Table of Contents

Data Centers In Alabama: Why You Must Colocate

Alabama offers an attractive mix of competitive power rates, abundant land and growing connectivity that makes the state appealing for data center colocation. Birmingham and Huntsville have emerged as technology hubs with strong demand from defense, aerospace and life‑sciences sectors.

The state’s commercial electricity rate averaged 14.68 ¢/kWh in October 2025, and nuclear and hydro resources help supply steady baseload power. Alabama’s tax incentives include extended sales‑ and use‑tax abatements for data centers investing more than $200 million, and projects meeting job creation thresholds may qualify for property‑tax abatements up to 30 years.

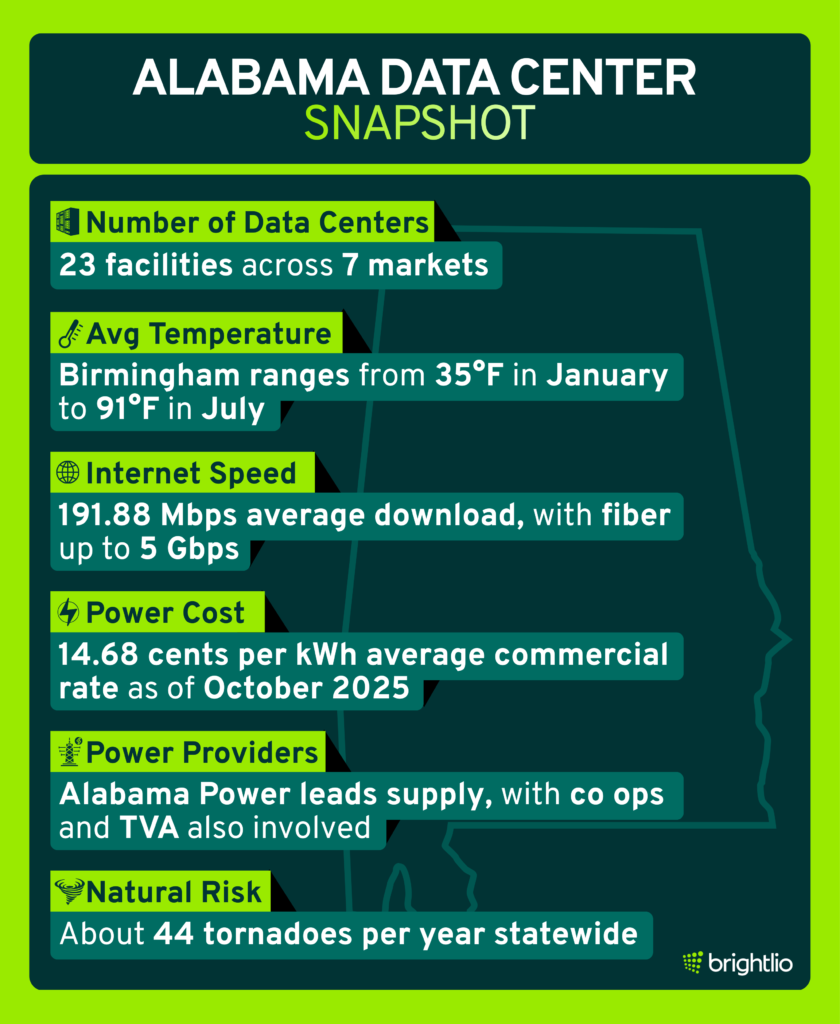

The state recorded 23 colocation facilities across seven markets in 2024. Huntsville, Birmingham and Montgomery anchor the market, with new hyperscale developments from Meta and high‑performance computing providers adding billions of dollars in investment.

Alabama’s seasonally adjusted unemployment rate of 2.7% in November 2025 signals a healthy labor market and ample talent pipeline. Tornadoes remain the most significant natural hazard, but modern data centers are engineered with wind‑rated structures and backup power to maintain uptime.

Alabama Data Center Infrastructure Overview

- Data centers: Alabama has 23 across 7 markets, led by Huntsville (8), Birmingham (6), and Mobile (3), plus smaller sites in Auburn, Anniston, and Montgomery.

