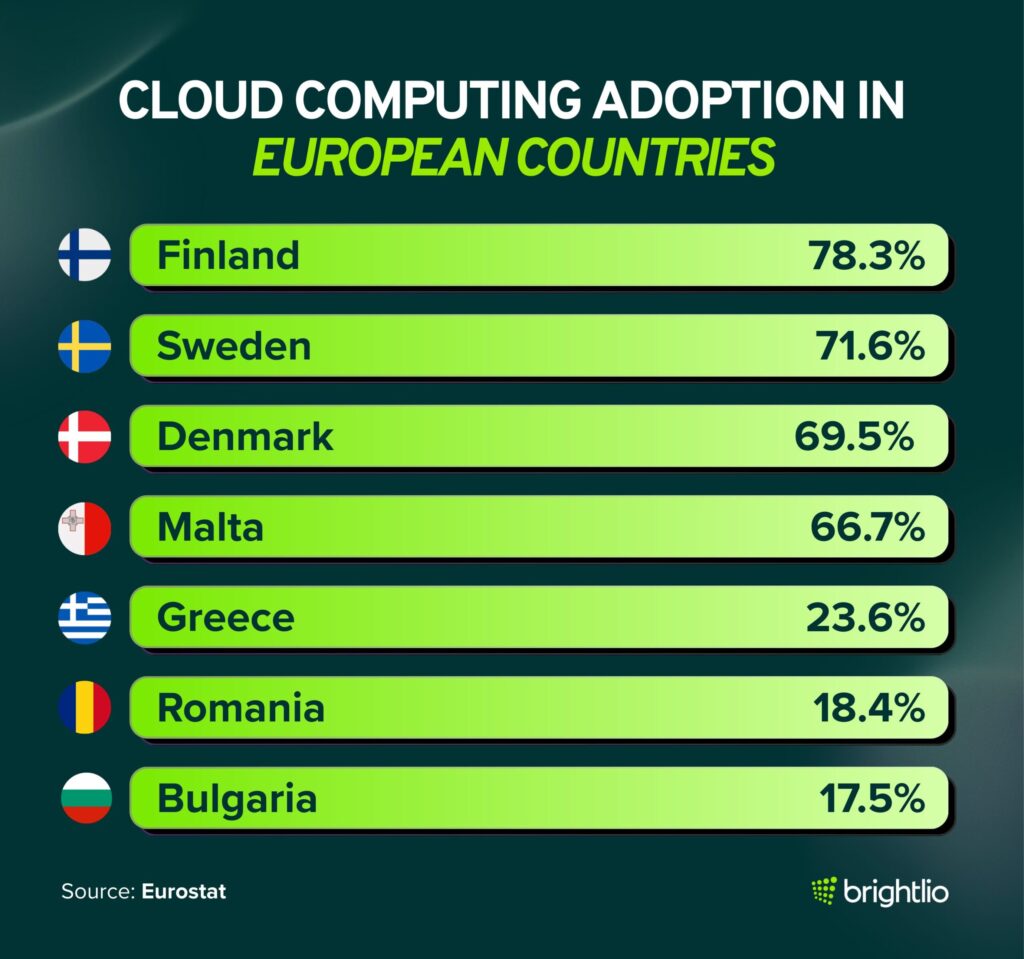

- In 2023, cloud computing adoption varied widely across EU countries, with Finland (78.3%), Sweden (71.6%), Denmark (69.5%), and Malta (66.7%) leading the way, while Greece (23.6%), Romania (18.4%), and Bulgaria (17.5%) lagged with the lowest adoption rates. ( Eurostat )

- For more advanced business needs, 51.6% of enterprises used cloud-based accounting or financial software, 25.9% ran ERP systems on the cloud, 25% relied on cloud-hosted CRM software, 26.1% used cloud platforms for application development, testing, or deployment, and 25.4% purchased high-performance computing platforms to run internal business software. ( Eurostat )

- Demand for cloud computing skills is set to grow by 25% this year. ( KodeKloud)

- In the EU in 2023, cloud adoption was highest in the Information and Communication sector at 79%, followed by the Professional, Scientific, and Technical sector at 62.4%, while other sectors saw adoption rates between 37.6% and 56%; the Real Estate sector recorded the fastest growth since 2021, with an increase of 7.5 percentage points. ( Eurostat )

- In the developing world, 30% of companies already use cloud services. Among larger organizations, 50% of those with over 2,500 employees and 41% of those with 1,000 to 2,500 employees are actively evaluating or planning their cloud strategies. ( Cloud Zero )

- More enterprises are shifting toward a multi-cloud or hybrid cloud approach, instead of relying solely on public or private cloud strategies. More on that shortly. ( Cloud Zero )

- Software-as-a-Service (SaaS) spending is expected to near $300 billion by 2025. ( Zylo )

- 51% of IT spending is expected to move away from traditional tools and go toward cloud-based solutions this year. ( Gartner )