- Climate: Birmingham averages about 35°F (Jan) to 91°F (Jul), so summer heat and humidity drive cooling needs.

- Internet: Alabama averages 191.88 Mbps download (31st nationally, 2025). AT&T advertises fiber up to 5 Gbps in Birmingham.

- Electricity: Average commercial rate in Oct 2025 was 14.68¢/kWh.

- Grid utilities: Alabama Power is the main investor-owned utility (PSC-regulated). Co-ops and TVA also supply power.

- Disasters: Located in Dixie Alley with about 44 tornadoes/year (about 8.6 per 10,000 sq mi). Hurricanes can impact the coast, while most data centers are inland.

Why Colocate in Alabama?

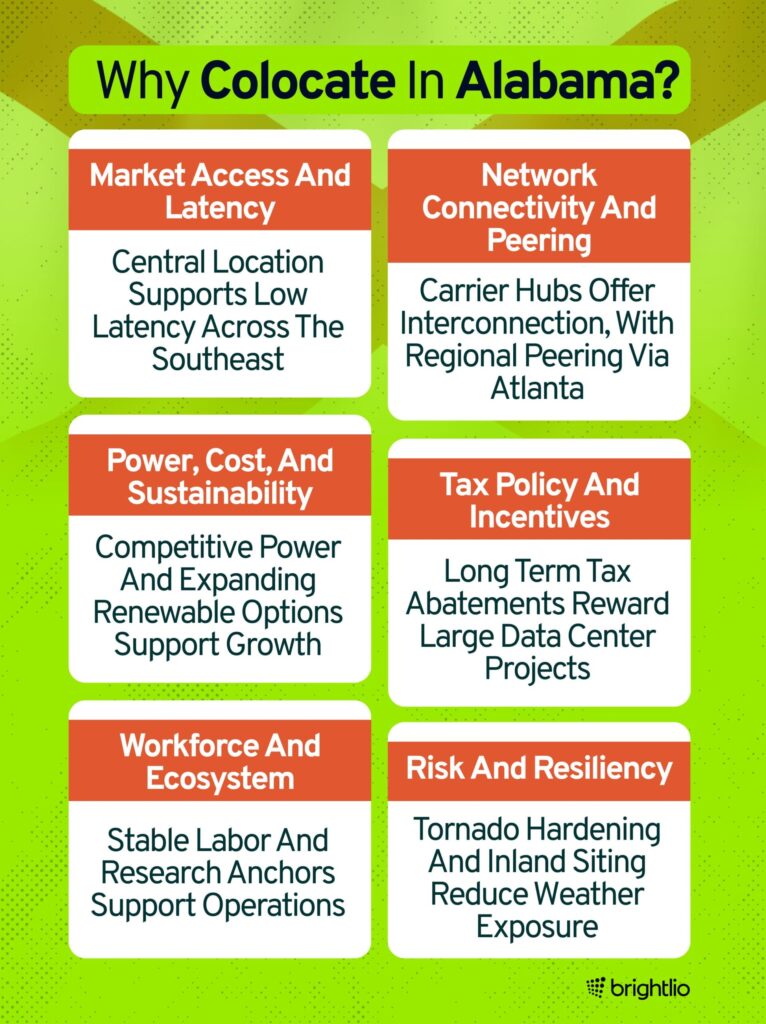

Colocating in Alabama can improve regional market reach and deliver strong network performance across the Southeast. Below are the key factors we’ll cover including market access and latency, network connectivity, and the carrier and hyperscale activity that supports long term growth:

1. Market Access and Latency

Alabama’s position in the southeastern U.S. offers low‑latency connections to Atlanta, Nashville and New Orleans. Huntsville sits on major north‑south fiber routes linking the Gulf Coast to Chicago and Washington, D.C., and Birmingham provides access to east‑west corridors toward Dallas.

Proximity to regional carriers and an emerging tech ecosystem has attracted hyperscale investments, including Meta’s campuses in Huntsville and Montgomery, totaling more than $3 billion in investment.

2. Network Connectivity and Peering

Birmingham and Huntsville serve as carrier hubs. DC BLOX’s campuses in both cities offer carrier‑neutral interconnection with AT&T, Comcast, Charter/Spectrum, Cogent, Zayo and CenturyLink over a 100 G+ optical network.

The Lumen Mobile 1 facility provides diverse fiber paths and Level 3 connectivity within its 5,625‑sq‑ft facility. Alabama lacks a major internet exchange, but operators peer regionally through Atlanta’s IX and use dark fiber to connect to Nashville and Jacksonville. DC BLOX also offers access to cloud providers via high‑capacity connections.

3. Power, Cost, and Sustainability

Alabama’s commercial power prices are competitive relative to neighboring states, and the electricity mix includes nuclear and hydroelectric sources. TVA’s Browns Ferry plant in northern Alabama produces nearly 3,700 MW of nuclear capacity; statewide, hydroelectric dams supply around 6 % of electricity. Solar capacity is expanding—Alabama had 664 MW of utility‑scale solar installed as of September 2025, with another 405 MW planned by 2026.

The 227 MW solar farm in northwest Alabama supplies renewable energy to data centers. Operators such as Meta have invested in renewable contracts to support their campuses, aligning sustainability with corporate mandates.

4. Tax Policy and Incentives

Alabama offers generous tax incentives for data centers. The state’s Data Processing Center provisions provide extended sales‑ and use‑tax abatements if a project invests at least $200 million and creates 20 jobs with average compensation of $40,000.

Sales‑ and use‑tax abatements extend to 20 years for investments between $200 million and $400 million, and up to 30 years for projects exceeding $400 million.

Property‑tax abatements mirror these thresholds, also offering up to 30 years of relief. Local governments may supplement incentives through industrial development boards and enterprise zones.

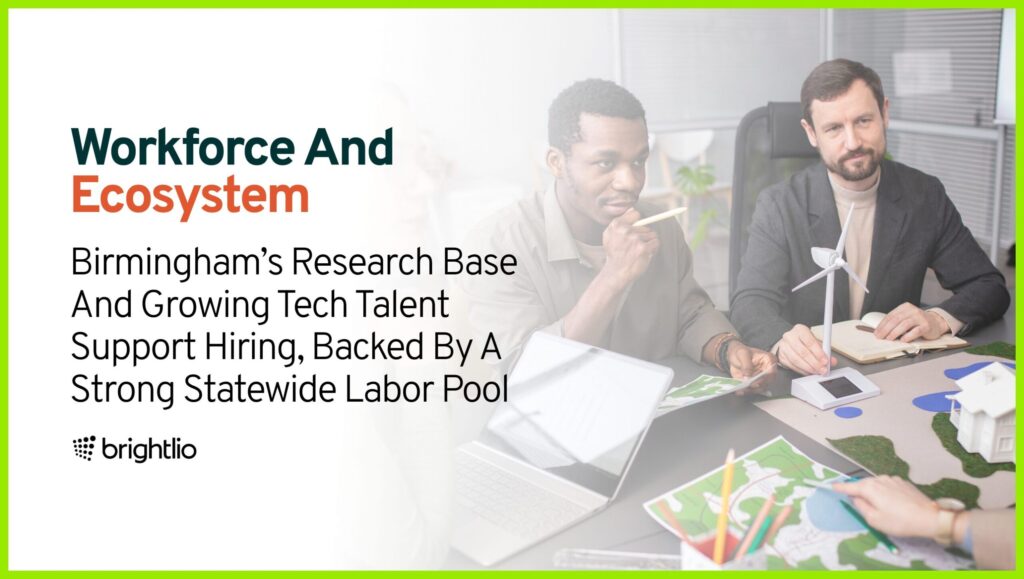

5. Workforce and Ecosystem

Birmingham anchors Alabama’s health‑care and research community. The University of Alabama at Birmingham (UAB) Health System is the state’s largest employer with more than 23,000 employees. CBRE ranked Birmingham 18th in emerging tech talent markets in 2024, reflecting growth in engineering and IT jobs.