Cloud Computing Cost and Efficiency Stats

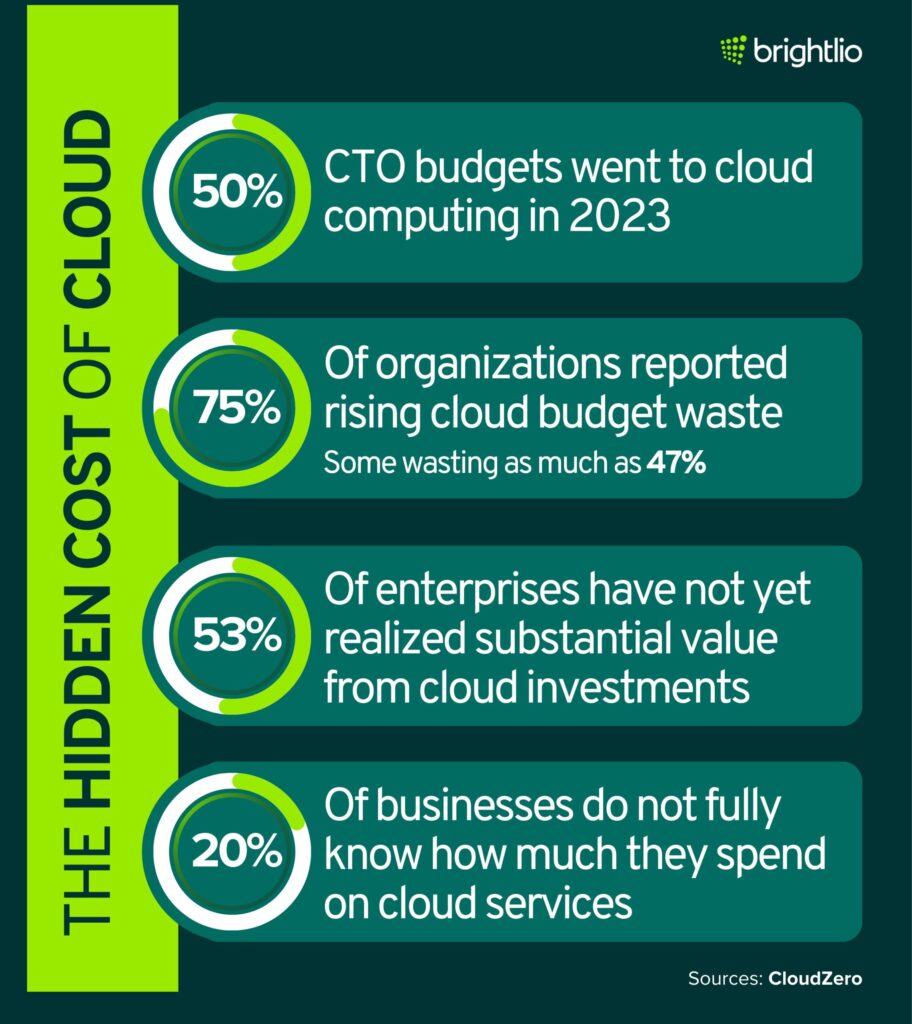

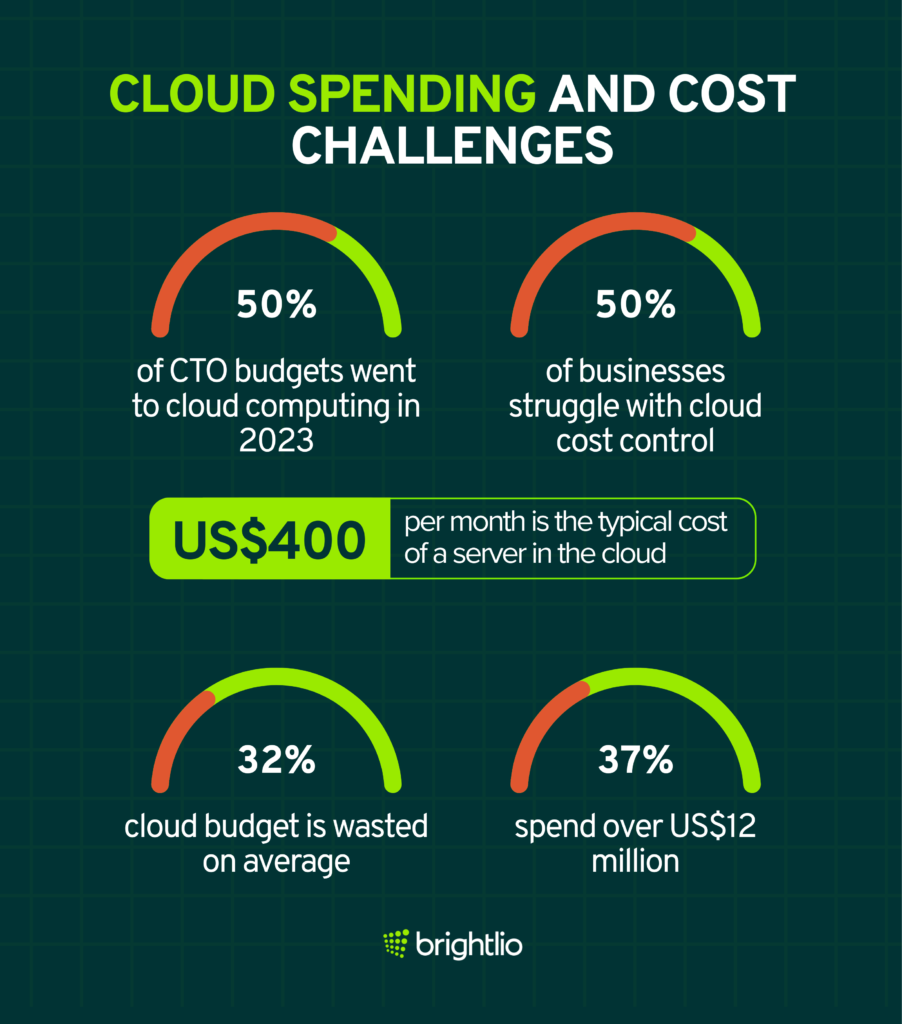

- Cloud computing accounted for more than half of CTO budgets in 2023.

- Cloud waste averaged 32 % of cloud budgets in 2022, up from 30 % in 2021. (Cloudzero)

- 75% of organizations reported an increase in cloud budget waste, with some wasting as much as 47 % of their cloud budget. (Cloudzero)

- 49% percent of businesses struggle to control cloud costs; 54 % blame poor visibility. (Cloudzero)

- 42% of CIOs and CTOs view cloud waste as their biggest challenge. (Cloudzero)

- 53% of enterprises have not yet seen substantial value from their cloud investments. (Cloudzero)

- Global spending on public cloud services rose from US$421 billion in 2021 to over US$599 billion in 2023.

- More than 20 % of businesses do not fully know how much they spend on cloud services.

- Migrating workloads to public clouds can reduce total ownership costs by up to 40%.

- A typical server costs about US$400 per month in the cloud, while a back-office infrastructure setup costs around US$15,000 per month.

Cloud Security and Compliance in Cloud Computing

- About 97 % of enterprise cloud apps are purchased without formal approval .

- Only 11 % of organizations have encrypted most of their sensitive data in the cloud .

- When asked about responsibility for data protection, 32 % of companies said it is theirs, 35 % said it belongs to providers, and 23 % evaluate vendor security features first.

- Gartner projects global spending on public cloud services will rise 20.7% to USD 591.8 billion in 2024, with Infrastructure-as-a-Service (IaaS) showing the strongest growth. (SentinelOne)

- Ransomware attacks on cloud have grown 13% in five years. Phishing drives 51% of credential theft, often through impersonation fraud. (SentinelOne)

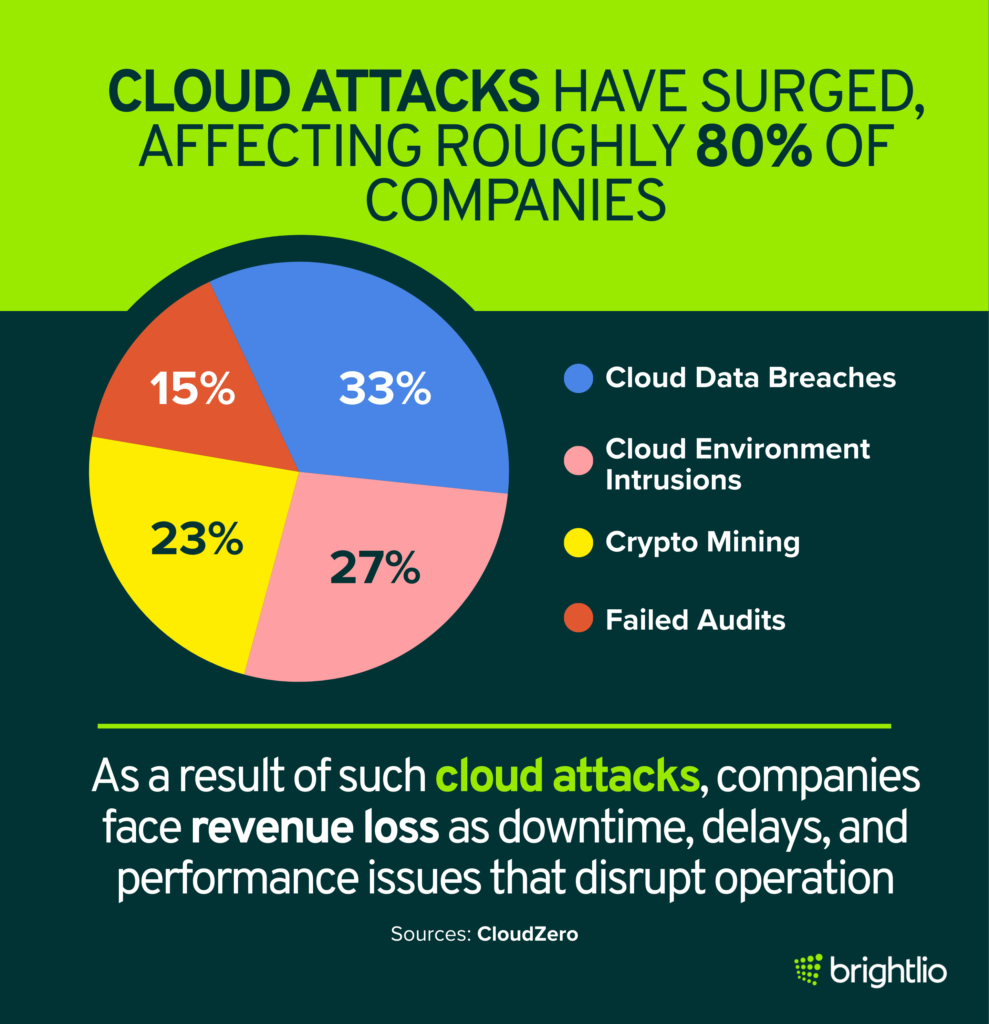

- Cloud attacks have surged, affecting roughly 80% of companies. Data shows that 33% of cases involve cloud data breaches, 27% involve environment intrusions, 23% involve crypto mining, and 15% stem from failed audits. The consequences cut into revenue, with downtime, delays, and degraded performance disrupting business operations. (SentinelOne)

- Hackers target 38% of SaaS applications and frequently exploit cloud-based email servers. Servers are the focus of 90% of breaches, with web application servers hit the hardest. (SentinelOne)

Industry-Specific Cloud Computing Trends

- Around 73 % of insurance companies use hybrid cloud setups .

- The hybrid cloud market is forecast to grow from US$44.6 billion in 2020 to US$128 billion in 2025

- The edge-computing market is expected to rise from US$3.6 billion in 2020 to US$15.7 billion in 2025 .

- Spending on cloud-based AI services is projected to increase from US$37.5 billion in 2020 to US$97.9 billion in 2023 .

- Serverless computing is projected to grow from US$3.3 billion in 2020 to US$14.1 billion in 2025 .

Cloud Data Storage and Management Facts

- The world is expected to generate 200 zettabytes of data by 2025, with half stored in public clouds .

- In 2015, just 25 % of global data was in the cloud; by 2025 this will reach 50 % .

- About 71 % of U.S. residents use a cloud-storage service. Google Drive leads, followed by Dropbox (66.2 %), OneDrive (39.35 %), and iCloud (38.89 %) .

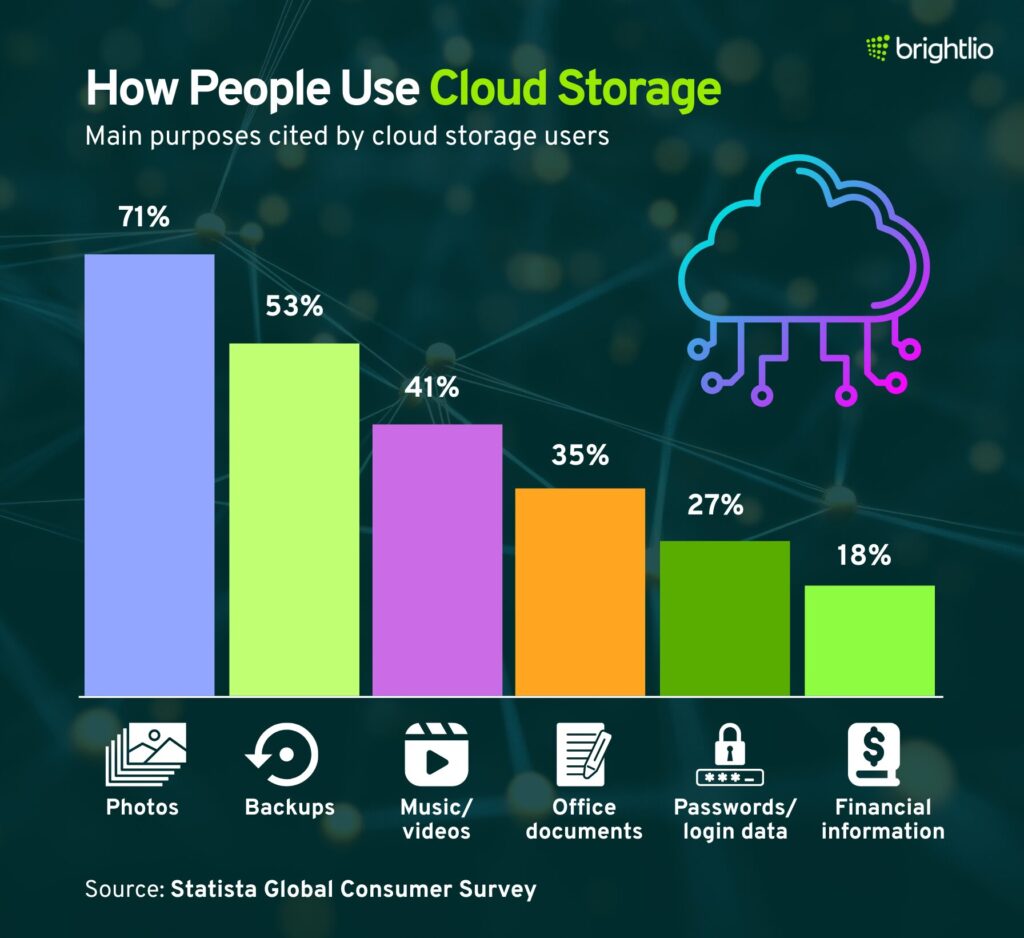

- Users store different data types in the cloud: 53 % backups, 41 % music and videos, 35 % work documents, 27 % passwords, and 18 % financial information.