UAB’s Bill L. Harbert Institute generated $6.5 million in licensing revenue and secured 17 U.S. patents in 2024, signalling a vibrant research commercialization environment.

Statewide unemployment was 2.7 % in November 2025 with 2.31 million employed, indicating a strong labor pool for data center operations.

6. Risk and Resiliency

Tornadoes pose the most frequent weather threat. Alabama averages 44 tornadoes per year, and building codes require hardened structures. DC BLOX’s facilities are rated to withstand 150 mph winds and feature N+1 power and cooling systems.

Huntsville and Birmingham are located inland, reducing hurricane risk compared with Gulf Coast cities. Operators plan for multi‑site resilience using secondary facilities in Atlanta or Nashville to ensure continuous operations during severe weather.

Key Cities or Submarkets in Alabama

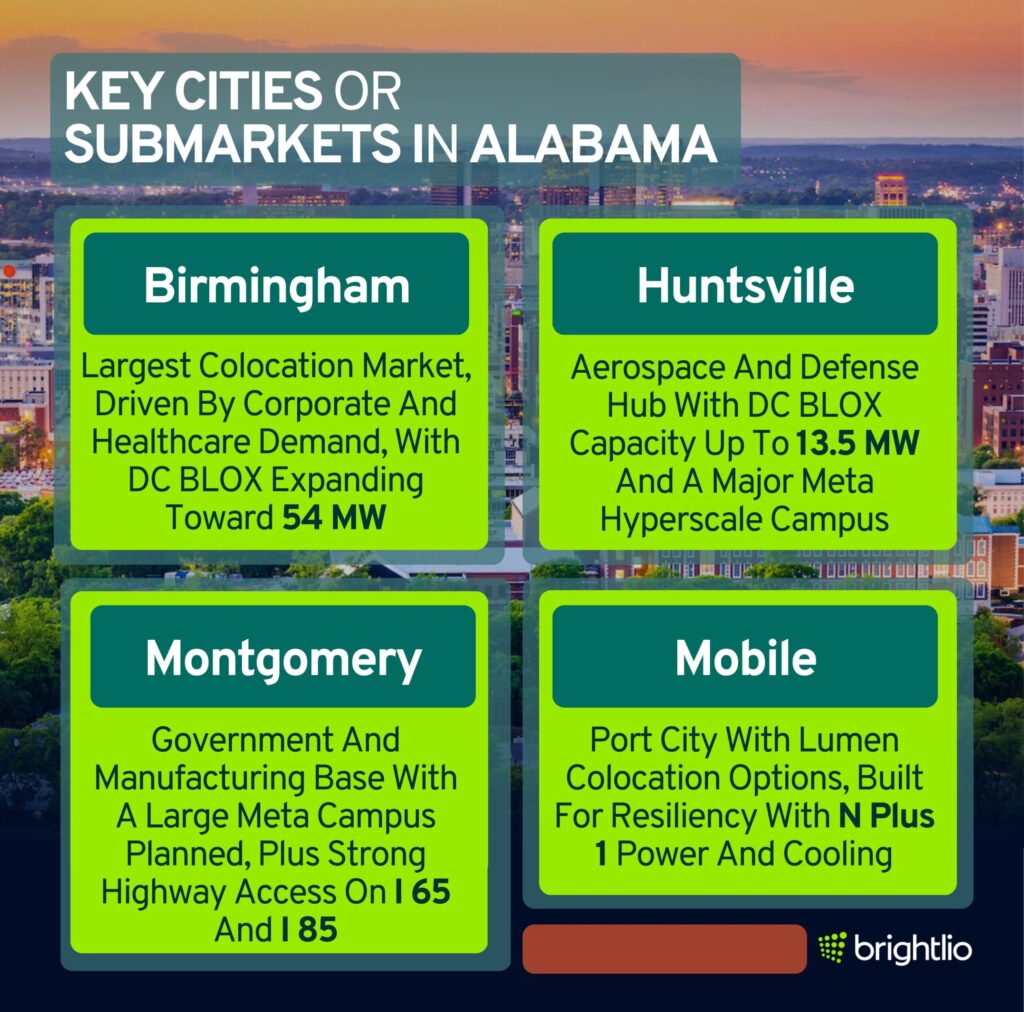

Alabama’s colocation market is concentrated in several cities that support enterprise demand, public sector workloads, and hyperscale expansion.

Below are the primary submarkets in Alabama that drive data center activity and regional connectivity:

1. Birmingham

Birmingham is Alabama’s largest colocation market, serving corporate headquarters, health‑care systems and industrial firms. UAB Health System’s presence and the city’s thriving life‑sciences sector drive demand.

DC BLOX operates a Tier III‑certified Birmingham facility with 31,000 sq ft in phase 1 and plans to expand to 263,000 sq ft with 54 MW of critical load. The site provides carrier‑neutral connectivity to multiple carriers and a 100 G+ network.

2. Huntsville

Huntsville hosts aerospace and defense companies near Redstone Arsenal and Cummings Research Park. DC BLOX’s Huntsville facility offers 52,400 sq ft of data center space and 7,400 sq ft of office space.

It supports up to 13.5 MW of critical load with N+1 UPS and generator redundancy. Meta’s $1.5‑billion hyperscale campus in Huntsville contributes to the city’s status as a cloud region and is supported by renewable energy projects.

3. Montgomery

Montgomery’s economy revolves around automotive manufacturing and government services. Meta broke ground on a $1.5 billion+ data center campus there in 2024, planning to bring the complex to nearly 1.3 million sq ft and more than $1.5 billion investment.

The project will add hundreds of construction jobs and expand Alabama’s hyperscale capacity. Montgomery benefits from proximity to I‑85 and I‑65 corridors connecting Atlanta and Mobile.

4. Mobile

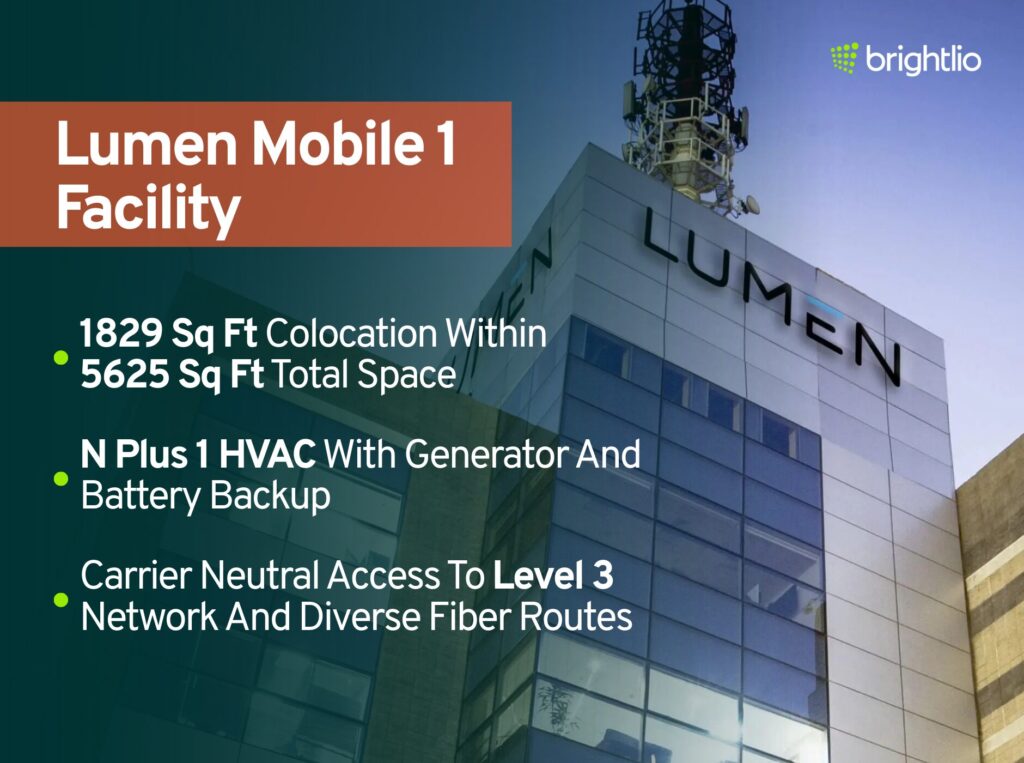

Mobile leverages its port and shipbuilding industry. Lumen’s Mobile 1 facility at 50 N. Lawrence Street offers 1,829 sq ft of colocation space within a 5,625‑sq‑ft building, with N+1 HVAC, UPS and generator backup.