Cloud Computing Market Leaders and Segments

- Amazon Web Services (AWS), Microsoft Azure, and Google Cloud held a combined 65% share of the global cloud market in Q2 2022. That share has since grown to 71% of the public cloud market. (G2)

- Amazon remains the largest cloud provider in the world, taking up 31% of the market share. Azure and Google follow with 25% and 11% share. (Statisa)

- 3.2 million companies use AWS. (Enlyft)

- As of Q1 2023, Microsoft makes over half of its money in the cloud computing market with Azure and M365. (Statista)

- AWS can be found in 26 regions, with 84 availability zones. (Dgtl Infra)

- Microsoft Azure, the second largest global player, has a 22% global share of the market. (Dgtl Infra)

- Microsoft has a commercial presence in 60 regions and 116 international availability zones. (Dgtl Infra)

- Google cloud takes up 11% of the worldwide cloud computing industry in 2023. (AAG)

- The Google cloud platform has 34 regional presence and 103 availability zones (Dgtl Infra)

- Alibaba takes up 6% of the global cloud market. (Dgtl Infra)

- Alibaba Cloud has a global presence in 27 regions and 84 availability zones (Dgtl Infra)

- Oracle cloud takes up 2% of the market and has a presence in 38 regions with 46 availability zones. (Dgtl Infra)

- IBM Cloud can be found in 11 regions with 29 availability zones globally. (Dgtl Infra)

Cloud Computing Statistics by Region

All cloud computing businesses are built differently due to the unique requirements of companies within those regions. Here, we break down each area, highlighting each market’s special characteristics.

10 Facts About Cloud Computing in North America

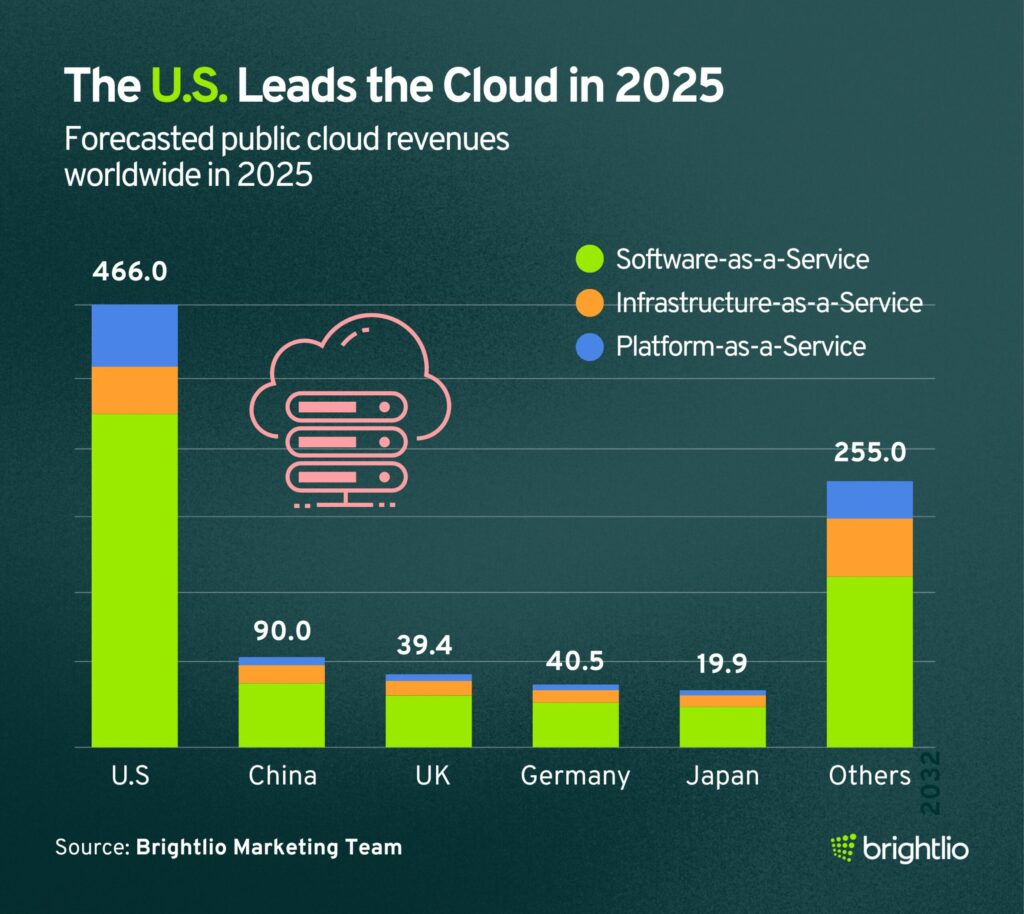

- Revenue from the public cloud sector in the United States is expected to reach $457.71 billion in 2025. Compared globally, the United States will generate the highest share of revenue. (Statista)

- Software as a Service holds the largest share in the North American cloud market, projected at $221.79 billion in 2025. (Statista)

- Annual growth in the United States is forecast at CAGR 15.08% from 2025 to 2030, pushing the market size to 923.73 billion US dollars by 2030. (Statista)

- In H1 2024, the U.S. led the global cloud market with 44% of cloud service revenue, 53% of hyperscale data center capacity, and 47% of cloud data center hardware and software sales. (Future CIO)

- The US cloud computing market is projected at 6 times larger the next closest country (China). (Statista)

- Canadian companies allocated 29% of their IT budgets to cloud computing. (Made in CA)

- 92% of Canadian companies use some form of cloud computing services. (Made in CA)

- Infrastructure as a service accounts for half of the US cloud computing market. (Statista)

- Mexico boasts cloud regions from four of the seven largest public cloud providers (Azure, Google, Huawei, and Oracle). (S&P Global)

- The United States represented 51% of Hypercale cloud data center revenue in 2023. (Cushman & Wakefield)

South America Cloud Computing Statistics

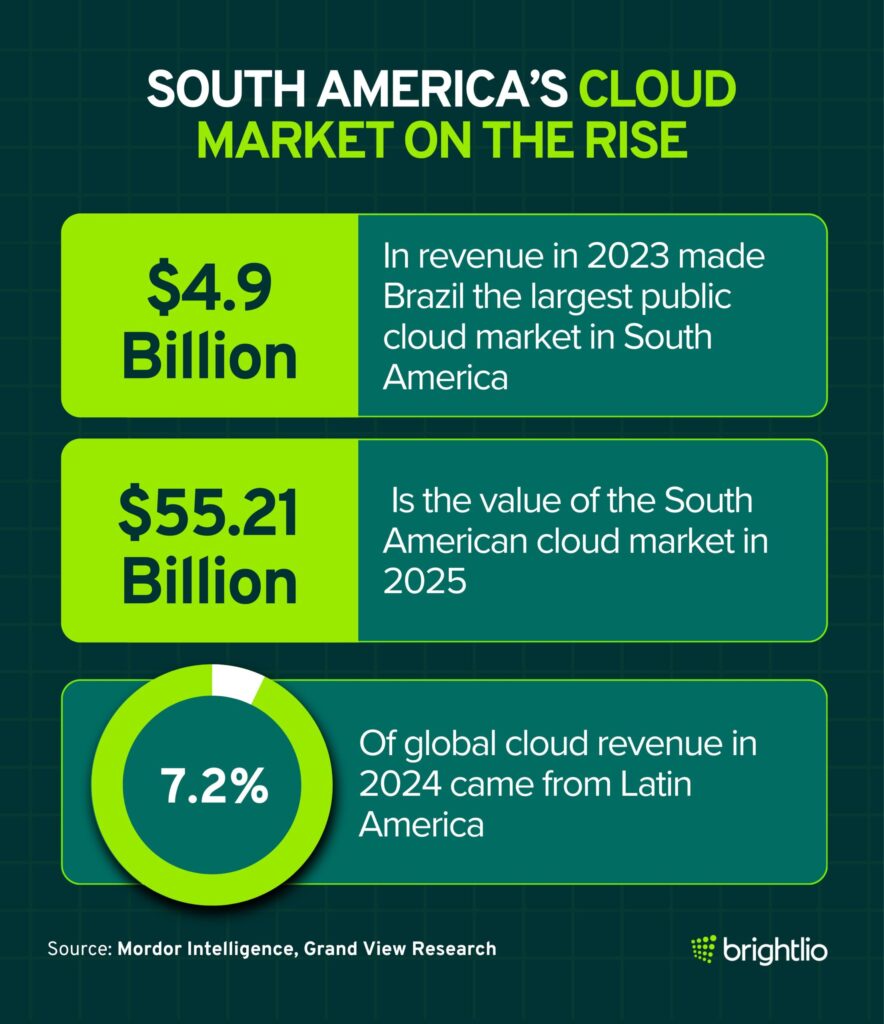

- Brazil is the largest public cloud market at $4.9 billion in revenue in 2023. This is expected to grow at an 18.73% rate to $9.73 billion by 2027. (Statista)

- The Chilean cloud market is expected to grow by 22.5% between 2020 and 2025.

- Brazil is home to cloud regions from all seven major public cloud providers (AWS, Azure, Google, Huawei, IBM, Oracle, and Tencent). (S&P Global)

- Chile is home to cloud regions from five major cloud providers (AWS, Azure, Google, Huawei, and Oracle). (S&P Global)

- The South American cloud market is valued at $55.21 billion in 2025 and is forecast to reach $88.17 billion in 2030, growing at 9.81% per year. (Mordor Intelligence)

- Public cloud makes up 71.97% of revenue in 2024, while hybrid cloud is expected to grow 11.04% annually from 2025 to 2030. (Mordor Intelligence)

- SaaS leads the market with 53.19% share in 2024, while PaaS will grow the fastest at 10.35% per year. (Mordor Intelligence)

- Large enterprises contributed 62.24% of revenue in 2024, but SMEs will grow faster at 10.07% CAGR. (Mordor Intelligence)

- Banking and insurance accounted for 21.13% of spending in 2024, with retail cloud use expected to grow at 10.46% annually. (Mordor Intelligence)

- Brazil led the market with 42.39% share in 2024, while Argentina is forecast to grow fastest at 10.71% annually. (Mordor Intelligence)

- South American public cloud revenue will hit $19.28 billion in 2025, with SaaS generating $6.30 billion. (Statista)

- Revenue is expected to reach $51.58 billion by 2030, expanding at 21.75% CAGR. (Statista)

- Public cloud revenue will jump 28.97% year over year in 2025. (Statista)

- The overall Latin American market generated $54.47 billion in 2024 and is projected to reach $184.87 billion by 2030, growing 21.8% annually. (Grand View Research)

- Latin America represented 7.2% of global cloud revenue in 2024. (Grand View Research)

- SaaS is the largest segment, but IaaS is expected to grow the fastest between 2025 and 2030. (Grand View Research)

- Brazil will post the highest growth rate in Latin America from 2025 to 2030. (Grand View Research)

- Telecom operators are investing heavily: Brisanet has built 61,000 km of fiber with 5G micro-data centers, SBA spent $975 million for 7,000 towers, and V.tal committed $1 billion for low-latency networks. (Mordor Intelligence)

- 73% of Latin American organizations plan to operationalize AI within 12 months, with workloads that demand 10-50 times more compute than traditional apps. (Mordor Intelligence)

- Microsoft announced a $2.7 billion investment in Brazil to train 5 million people in AI skills. (Mordor Intelligence)

Africa Cloud Computing Statistics

- 61% of companies located in Africa increased spending on cloud services in 2022. 90% of these companies reported improved business growth, 66% experienced an increase in organizational innovation after migrating to cloud services, and 56% experienced enhanced business security. (IT Online)

- Cloud computing is gaining momentum in regions like Sub-Saharan Africa (SSA) and Central and Eastern Europe (CEE), with 40% of organizations in developing areas actively evaluating or planning their cloud strategies, according to Oracle and IDC. ( Cloud Zero )