Tw Telecom’s (now part of Lumen) data center at 63 S. Royal Street provides caged floor space, dual water‑side economizer cooling and carrier‑neutral connectivity through tw telecom’s SONET network.

Notable Colocation Providers and Facilities in Alabama

Alabama has a mix of colocation options that support enterprise, public sector, and large scale infrastructure needs across the state.

Below are several notable providers and facilities that show where capacity, connectivity, and expansion activity are concentrated:

1. DC BLOX Birmingham Data Center

Located at 433 First Avenue North, Birmingham, this Tier III‑certified facility began with 31,000 sq ft and is expanding toward 263,000 sq ft with 54 MW of critical load.

It is carrier‑neutral, linking to AT&T, Comcast, Charter/Spectrum, Cogent, Zayo and CenturyLink over a 100 G+ optical network. The site features N+1 UPS and generators, 150 mph wind‑rated construction and high‑density cabinets up to 32 kW.

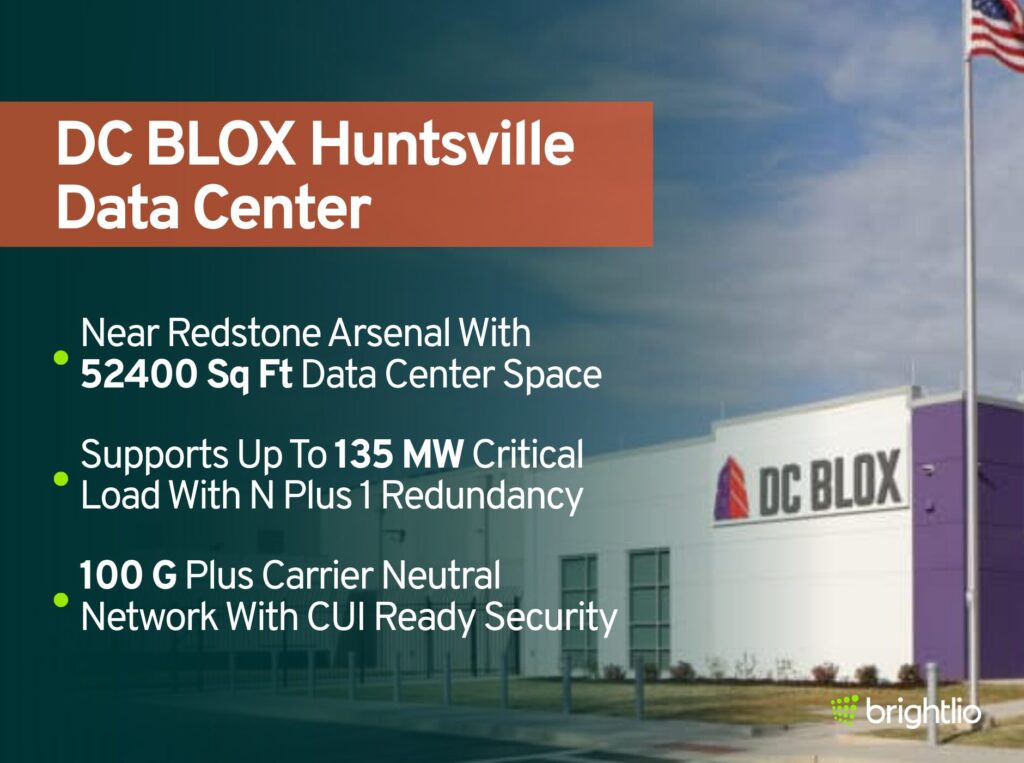

2. DC BLOX Huntsville Data Center

Situated near Redstone Arsenal, the Huntsville campus offers 52,400 sq ft of data center space and 7,400 sq ft of office space, expandable from an initial 9,000 sq ft shell. It supports up to 13.5 MW of critical load and has N+1 UPS and generator redundancy.