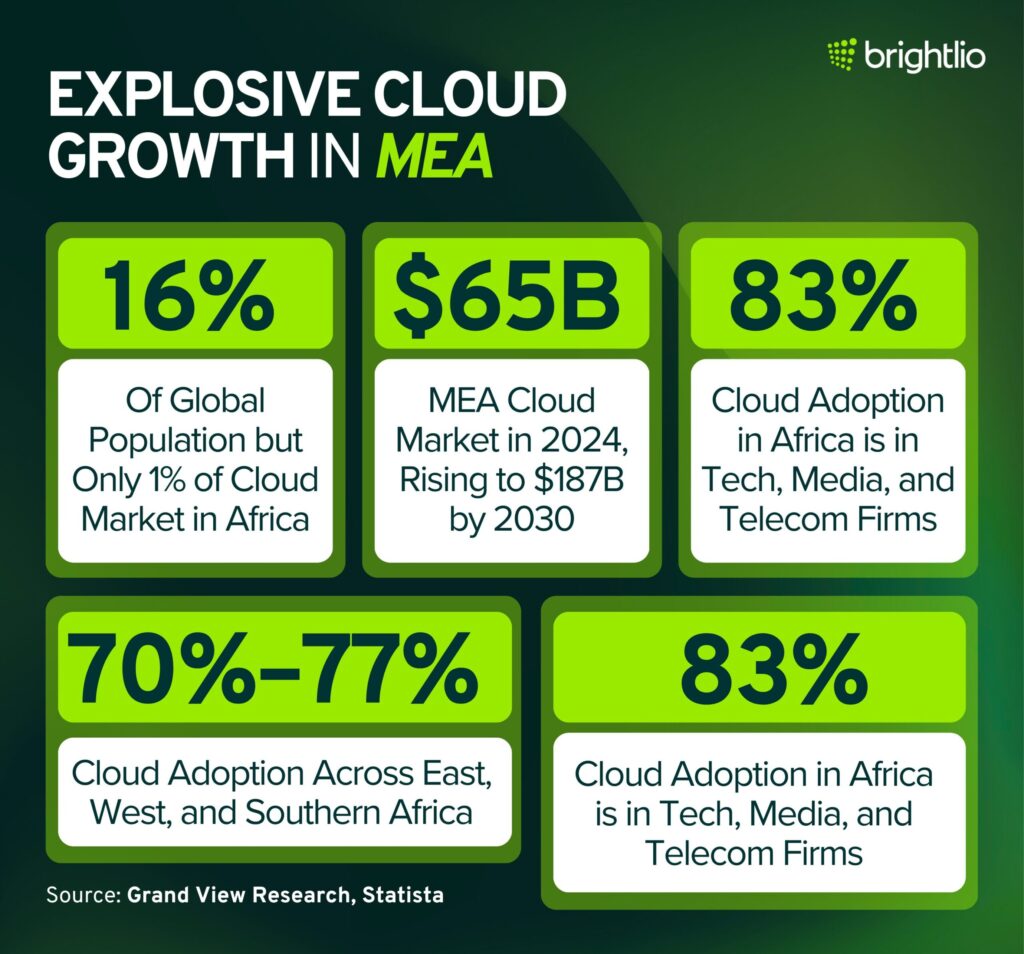

- Africa is home to 16% of the world’s population but accounted for 1% of the global public cloud services market in 2022. (qz.com)

- The public cloud market in South Africa will grow from $3.28 billion in 2023 to $6.87 billion in 2027, with an annual growth rate of 20.3%. (Statista)

- Africa’s bandwidth capacity doubled between 2017 and 2020. (The Africa Report)

- The Middle East & Africa (MEA) cloud computing market produced 65.16 billion USD in revenue during 2024 and is on course for 186.84 billion USD in 2030, reflecting 18.3 % average annual growth. (Grand View Research)

- SaaS generated the highest revenue among cloud services in MEA during 2024, while IaaS is expected to be the fastest-growing segment through 2030. (Grand View Research)

- MEA represented 8.7 % of global cloud computing revenue in 2024, and South Africa is projected to log the strongest growth rate among MEA countries from 2025 to 2030. (Grand View Research)

- Statista’s forecast places Africa’s public-cloud revenue at 15.55 billion USD in 2025, with PaaS accounting for about 4.98 billion USD of this figure. (Statista)

- The same forecast anticipates 23.27 % average annual growth between 2025 and 2030, which would expand the African public-cloud market to 44.26 billion USD. (Statista)

- Public-cloud revenue across Africa is projected to increase almost 30 % year over year in 2025. (Statista)

- McKinsey’s survey found that African organizations host roughly 45 % of their workloads in public cloud, and cloud accounts for 38 % of total IT expenditure. (McKinsey & Company)

- Only 17 % of African companies in McKinsey’s sample have fully migrated their workloads to cloud environments. (McKinsey & Company)

- About 26 % of surveyed firms are still in an experimental phase, keeping less than half of their workloads in cloud. (McKinsey & Company)

- Within the surveyed group, compute services represented 29 % and storage 32 % of cloud usage. (McKinsey & Company)

- Cloud adoption rates across East, West, and Southern Africa range between 70 % and 77 %, with Southern Africa reporting 50 % of workloads on public cloud. (McKinsey & Company)

- Technology, media and telecom organizations exhibited 83 % average cloud adoption, with 61 % of workloads hosted in public cloud. (McKinsey & Company)

- Financial services firms lag, with 56 % of workloads in cloud; this comprises 39 % in public cloud and 17 % in private cloud. (McKinsey & Company)

- Half of the survey respondents work with a single cloud service provider; by comparison, 87 % of companies in North America use only one provider. (McKinsey & Company)

- AWS operates 1 cloud region in Cape Town, and Microsoft Azure has 1 in Johannesburg, whereas Google Cloud is yet to establish a region in Africa. (McKinsey & Company)

- Legal and regulatory barriers were cited as significant obstacles by more than 50 % of organizations; only 10 % said that existing policy frameworks support cloud adoption. (McKinsey & Company)

- A skills shortage looms: 97 % of African companies expect a technical talent challenge in 2023, with talent retention highlighted as a key concern. (McKinsey & Company)

Cloud Computing Statistics for Europe

- Europe’s cloud computing market is projected to reach a valuation of $114 billion in 2023 compared to $63 billion in 2021. The region’s market share is expected to grow as much as $260 billion in 2027. (Statista)

- The European market grew 5x between 2017 and 2022. (G2)

- Between 2023 and 2027, the region’s cloud computing market is projected to experience a CAGR of 13%. (Statista)

- In 2023, the SaaS market is predicted to become Europe’s largest cloud computing sector, with a monetary volume of $61 billion. (Statista)

- The continent’s PaaS market is expected to reach a valuation of $22.14 billion in 2023 and is projected to reach 42.11 billion euros in 2027. (Statista)

- In 2023, Europe’s IaaS market is predicted to reach a volume of 23.88 billion Euros and is expected to grow as much as 41.4 billion Euros in 2027. (Statista)

- Germany ranks third in the global market’s 2023 valuation with a volume of $21 billion. (Cloud Tech)

- Germany is predicted to experience the most significant increase in the SaaS market revenue, growing to $16.3 billion in 2025. (Statista)

- Italy’s cloud computing service market is estimated to experience a CAGR of 30% between 2023 and 2032 as a result of the strong presence of multinational corporations. (Statista)

- Europe’s cloud-computing market was valued at USD 185.3 billion in 2024 and is forecast to reach USD 588.2 billion by 2030, with a 20.4% CAGR. (Grand View Research)

- European cloud providers held 15% of local market share in 2022, down from 29% in 2017, but that share has since stabilized at around 15%. (SRG Research)

- Amazon, Microsoft, and Google control about 70% of the European market, while SAP and Deutsche Telekom each hold about 2%. (SRG Research)

- Europe’s cloud market reached €61 billion in 2024, with revenues of €36 billion from cloud infrastructure services in the first half of 2025. (SRG Research)

- The European cloud market is expected to grow by about 24% in 2025 compared with 2024. (SRG Research)

- Europe accounted for 24.6% of the global cloud-computing market in 2024. (Grand View Research)

- France is expected to record the highest growth rate among European countries between 2025 and 2030. (Grand View Research)

- Statista estimates that Europe’s cloud market was worth €110 billion in 2023 and will increase to around €129 billion in 2024. (Statista)

- In 2023, 45.2% of EU enterprises purchased cloud-computing services, up 4.2 points from 2021. (Eurostat)

- Among enterprises using cloud services, 75.3% bought advanced solutions like security software, databases, or development platforms. (Eurostat)

- The most common services were e-mail (82.7%), file storage (68%), office software (66.3%), and security software (61%). (Eurostat)

- Finance and accounting applications were used by 51.6% of enterprises on the cloud, ERP by 25.9%, and CRM by 25%. (Eurostat)

- Large enterprises led in adoption: 77.6% used cloud services in 2023, compared with 59% of medium-sized firms and 41.7% of small firms. (Eurostat)

- SaaS was used by 95.8% of cloud-adopting firms, IaaS by 74.2%, and PaaS by 26.1%. (Eurostat)

- Sophisticated cloud services were purchased by 83.6% of large enterprises, 77.4% of medium-sized enterprises, and 74.2% of small enterprises. (Eurostat)

- Finland (78.3%), Sweden (71.6%), Denmark (69.5%), and Malta (66.7%) had the highest enterprise cloud adoption, while Greece (23.6%), Romania (18.4%), and Bulgaria (17.5%) had the lowest. (Eurostat)

- High dependence on cloud was reported in Finland (63.6% of enterprises), Denmark (62.8%), Sweden (56.1%), and the Netherlands (52.3%). (Eurostat)

- Generative AI services in Europe’s cloud market are growing at 140–160%, with the UK and Germany as the largest markets, and Ireland, Spain, and Italy seeing the fastest growth. (SRG Research)

Asia and the Pacific Cloud Computing Statistics

- Cloud infrastructure user spending in Asia and the Pacific reached $8.7 billion in the second quarter of 2022, accounting for 14% of the global cloud spending in that year. (Canalys)

- The revenue of the public cloud market in Asia is projected to reach $110 billion by 2023 and grow at a 36.4% rate. (Statista)

- The IaaS sector makes up the bulk of Asia’s cloud service market, with a valuation of $53 billion in 2023. (Statista)

- By 2026, the PaaS Asian market will reach a valuation of $27 billion, constituting 16% of the region’s cloud computing market. (IDC)

- The region’s SaaS sector is expected to amass up to $57 billion by 2026, adding over 34% to the Asia-Pacific cloud market. (IDC)

- The Asia-Pacific cloud-computing market was valued at USD 94.6 billion in 2022 and is expected to grow at 16.6% CAGR through 2030. (Grand View Research)

- SaaS made up over 55% of revenue in 2022, while IaaS is forecast to be the fastest-growing segment. (Grand View Research)

- Private cloud held 42% of the market in 2022, but hybrid cloud adoption is accelerating, with 97% of organizations considering it the ideal model. (Grand View Research)

- Large enterprises generated more than half of revenues in 2022, but SMEs—representing 97% of businesses in the region—are expected to grow fastest. (Grand View Research)

- Telecom firms in Asia-Pacific are investing about USD 200 million annually into cloud transformation, with one-third going to infrastructure. (Grand View Research)

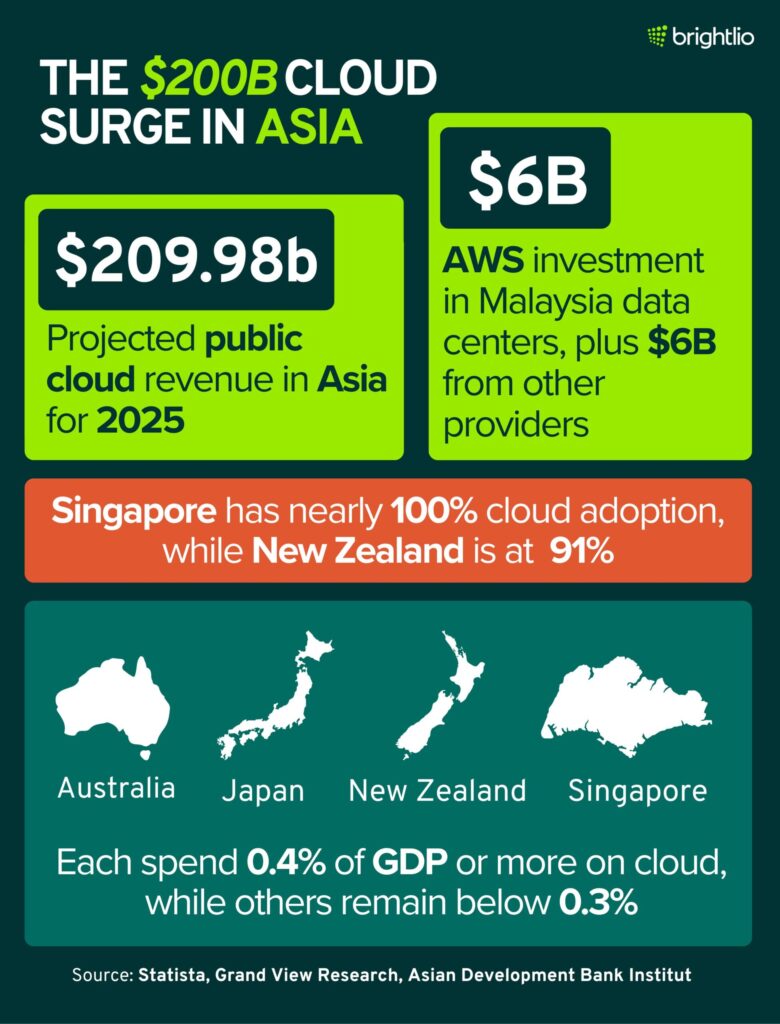

- AWS announced USD 6 billion in investments for data centers in Malaysia, alongside combined USD 6 billion commitments from Alibaba, Microsoft, IBM, Tencent, Google, and Oracle. Microsoft alone pledged USD 1 billion over five years. (Grand View Research)