It connects to a 100G+ network with carriers like AT&T, Comcast, Charter/Spectrum, Cogent, Zayo, and CenturyLink. High‑density options and controlled unclassified information (CUI) security make it suitable for defense contractors.

3. Meta Huntsville & Montgomery Data Centers

Meta operates hyperscale campuses in Huntsville and Montgomery. The Huntsville site, announced in 2018, represents a $1.5 billion+ investment and will support more than 300 jobs.

The Montgomery campus broke ground in 2024 and is planned to reach nearly 1.3 million sq ft, with investment of more than $1.5 billion. Both campuses are powered by renewable energy projects totaling 227 MW and are engineered to hyperscale specifications.

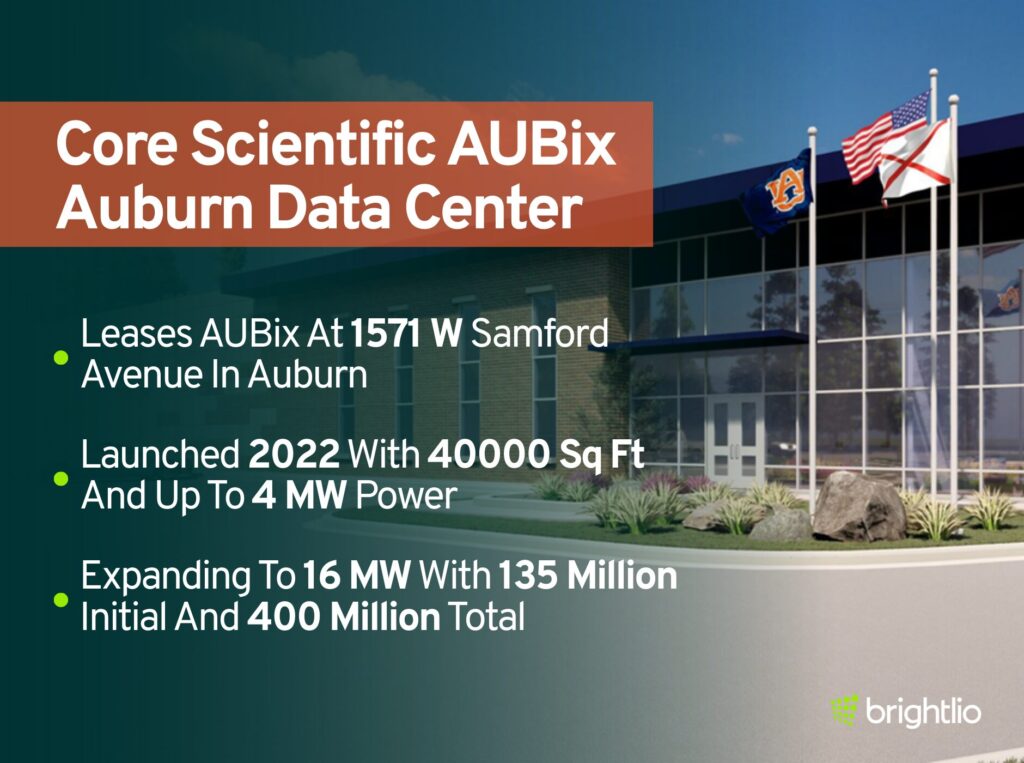

4. Core Scientific (AUBix) Auburn Data Center

Core Scientific leases the AUBix data center at 1571 W. Samford Avenue in Auburn. The facility launched in 2022 with a 40,000‑sq‑ft single‑story building offering up to 4 MW of power; Core Scientific plans to invest $135 million initially and more than $400 million total, expanding capacity to 16 MW. The site provides high‑performance computing hosting for AI and blockchain workloads, with redundant power and network systems.

5. Lumen Mobile 1 Facility

The Lumen Mobile 1 data center at 50 N. Lawrence Street offers 1,829 sq ft of colocation within 5,625 sq ft of total space.

It features N+1 HVAC, temperature‑controlled environment, generator and battery backup, and carrier‑neutral access to Level 3’s network and diverse fiber routes.

6. Tw Telecom (63 S. Royal Street)

This facility provides open racks, lockable cabinets and caged floor space. Security measures include 24×7 surveillance and fingerprint access; infrastructure incorporates gaseous fire suppression, redundant UPS systems and diesel generators with on‑site fuel, and dual water‑side economizer cooling. Connectivity is carrier‑neutral with links to tw telecom’s SONET‑based network.

Recent Developments in Alabama (Last 12 to 24 Months)

- September 2025 – Meta doubles investment in Montgomery: Meta announced that adding two buildings to its Montgomery campus would increase the facility to nearly 1.3 million sq ft and more than $1.5 billion investment.

- November 2025 – Birmingham ranked for emerging tech talent: CBRE’s 2024 Emerging Tech Talent report placed Birmingham No. 18, up from 24 a year earlier.

- September 2024 – DC BLOX expands Birmingham facility: DC BLOX unveiled plans to expand its Birmingham data center campus to 263,000 sq ft and 54 MW of critical load.

- August 2024 – Core Scientific invests in Auburn: Core Scientific announced a $135 million initial investment to retrofit the AUBix Auburn data center, with plans to invest more than $400 million and expand capacity to 16 MW.

- March 2024 – Solar capacity milestone: The EIA reported that Alabama’s utility‑scale solar capacity reached 664 MW, with another 405 MW scheduled through 2026.

How Brightlio Can Help With Colocation in Alabama

Brightlio offers comprehensive colocation sourcing and network connectivity advisory to help organizations evaluate options in Alabama. Our team draws on deep market knowledge and relationships with providers like DC BLOX, Lumen and Core Scientific to match clients with facilities that meet power, cooling and compliance requirements.

We compare pricing, negotiate contracts and coordinate cross‑connects and cloud on‑ramps for workloads spanning multiple locations. Brightlio also assists with public cloud integration and unified communications strategies to align data center deployments with broader IT roadmaps. Contact Brightlio to start planning a resilient and cost‑effective colocation solution in Alabama.

If you found the overview of data centers in Alabama useful, you may also be interested in these regional guides covering other major U.S. data center markets.

Virginia has the largest concentration of data centers in the United States.

Northern Virginia, especially the Ashburn area, leads due to dense fiber networks, reliable power, and proximity to major internet exchange points. Multiple industry trackers consistently rank Virginia ahead of Texas and California by total operational facilities.

Several large projects are underway or planned in Alabama:

1. Meta (Facebook)

Meta is building and expanding large data center campuses in Montgomery and Huntsville, focused on AI and cloud workloads. These projects represent multi-billion-dollar investments and are among the largest tech infrastructure builds in the state

2. Logistic Land Investment LLC (TPA Group)

This developer is behind Project Marvel in Bessemer, a proposed hyperscale data center campus valued at roughly $14.5 billion. The project is one of the largest planned data center developments in the southeastern U.S.

Public opposition to data centers has grown for several reasons:

High electricity demand

Large facilities can strain local power grids and are often linked to rising utility bills

Water consumption

Cooling systems may use significant amounts of water, raising concerns in areas with limited supply

Noise and visual impact

Backup generators, cooling equipment, and large buildings affect nearby neighborhoods

Environmental impact

Critics cite carbon emissions, land use, and loss of green space

Limited local benefits

Data centers require few permanent workers relative to their size, leading some residents to question tax incentives and public subsidies

Tamzid is a technology writer focused on SEO, content marketing, and data center infrastructure. He explains topics like colocation, cloud architecture, and network connectivity in clear, practical terms. At Brightlio, he tracks data center trends and the systems that keep digital services online.

Recent Posts

Data Centers In Alabama: Why You Must Colocate

10 Largest Underground Data Centers in the World

100+ VoIP Statistics from Credible Sources (Jan – 2026)

10 Largest Data Centres in the UK

Let's start

a new project together