- Ken Research also values the market near USD 95 billion, citing digitalization, AI, and big data as key drivers. (Ken Research)

- China, Japan, and India are identified as the leading markets due to strong investments and regulatory frameworks. (Ken Research)

- Indonesia expanded its cloud-based Clean Air Initiative to 100 cities in 2024 for real-time pollution monitoring. (Ken Research)

- India’s 2024 budget allocated USD 2.6 billion to its Ministry of Electronics and IT for digital infrastructure. (Ken Research)

- Singapore is home to more than 100 hyperscale data centers, supporting its role as a regional hub. (Ken Research)

- Around 150 million people in rural Southeast Asia still lack high-speed internet, limiting cloud adoption. (Ken Research)

- South Korea and Japan are expected to be early adopters of edge computing by 2029. (Ken Research)

- ADBI estimates cloud contributed 0.25%–2.23% of GDP across Asia-Pacific countries in 2023. Singapore was near the top with 2.23%, while India and several Southeast Asian countries were closer to 0.25%–0.50%. (ADBI)

- Improved pro-cloud policies could raise GDP by 0.5%–0.7% in coming years.(ADBI)

- A one-step policy improvement raises maturity by 12%–33% and can boost spending by 10.5%–28%. (ADBI)

- With supportive policies, GDP could rise by 0.6% in Vietnam, 0.5% in Korea and the Philippines, and 0.3% in Indonesia and Thailand. (ADBI)

- Singapore has nearly 100% cloud adoption, while New Zealand is at 91%. (ADBI)

- Australia, Japan, New Zealand, and Singapore each spend 0.4% of GDP or more on cloud, while others remain below 0.3%. (ADBI)

Is cloud computing in demand?

Yes. Surveys show cloud adoption across industries is almost universal and spending is rising quickly. A report from Zippia cited by Edge Delta notes that 94 % of major companies worldwide already use cloud computing.

Gartner predicts that more than 85 % of organizations will have a cloud‑first strategy by 2025 and that 95 % of new digital workloads will run on cloud‑native platforms.

In financial services, the Cloud Security Alliance survey found 98 % of respondents use some form of cloud computing.

Gartner also forecasts that global end‑user spending on public cloud services will jump from $595.7 billion in 2024 to $723.4 billion in 2025. These figures show that demand for cloud services and cloud infrastructure remains strong.

What are the four types of cloud computing?

The four main deployment models of cloud computing are:

| Model | Key features | Source |

|---|---|---|

| Public cloud | Services run on shared infrastructure managed by third-party providers such as Amazon Web Services (AWS), Microsoft Azure, or Google Cloud. Organizations share resources and pay based on usage. | Supermicro |

| Private cloud | Infrastructure is dedicated to a single organization, typically hosted on-premises or at a specialized facility. It provides greater control, security, and compliance. | Supermicro |

| Hybrid cloud | Combines public and private environments to balance scalability with security and cost considerations. Workloads can move between environments as needs change. | Supermicro |

| Multi-cloud | Involves using services from multiple public cloud providers to reduce dependency on a single vendor and optimize cost and performance. | Supermicro |

How Can Brightlio Help With Cloud Services?

At Brightlio, we offer public cloud solutions customized to meet your needs and budget. Our experts can also guide you on managing cloud costs, so you get the most value out of your investment.

We also offer connectivity, unified communications, and colocation services. If your organization depends on cloud data centers, our team can design strategies that improve performance and reliability. We are committed to being your most trusted and responsive IT solutions provider.

Contact Brightlio today to get started!

If you enjoyed this article, you may also enjoy our facts about data centers.

FAQs

Amazon Web Services remains the largest provider. In Q2 2025 Synergy Research Group reported shares of 30% for Amazon, 20% for Microsoft and 13% for Google.

Yes. Netflix began its migration after an outage in 2008 and completed the move in January 2016. Its streaming platform now runs entirely on AWS.

AWS holds the largest share of global cloud infrastructure revenue at about 30% in Q2 2025, followed by Azure at 20% and Google Cloud at 13%.

Gartner expects more than 85% of organizations to adopt cloud first strategies and predicts that 95% of new digital workloads will use cloud native platforms. Public cloud end user spending is forecast to reach $723.4 billion in 2025. Gartner also projects that hybrid strategies will be adopted by about 90% of organizations through 2027.

Most large organizations use cloud services. Surveys summarized by Edge Delta report 94% enterprise adoption worldwide. The Cloud Security Alliance reports 98% adoption in financial services.

About 94% of enterprises and 98% of financial service organizations use cloud services. Multi cloud and hybrid use sits at 89% and 73%.

Gartner projects 95% of new workloads will be cloud native and expects hybrid strategies to reach 90% penetration through 2027.

Public cloud spending is projected at $723.4 billion in 2025, with 33% of organizations spending more than $12 million and 71% expecting growth. About 60% of corporate data now resides in the cloud.

Synergy Research Group reports Q2 2025 shares of about 30% for AWS, 20% for Microsoft and 13% for Google. Other providers such as Oracle, IBM, Alibaba and CoreWeave hold single digit shares.

Cloud adoption sits near universal levels: about 94% of enterprises use cloud services, and 98% of financial services organizations report active use. Multi cloud patterns remain common, with 89% using several public clouds and 73% combining public and private environments.

Public cloud spending is forecast to reach $723.4 billion in 2025. Surveys show 33% of organizations spend more than $12 million per year and 71% plan for larger budgets.

About 60% of corporate data now lives in the cloud. Analysts expect the global datasphere to reach about 175 zettabytes in 2025, with a large share stored off premises.

Cost control remains difficult. About 32% of cloud budgets go to idle resources and only 30% of companies can track costs accurately.

Gartner projects that 95% of new digital workloads will run on cloud native platforms in 2025. Demand for skilled architects continues to grow.

These figures show strong adoption paired with recurring challenges in cost management and governance.

1. About 94% of enterprises use cloud services, and 98% of financial organizations use some form of cloud.

2. Public cloud spending will rise from $595.7 billion in 2024 to $723.4 billion in 2025.

3. More than 85% of organizations are expected to adopt cloud first policies.

4. Roughly 95% of new digital workloads will be built on cloud native platforms in 2025.

5. Multi cloud and hybrid cloud use remains common at 89% and 73%.

6. About 60% of corporate data sits in the cloud.

7. Around 33% of organizations spend more than $12 million per year and 71% anticipate higher budgets.

8. About 32% of cloud spending goes to underused resources and only 30% can track costs precisely.

9. AWS, Microsoft and Google hold 30%, 20% and 13% of global cloud infrastructure revenues.

10. Netflix’s streaming platform runs fully on AWS after completing its seven year migration in 2016.

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

10 Largest Data Centres in the UK

Let's start

a new project together